Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Free Market Foundations

- Thread starter antagon

- Start date

CrusaderFrank

Diamond Member

- May 20, 2009

- 148,629

- 71,936

- 2,330

frank, the entire US is heavily regulated. do you live here?

So you think having the Government now in control of 100% of the mortgage market is the peak of efficiency?

CrusaderFrank

Diamond Member

- May 20, 2009

- 148,629

- 71,936

- 2,330

i think asserting that the government has 100% control of the mortgage market is ignorance.

Did you not know that Freddie, Fannie and FHA now control 100% of the US mortgage market? They're even making loans on multi-million luxury NY Condos because no one else will.

asterism

Congress != Progress

asterism, i have a different concept of class than the one you put forward, but i can abide. I argue that the wealthier participants in the economy pay virtually all of the income tax liability accrued in the economy. those who earn at levels within a threshold of the poverty line cant really accrue wealth. in the US tax system, they don't really accrue income tax liability either. being active in our economy affords your 'tricks' to minimize the share of income allotted to tax. far from a progressive policy, expensibility and deductability are decidedly regressive for this reason. as a business owner, but not to be mistaken as a buffet-grade participant in our economy, i welcome expensibility.

Show me a successful sustainable society that has a narrow income disparity and I'll show you that the average quality of life in that society is quite low by our modern standards. The Politburo underlings may not have been rich in cash, but that's because nobody had much cash. They got better housing and travel permits though. Not anywhere close to our average.

quite the opposite. i argue that societies which manage to field a middle class which encompasses the bear share of their constituents, exhibit both a moderate mean income gap and a high quality of life.

i interpreted your criticism of a ruling class juxtaposed to a proletariat and associable with america's progressive policy to be a failure to recognize the greater income disparity and commensurately lower QoL of a pre-progressive US. it should be noted that just as I deride the notion that market freedom is a paramount value in our economy, i criticize the idea that narrowing the income gap or spreading purchasing power is a wise singular or paramount aim of the economy or the policies that guide it. i'm definitely not advocating communism or centralism.

Perhaps income disparity doesn't have the importance you claim.

However I do see some insight into the eugenicist worldview as expressed by progressives, one that focuses on indicators that can be predicted to generate unrest. Rather than cure the disease that causes the unrest, the focus is on treating the symptoms. That implies a perspective that there is no cure, which then leads to a methodology oriented towards controlling and pacifying the general population.

i argue that income disparity is crucial to a capitalist economy. the greater the extremes of income, the less perfect the market will be. this is the matter which i addressed a bit earlier with regard to the pillars of capitalism. the three most popular - supply, demand and price - function in equal measure to purchasing power and currency (Kevin_Kennedy makes the important point that interest rates are tied to the currency pillar, or may stand alone). income disparity offers a view to the distribution of purchasing power. as i said, capitalist economies trickle up, and without measures to skim wealth hoarded by those at the top and reintroduce additional purchasing power in the economy, only the number 1 cylinder would be getting any fuel, so to speak, and the economy will have to correct. some elements of this thinking are pre-progressive, classical capitalist observations.

i'm not so much a cynic, i guess, but i think there is a value in taming unrest through economic measures. the economy is a facility of the society which creates it through their participation. where you argue that progressive solutions have merely treated the symptoms like i would accept welfare does, i also contend that progressive labor legislation enfranchises the economy's participants with more of the rewards of its growth and health. progressive tax policy is also structural to the economy -- hardly a band-aid.

back to the distribution of wealth, because wealth is created through commerce, i argue that despite the cost of taxes and high hourly wages, the creation of wealth in countries with progressive reforms avails more commerce and greater wealth to their participants with the american economy to wit.

Do you have any concrete examples?

asterism

Congress != Progress

do you know that neither freddie, fannie or the FHA has anything to do with my mortgage?

Perhaps theres a miscommunication in terms. The statement was "Government now in control of 100% of the mortgage market." Your mortgage is no longer on the market.

