Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

GM is doing AWESOME

- Thread starter buckeye45_73

- Start date

Dick Tuck

Board Troll

- Aug 29, 2009

- 8,511

- 505

- 48

We don't see any suffering due to airline consolidation. So, you are only guessing.

The claim that all these businesses would have disappeared without Obama is bogus.

Demand drives business and banks are not the only ones with money.

Demand goes into the toilet when the economy is collapsing.

Now you are grasping.

The economy is in the toilet.

But GM is doing fine.

You don't get it both ways.

And don't bother with the...headed to depression argument. You can't support it.

By any reasonable standard, the economy is growing. It began its path to recovery as soon as the stimulus bill passed. On January 20th, 2009, the economy was on the brink of entering a full blown depression. International companies have to deal with more than the American economy. How well is GMs growth in the Chinese and European markets doing today?

As for us entering a depression, I don't have to support it. A consensus of economists made that call. I'd rather listen to someone who knows what they're talking about than to a right wing hack.

Dick Tuck

Board Troll

- Aug 29, 2009

- 8,511

- 505

- 48

GM is stuffing the channel to inflate sales and has significantly increased Subprime loans to car buyers.

And with all this, the stock price has dived.

Twould have been better to let them go bankrupt.

And Ford is trading at 2009 levels. What's your point?

SniperFire

Senior Member

Demand goes into the toilet when the economy is collapsing.

Now you are grasping.

The economy is in the toilet.

But GM is doing fine.

You don't get it both ways.

And don't bother with the...headed to depression argument. You can't support it.

By any reasonable standard, the economy is growing. It began its path to recovery as soon as the stimulus bill passed. On January 20th, 2009, the economy was on the brink of entering a full blown depression. International companies have to deal with more than the American economy. How well is GMs growth in the Chinese and European markets doing today?

As for us entering a depression, I don't have to support it. A consensus of economists made that call. I'd rather listen to someone who knows what they're talking about than to a right wing hack.

By any reasonable standard, this is one of if not THE worst recovery in American history, and our wealth and job creators - the people who can bring us out of this - hate our POTUS and his policies.

Actually, I am a qualified expert on bankruptcy law and procedure; and have testified as an expert witness on the subject in civil and criminal cases before the state and federal courts. Furthermore, I am very familiar with the GM bankruptcy case. The case was a huge success; and President Obama deserves much of the credit for it.

SniperFire

Senior Member

With U6 unemployment close to 15%, the country is in a de facto recession.

GDP has stalled and a double dip now seems inevitable.

Hopey Changey.

Dick Tuck

Board Troll

- Aug 29, 2009

- 8,511

- 505

- 48

With U6 unemployment close to 15%, the country is in a de facto recession.

There's a clear definition of what a recession is. It's two consecutive quarters of negative GDP. We haven't had a negative quarter of GDP since the stimulus was passed. You don't get to make up new definitions for things to suit you.

- Feb 12, 2007

- 59,384

- 24,019

- 2,290

GM is stuffing the channel to inflate sales and has significantly increased Subprime loans to car buyers.

And with all this, the stock price has dived.

Twould have been better to let them go bankrupt.

And Ford is trading at 2009 levels. What's your point?

My point is that GM is engaged in horrible business practices which are inflating it's numbers. Dealers are holding far more days supply of unsold inventory (I wonder what kind of return guarantees they've gotten for holding it?) - and sales are inflated by selling a larger ratio to people with Bad Credit. That worked real well for housing...

McDowell's

Rookie

- Jul 27, 2010

- 883

- 239

- 0

- Banned

- #130

The taxpayers are not out any money. The GM reorganization, which was one of the biggest bankruptcy cases in our history, was a huge success. Alternatively, letting GM fail would have been a catastrophic loss with consequential damage to the economy, and at the worst possible time. It was just not an option.

You are not only ignorant about bankruptcy law, but are ignorant about the simple facts:

Government Motors: GM Stock Hits New Low, Taxpayer Loss Hits $35 Billion

By ED CARSON, INVESTOR'S BUSINESS DAILY

Posted 07/24/2012 07:47 PM ET

Government Motors: GM Stock Hits New Low, Taxpayer Loss Hits $35 Billion - Investors.com

The guy talks a good game on the surface but when you note he thinks there is no loss exposure to the taxpayer in one post and then rightfully cites how equity holders take a back seat to other stakeholders in another post you can tell he must not have much common sense.

