Widdekind

Member

- Mar 26, 2012

- 813

- 35

- 16

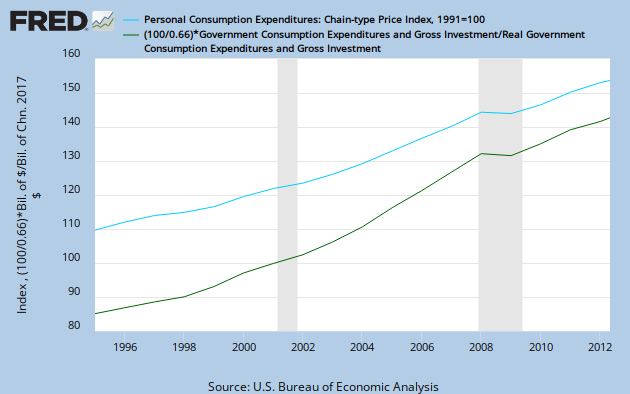

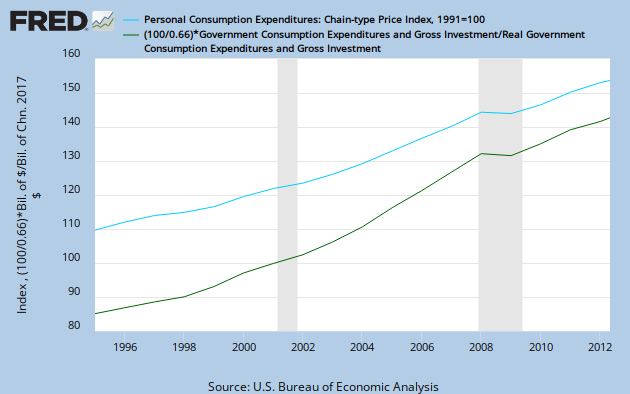

From c.2000 onwards, the price-level of government purchases (CPI for "G" in GDP) inflated above the price-level of personal consumption (CPI for "C" in GDP). By 2010, the price-level for government was 20% higher than for persons. In the absence of that relative rise in government prices, the same government purchases would have cost up to 20% less each year (10% less each year on average), for a decade. The total extra cost, from that decade of increasingly inflated government prices, was nearly $4T, of nearly $40T total government purchases (2005 dollars). Inexpertly, public reports of fraud, missing money, and other "inefficiencies", during the War on Terror, could plausibly account, for the inflated government price-levels, and extra costs.