Try to refi without Fannie or Freddie. It's impossible.

antagon

The Man

- Dec 6, 2009

- 3,572

- 295

- 48

- Thread starter

- #48

asterism, i have a different concept of class than the one you put forward, but i can abide. I argue that the wealthier participants in the economy pay virtually all of the income tax liability accrued in the economy. those who earn at levels within a threshold of the poverty line cant really accrue wealth. in the US tax system, they don't really accrue income tax liability either.... ***concrete example edit***5% of americans pay 60% of the taxes, and 40% dont pay at all.***

Do you have any concrete examples?

all of my observations are based on the developed world, particularly the united states where i've lived most of my life. compared to developing or underdeveloped markets, the US is very heavily regulated. it employs a tax system which takes from the rich and gives to the poor to cast a crude generalization. the government steps in and says you cant pay people below a certain amount, that you have to float them health benefits, that you need to get a license to conduct certain types of commerce. despite all of this, and i argue that it is in part due to all of this, the united states is the only country on the planet that is at once physically and popularly large, while maintaining a high standard of living and per capita produce. it makes our economy on aggregate the leader in production and exportation, while being a consumption powerhouse. far and away, the US is the strongest force on the planet, economically and geopolitically.

i argue that because developing and underdeveloped markets don't have this level of regulation, or an interest in taxation for social and infrastructural development, that their economies struggle to function with the same efficiency as the US or most other developed countries. when i look back in history at the US 150 years ago, before most of this heavy-handed regulation and tax policy was emplaced, i find that it had the same character as many of these developing nations, and so have drawn a consequential link between the structure, tax and regulation in our society and the efficiency of the economy that operates within it. it seems to me that capitalist open market economies work better when bolted down and managed than when they run haywire.

in the OP, i questioned of those who believe that it is freedom which begets efficiency: what concrete examples do they possess to illustrate that this is the case?

antagon

The Man

- Dec 6, 2009

- 3,572

- 295

- 48

- Thread starter

- #49

do you know that neither freddie, fannie or the FHA has anything to do with my mortgage?

Perhaps theres a miscommunication in terms. The statement was "Government now in control of 100% of the mortgage market." Your mortgage is no longer on the market.

Try to refi without Fannie or Freddie. It's impossible.

this is not impossible. there are ways to finance homes, particularly multifams like mine directly to firms which securitize debt. if they have the pocket to do so without freddie's guarantee, they do. that is an optional business model. the amount of pocket the borrower comes into the deal with has a big bearing on this, of course.

i think frank's statement is hysteria. for me "100%" would have to entail freddie originating loans themself, and "control" would have to mean that there are is no secondary mortgage market whatsoever.

nevertheless, i argue that the role of government in the US mortgage and banking markets lends to its efficiency: its ability to fund homes, make profits for lenders and investors, and handle crises cannot be compared to any other country. private and public innovation must combine for these results. this combination attracts investors and lenders from all over the world to the US market, rather than to those markets where they are ment to hack out volatility on their own, and where there isn't a large populace of homebuyers like the US. this attraction persists even in the wake of a crisis centered on the US market.

asterism

Congress != Progress

asterism, i have a different concept of class than the one you put forward, but i can abide. I argue that the wealthier participants in the economy pay virtually all of the income tax liability accrued in the economy. those who earn at levels within a threshold of the poverty line cant really accrue wealth. in the US tax system, they don't really accrue income tax liability either.... ***concrete example edit***5% of americans pay 60% of the taxes, and 40% dont pay at all.***

Do you have any concrete examples?

all of my observations are based on the developed world, particularly the united states where i've lived most of my life. compared to developing or underdeveloped markets, the US is very heavily regulated. it employs a tax system which takes from the rich and gives to the poor to cast a crude generalization. the government steps in and says you cant pay people below a certain amount, that you have to float them health benefits, that you need to get a license to conduct certain types of commerce. despite all of this, and i argue that it is in part due to all of this, the united states is the only country on the planet that is at once physically and popularly large, while maintaining a high standard of living and per capita produce. it makes our economy on aggregate the leader in production and exportation, while being a consumption powerhouse. far and away, the US is the strongest force on the planet, economically and geopolitically.

i argue that because developing and underdeveloped markets don't have this level of regulation, or an interest in taxation for social and infrastructural development, that their economies struggle to function with the same efficiency as the US or most other developed countries. when i look back in history at the US 150 years ago, before most of this heavy-handed regulation and tax policy was emplaced, i find that it had the same character as many of these developing nations, and so have drawn a consequential link between the structure, tax and regulation in our society and the efficiency of the economy that operates within it. it seems to me that capitalist open market economies work better when bolted down and managed than when they run haywire.