Unless the government has recouped all of its cash outlay, there is a risk of loss. Saying they have recouped their most secure position and only have their riskiest position still open and then claiming there is no loss exposure is pretty damn dense.

Listening

Gold Member

- Aug 27, 2011

- 14,989

- 1,650

- 260

Demand goes into the toilet when the economy is collapsing.

Now you are grasping.

The economy is in the toilet.

But GM is doing fine.

You don't get it both ways.

And don't bother with the...headed to depression argument. You can't support it.

By any reasonable standard, the economy is growing. It began its path to recovery as soon as the stimulus bill passed. On January 20th, 2009, the economy was on the brink of entering a full blown depression. International companies have to deal with more than the American economy. How well is GMs growth in the Chinese and European markets doing today?

As for us entering a depression, I don't have to support it. A consensus of economists made that call. I'd rather listen to someone who knows what they're talking about than to a right wing hack.

These are the same ones who said the Stimulus worked. Sorry, but if you want to debate economics, you need to bring some models that can be reviewed. I am sue you'd trust your kindergarten teacher on who to vote for.

The economy is no longer in recession. It's growth sucks....or else Obama would be running or whole different line of commercials.

Housing adjusted dramatically. But car prices didn't.

How interesting.

Dick Tuck

Board Troll

- Aug 29, 2009

- 8,511

- 505

- 48

With U6 unemployment close to 15%, the country is in a de facto recession.

GDP has stalled and a double dip now seems inevitable.

Hopey Changey.

Bullshit. We may go into a recession, but I doubt it. The Europeans are standing behind the Euro, and that was a big move that's going to impact everything.

Dick Tuck

Board Troll

- Aug 29, 2009

- 8,511

- 505

- 48

Now you are grasping.

The economy is in the toilet.

But GM is doing fine.

You don't get it both ways.

And don't bother with the...headed to depression argument. You can't support it.

By any reasonable standard, the economy is growing. It began its path to recovery as soon as the stimulus bill passed. On January 20th, 2009, the economy was on the brink of entering a full blown depression. International companies have to deal with more than the American economy. How well is GMs growth in the Chinese and European markets doing today?

As for us entering a depression, I don't have to support it. A consensus of economists made that call. I'd rather listen to someone who knows what they're talking about than to a right wing hack.

These are the same ones who said the Stimulus worked. Sorry, but if you want to debate economics, you need to bring some models that can be reviewed. I am sue you'd trust your kindergarten teacher on who to vote for.

The economy is no longer in recession. It's growth sucks....or else Obama would be running or whole different line of commercials.

Housing adjusted dramatically. But car prices didn't.

How interesting.

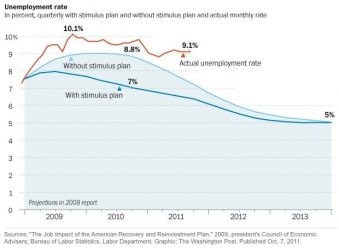

The Stimulus did work. And no, I don't think these were the same economists that advised Bush and Obama about how screwed up things were, and what would happen if nothing were done. I know Volker was one of those advisors.

SniperFire

Senior Member

With U6 unemployment close to 15%, the country is in a de facto recession.

GDP has stalled and a double dip now seems inevitable.

Hopey Changey.

Bullshit. We may go into a recession, but I doubt it. The Europeans are standing behind the Euro, and that was a big move that's going to impact everything.

You are ignorant and uneducated. It is not a foregone conclusion, but it certainly isn't 'bullshit':

April 27, 2012

Europe Is In Recession, the U.S. Isn't Far Behind

RealClearMarkets - Europe Is In Recession, the U.S. Isn't Far Behind

McDowell's

Rookie

- Jul 27, 2010

- 883

- 239

- 0

- Banned

- #135

GM is stuffing the channel to inflate sales and has significantly increased Subprime loans to car buyers.

And with all this, the stock price has dived.

Twould have been better to let them go bankrupt.

And Ford is trading at 2009 levels. What's your point?

My point is that GM is engaged in horrible business practices which are inflating it's numbers. Dealers are holding far more days supply of unsold inventory (I wonder what kind of return guarantees they've gotten for holding it?) - and sales are inflated by selling a larger ratio to people with Bad Credit. That worked real well for housing...

You have to wonder if they are doing the right and responsible thing and adjusting their bad debt estimates accordingly. I would guess probably not.