Interesting concept. There seems to be a question of whether it's an all or nothing direct cause and effect scenario. Emerging markets tend to have widespread corruption, which I think stunts their growth. The US certainly has its share of corruption, but not anywhere close to say Mexico or India.

But I do agree with the premise that markets are free when held to boundaries. I don't think economies can be "managed" effectively though.

in the OP, i questioned of those who believe that it is freedom which begets efficiency: what concrete examples do they possess to illustrate that this is the case?

Western Europe is a pretty good example. They have more of the type of regulation you seem to appreciate but much lower prosperity.

asterism

Congress != Progress

do you know that neither freddie, fannie or the FHA has anything to do with my mortgage?

Perhaps theres a miscommunication in terms. The statement was "Government now in control of 100% of the mortgage market." Your mortgage is no longer on the market.

Try to refi without Fannie or Freddie. It's impossible.

this is not impossible. there are ways to finance homes, particularly multifams like mine directly to firms which securitize debt. if they have the pocket to do so without freddie's guarantee, they do. that is an optional business model. the amount of pocket the borrower comes into the deal with has a big bearing on this, of course.

That wouldn't be a mortgage then, it would be either a capital investment in a business or a secured loan based on expected profit.

i think frank's statement is hysteria. for me "100%" would have to entail freddie originating loans themself, and "control" would have to mean that there are is no secondary mortgage market whatsoever.

I disagree. Control can be accomplished through background manipulation and policy.

nevertheless, i argue that the role of government in the US mortgage and banking markets lends to its efficiency: its ability to fund homes, make profits for lenders and investors, and handle crises cannot be compared to any other country. private and public innovation must combine for these results. this combination attracts investors and lenders from all over the world to the US market, rather than to those markets where they are ment to hack out volatility on their own, and where there isn't a large populace of homebuyers like the US. this attraction persists even in the wake of a crisis centered on the US market.

The problem arises when the government's role is that of social engineering instead of efficiency. There are plenty of valid reasons for a private citizen to have three houses, all with mortgages. This is currently forbidden by the government. Some policy maker some where has decreed that three mortgaged properties is "too risky." However, there are still first time homebuyer programs that allow a young struggling couple to buy a property that is 7 times their combined annual gross income.

antagon

The Man

- Dec 6, 2009

- 3,572

- 295

- 48

- Thread starter

- #52

Do you have any concrete examples?

all of my observations are based on the developed world, particularly the united states where i've lived most of my life. compared to developing or underdeveloped markets, the US is very heavily regulated. it employs a tax system which takes from the rich and gives to the poor to cast a crude generalization. the government steps in and says you cant pay people below a certain amount, that you have to float them health benefits, that you need to get a license to conduct certain types of commerce. despite all of this, and i argue that it is in part due to all of this, the united states is the only country on the planet that is at once physically and popularly large, while maintaining a high standard of living and per capita produce. it makes our economy on aggregate the leader in production and exportation, while being a consumption powerhouse. far and away, the US is the strongest force on the planet, economically and geopolitically.

i argue that because developing and underdeveloped markets don't have this level of regulation, or an interest in taxation for social and infrastructural development, that their economies struggle to function with the same efficiency as the US or most other developed countries. when i look back in history at the US 150 years ago, before most of this heavy-handed regulation and tax policy was emplaced, i find that it had the same character as many of these developing nations, and so have drawn a consequential link between the structure, tax and regulation in our society and the efficiency of the economy that operates within it. it seems to me that capitalist open market economies work better when bolted down and managed than when they run haywire.

Interesting concept. There seems to be a question of whether it's an all or nothing direct cause and effect scenario. Emerging markets tend to have widespread corruption, which I think stunts their growth. The US certainly has its share of corruption, but not anywhere close to say Mexico or India.

But I do agree with the premise that markets are free when held to boundaries. I don't think economies can be "managed" effectively though.

in the OP, i questioned of those who believe that it is freedom which begets efficiency: what concrete examples do they possess to illustrate that this is the case?

Western Europe is a pretty good example. They have more of the type of regulation you seem to appreciate but much lower prosperity.

i should clarify now that i claim there is a public and private component to this cause and effect relationship, but that not holding up the public end will result in a less effecient, less effective market. if i say a skinny bureaucracy can be at issue in more corrupt countries, that might seem counter-intuitive, however, the concept of checks and balances in our constitution is an example of ways which corruption can be stemmed by having ombudsmen for the ombudsman. in the US, our government plays organizations off of eachother and has channels, albeit cumbersome, for the private sector to wage complaints and determine the leadership and direction in our government. free press and good law enforcement make whistle blowing safe in the US, where you and your whistle will never be seen again in mexico.

on management, it would depend on what is meant by the word. when i say managing an open market economy, i dont mean pretending to know better than supply and demand where resources need to be allocated. i think this takes the open or free out of the market entirely, which is not what i'm talking about. that imperils the market basis itself.

i do mean proposing systems which help to ensure a more perfect market. in this sense, a hands-off management idea will lead to a less perfect market where participants can manipulate market imperfections like imperfect competition (via monopoly or price collusion), hoard the proceeds of wealth creation (through market exploitation, rather than tax-paying participation), sell shitty goods at market (imperfect information), etc. perfect markets are unobtainable. perfection in the market is not the goal in and of itself. but managing an economy in the direction of a more perfect market is a virtue which i argue developed nations have done. regulation affects a great deal of that... progressive taxation and wage standards affect the distribution of buying power and capital in the market. the result is greater efficiency.

western europe is an example of a developed market. i would argue that they have similar sets of heavy-handed regulation as the US, and that describing prosperity there as 'much lower' would not be statistically accurate or easily reflected by visiting any one of those nations. i think the US economy performs better than these markets, but it is hard to say if they are more tightly regged than the US. british financial services, for example, have a regulatory advantage over the US. a london banker pays less tax than a new york banker would too. our system is bigger and better because it offers a better chance at moola than england.

i am a contractor. if i were in england or france, i wouldn't need a license. if i were in england, i wouldn't need to pay all of this workman's comp. any yahoo off the street could approach a door with his tool belt and legally trade as a builder. this is better, axiomatically (freer = better), but for consumers and the construction industry it is not better in practice. i think the US shows that regulation over building tradesmen makes for a better, stronger, wealthier building trade (now that i have my license

i think that the social controls and methods used in some of these countries to smooth their business cycles are more aggressive than the US and that that has curbed aggregate growth in their economy. i feel these differences are nuance level compared to those differences between developed economies and non-developed economies, which make no/low attempt to operate more perfect markets, but are pleased to be exploited by developed nations, instead.

true enough for me, kevin. there was no central bank in the US during the jackson era. some 25 years. no central banks in the 19th century manipulated rates of interest whatsoever.

i don't think you can validate a theory by moving the goalposts under a rainbow, man.

Free markets in the 19th century?!

God almighty, Ant, where did you get that impression?

The Hamilton Tariff of 1789

The Tariff of 1816

The Tariff of 1824

Not exactly what you'd define as "free market economics" methinks

Last edited:

CrusaderFrank

Diamond Member

- May 20, 2009

- 148,629

- 71,936

- 2,330

do you know that neither freddie, fannie or the FHA has anything to do with my mortgage?

Can't you read either?

I said "now controls" I'm not talking about mortgage made in the past, I'm talking about in the present.

The US Federal government through Fannie, Freddie and FHA now controls 100% of the US mortgage market

Clear enough?

asterism

Congress != Progress

all of my observations are based on the developed world, particularly the united states where i've lived most of my life. compared to developing or underdeveloped markets, the US is very heavily regulated. it employs a tax system which takes from the rich and gives to the poor to cast a crude generalization. the government steps in and says you cant pay people below a certain amount, that you have to float them health benefits, that you need to get a license to conduct certain types of commerce. despite all of this, and i argue that it is in part due to all of this, the united states is the only country on the planet that is at once physically and popularly large, while maintaining a high standard of living and per capita produce. it makes our economy on aggregate the leader in production and exportation, while being a consumption powerhouse. far and away, the US is the strongest force on the planet, economically and geopolitically.

i argue that because developing and underdeveloped markets don't have this level of regulation, or an interest in taxation for social and infrastructural development, that their economies struggle to function with the same efficiency as the US or most other developed countries. when i look back in history at the US 150 years ago, before most of this heavy-handed regulation and tax policy was emplaced, i find that it had the same character as many of these developing nations, and so have drawn a consequential link between the structure, tax and regulation in our society and the efficiency of the economy that operates within it. it seems to me that capitalist open market economies work better when bolted down and managed than when they run haywire.