- Feb 12, 2007

- 59,384

- 24,019

- 2,290

By any reasonable standard, the economy is growing. It began its path to recovery as soon as the stimulus bill passed. On January 20th, 2009, the economy was on the brink of entering a full blown depression. International companies have to deal with more than the American economy. How well is GMs growth in the Chinese and European markets doing today?

As for us entering a depression, I don't have to support it. A consensus of economists made that call. I'd rather listen to someone who knows what they're talking about than to a right wing hack.

These are the same ones who said the Stimulus worked. Sorry, but if you want to debate economics, you need to bring some models that can be reviewed. I am sue you'd trust your kindergarten teacher on who to vote for.

The economy is no longer in recession. It's growth sucks....or else Obama would be running or whole different line of commercials.

Housing adjusted dramatically. But car prices didn't.

How interesting.

The Stimulus did work. And no, I don't think these were the same economists that advised Bush and Obama about how screwed up things were, and what would happen if nothing were done. I know Volker was one of those advisors.

The Stimulus Worked? As if.

Attachments

Listening

Gold Member

- Aug 27, 2011

- 14,989

- 1,650

- 260

the stimulus did work.

rotflmao

Dick Tuck

Board Troll

- Aug 29, 2009

- 8,511

- 505

- 48

GDP has stalled and a double dip now seems inevitable.

Hopey Changey.

Bullshit. We may go into a recession, but I doubt it. The Europeans are standing behind the Euro, and that was a big move that's going to impact everything.

You are ignorant and uneducated. It is not a foregone conclusion, but it certainly isn't 'bullshit':

April 27, 2012

Europe Is In Recession, the U.S. Isn't Far Behind

RealClearMarkets - Europe Is In Recession, the U.S. Isn't Far Behind

A lot has happened since April, when that article was written, especially this past weeks actions by the ECB. And we've clearly not entered a recession since April. Your stupidity astounds.

- Feb 12, 2007

- 59,384

- 24,019

- 2,290

What do you call decelerating GDP growth?

In fiscal year 2012, the White House downgraded its its projection to a 2.3 percent growth in gross domestic product compared to 2.7 percent when Obama released his budget in February. It lowered expectations in 2013 from 3 percent GDP growth to 2.7 percent.

The new projections incorporates economic data through June, so Friday's new 1.5 percent GDP growth advanced estimate for the second quarter of calendar 2012 is not included.

The revised deficit number total reflects both lower spending and lower revenue.

White House projects $1.2 trillion deficit, lower economic growth in 2012 - The Hill's On The Money

In fiscal year 2012, the White House downgraded its its projection to a 2.3 percent growth in gross domestic product compared to 2.7 percent when Obama released his budget in February. It lowered expectations in 2013 from 3 percent GDP growth to 2.7 percent.

The new projections incorporates economic data through June, so Friday's new 1.5 percent GDP growth advanced estimate for the second quarter of calendar 2012 is not included.

The revised deficit number total reflects both lower spending and lower revenue.

White House projects $1.2 trillion deficit, lower economic growth in 2012 - The Hill's On The Money

Dick Tuck

Board Troll

- Aug 29, 2009

- 8,511

- 505

- 48

GM is stuffing the channel to inflate sales and has significantly increased Subprime loans to car buyers.

And with all this, the stock price has dived.

Twould have been better to let them go bankrupt.

And Ford is trading at 2009 levels. What's your point?

My point is that GM is engaged in horrible business practices which are inflating it's numbers. Dealers are holding far more days supply of unsold inventory (I wonder what kind of return guarantees they've gotten for holding it?) - and sales are inflated by selling a larger ratio to people with Bad Credit. That worked real well for housing...

That's your opinion. You support your conclusion based on stock price. you have to say that Ford similarly is "engaged in horrible business practices". Do you think that credit ought to be as tight as it was in 2009? Comparing this decision to the nonsense that Wall Street pushed for housing is insane.

Similar threads

- Replies

- 147

- Views

- 2K

- Replies

- 7

- Views

- 83

- Replies

- 2

- Views

- 137

- Replies

- 17

- Views

- 367

Latest Discussions

- Replies

- 12

- Views

- 53

- Replies

- 19

- Views

- 154

- Replies

- 289

- Views

- 2K

- Replies

- 4

- Views

- 66

- Replies

- 93

- Views

- 387

Forum List

-

-

-

-

-

Political Satire 8088

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 471

-

-

-

-

-

-

-

-

-

-