Interesting concept. There seems to be a question of whether it's an all or nothing direct cause and effect scenario. Emerging markets tend to have widespread corruption, which I think stunts their growth. The US certainly has its share of corruption, but not anywhere close to say Mexico or India.

But I do agree with the premise that markets are free when held to boundaries. I don't think economies can be "managed" effectively though.

in the OP, i questioned of those who believe that it is freedom which begets efficiency: what concrete examples do they possess to illustrate that this is the case?

Western Europe is a pretty good example. They have more of the type of regulation you seem to appreciate but much lower prosperity.

i should clarify now that i claim there is a public and private component to this cause and effect relationship, but that not holding up the public end will result in a less effecient, less effective market. if i say a skinny bureaucracy can be at issue in more corrupt countries, that might seem counter-intuitive, however, the concept of checks and balances in our constitution is an example of ways which corruption can be stemmed by having ombudsmen for the ombudsman. in the US, our government plays organizations off of eachother and has channels, albeit cumbersome, for the private sector to wage complaints and determine the leadership and direction in our government. free press and good law enforcement make whistle blowing safe in the US, where you and your whistle will never be seen again in mexico.

I agree. In my opinion, the government that dictates the rules of commerce and then participates in commerce is what's wrong now. All too often, "less government" is mischaracterized as "no government." "Less regulation" is characterized as "free to swindle."

Your example of whistle blowing is apt.

on management, it would depend on what is meant by the word. when i say managing an open market economy, i dont mean pretending to know better than supply and demand where resources need to be allocated. i think this takes the open or free out of the market entirely, which is not what i'm talking about. that imperils the market basis itself.

I agree. The government should not be arbitrarily picking the winners and losers.

i do mean proposing systems which help to ensure a more perfect market. in this sense, a hands-off management idea will lead to a less perfect market where participants can manipulate market imperfections like imperfect competition (via monopoly or price collusion), hoard the proceeds of wealth creation (through market exploitation, rather than tax-paying participation), sell shitty goods at market (imperfect information), etc. perfect markets are unobtainable. perfection in the market is not the goal in and of itself. but managing an economy in the direction of a more perfect market is a virtue which i argue developed nations have done. regulation affects a great deal of that... progressive taxation and wage standards affect the distribution of buying power and capital in the market. the result is greater efficiency.

Only if done in a sustainable fashion though, and that hasn't been the case in decades.

western europe is an example of a developed market. i would argue that they have similar sets of heavy-handed regulation as the US, and that describing prosperity there as 'much lower' would not be statistically accurate or easily reflected by visiting any one of those nations.

GDP at Purchasing Power Parity per capita is a very good measure.

i think the US economy performs better than these markets, but it is hard to say if they are more tightly regged than the US. british financial services, for example, have a regulatory advantage over the US. a london banker pays less tax than a new york banker would too. our system is bigger and better because it offers a better chance at moola than england.

It is difficult to directly compare the different environments, I agree. That's also why it's not necessarily accurate to limit the factors of prosperity to just regulation either. I'm not sure if I agree, but my Macroeconomics Professor argued that the overall tax burden as a percentage of GDP encompasses regulation.

i am a contractor. if i were in england or france, i wouldn't need a license. if i were in england, i wouldn't need to pay all of this workman's comp. any yahoo off the street could approach a door with his tool belt and legally trade as a builder. this is better, axiomatically (freer = better), but for consumers and the construction industry it is not better in practice. i think the US shows that regulation over building tradesmen makes for a better, stronger, wealthier building trade (now that i have my license).

That's only taken in the limited context of consumer contracting. One cannot build a skyscraper nor a master planned community as a journeyman unlicensed builder. That said, I agree with your general point that in this case contractor licensing regulation increases prosperity.

i think that the social controls and methods used in some of these countries to smooth their business cycles are more aggressive than the US and that that has curbed aggregate growth in their economy. i feel these differences are nuance level compared to those differences between developed economies and non-developed economies, which make no/low attempt to operate more perfect markets, but are pleased to be exploited by developed nations, instead.

I agree.

antagon

The Man

- Dec 6, 2009

- 3,572

- 295

- 48

- Thread starter

- #56

true enough for me, kevin. there was no central bank in the US during the jackson era. some 25 years. no central banks in the 19th century manipulated rates of interest whatsoever.

i don't think you can validate a theory by moving the goalposts under a rainbow, man.

Free markets in the 19th century?!

God almighty, Ant, where did you get that impression?

The Hamilton Tariff of 1789

The Tariff of 1816

The Tariff of 1824

Not exactly what you'd define as "free market economics" methinks

there's no such thing as a free market, i guess. kevken was talking about interest rate manipulation, however, and so was i.

antagon

The Man

- Dec 6, 2009

- 3,572

- 295

- 48

- Thread starter

- #57

i think this goes back to the start of my discussion where i felt the need to tread carefully and look at the aggregate picture of government influence. for example, it cant be ignored that losers and winners were picked in the financial services sector during the crisis, but on aggregate, the government supported the industry. it is these bigger pictures that macroeconomics deals with. the realities at that level are different than those which seem intuitive at the microeconomic level. for example, you've characterized me as appreciative of regulation because i am arguing that the returns of well regulated highly taxed progressive economies are higher. as a macroeconomic argument this is certain. it makes america a better place to do business when looking at the big picture. on a microeconomic level, i have a higher tax liability and higher wage costs and burden because of all that. i dont appreciate that. in the end, it is easier to accrue wealth in a country which has all of that than one which does not. the plurality of americans on the forbes list might be a testament to this fact.All too often, "less government" is mischaracterized as "no government." "Less regulation" is characterized as "free to swindle."... The government should not be arbitrarily picking the winners and losers.

politics are often campaigned on microeconomic bases for their populist shine, when the bottom line is that a responsible government will affect a better service to the economy by concerning itself with macroeconomics. that is the realm of governments.

take out the micro-states and hydrocarbon oligarchies from the per cap gdp(ppp) and you've got japan, western/northern europe, canada and the US.... ok australia probably. nothing dramatic between these countries.GDP at Purchasing Power Parity per capita is a very good measure... It is difficult to directly compare the different environments, I agree. That's also why it's not necessarily accurate to limit the factors of prosperity to just regulation either. I'm not sure if I agree, but my Macroeconomics Professor argued that the overall tax burden as a percentage of GDP encompasses regulation.

all along, i have tried to mix the tax and regulations picture. i dont think they are quite the same thing, but i believe that tax is crucial to currency, the distribution of buying power and market liquidity. these are not regulations, but they regulate the flow of cash (fuel) in the economy (engine).

what your professor suggested is interesting. initself this could be misleading, however. it draws back on your comment on sustainability: if this ratio is low, but the public largess is habitually underfinanced, isn't the government hiding the burden in debt?

this is the status quo in the US.

looking deeper into sustainability, i think that the whole character of economies must tack intermittently to maintain course. sometimes they need to bear off wind altogether. hopefully you sail, and that wasn't gibberish, but my point is that we switch up our economy with macro solutions to macro concerns: the progressive response to the depression, the supply-side response to double digit interest and stagflation, the xxxxxx response to multi-trillion dollar debt and basement interest rates. i think these responses have to come from the government in the form of policy packages, and classify them as crucial management of an economy. if we maintained course at any of these junctures like many before, our economy would not have made it through the decades to follow each.

antagon

The Man

- Dec 6, 2009

- 3,572

- 295

- 48

- Thread starter

- #58

do you know that neither freddie, fannie or the FHA has anything to do with my mortgage?

Can't you read either?

I said "now controls" I'm not talking about mortgage made in the past, I'm talking about in the present.

The US Federal government through Fannie, Freddie and FHA now controls 100% of the US mortgage market

Clear enough?

i get your point frank, even if i am unwilling to accept that these organization's role amounts to 100% control of a market shared by thousands of participants, and even though my mortgage is currently securitized and participating in the mortgage market.

if it is your point that this somehow makes the US lending market less efficient or less effective, i beg how.

asterism

Congress != Progress

i think this goes back to the start of my discussion where i felt the need to tread carefully and look at the aggregate picture of government influence. for example, it cant be ignored that losers and winners were picked in the financial services sector during the crisis, but on aggregate, the government supported the industry.All too often, "less government" is mischaracterized as "no government." "Less regulation" is characterized as "free to swindle."... The government should not be arbitrarily picking the winners and losers.

I disagree. The industry has been nationalized.

it is these bigger pictures that macroeconomics deals with. the realities at that level are different than those which seem intuitive at the microeconomic level. for example, you've characterized me as appreciative of regulation because i am arguing that the returns of well regulated highly taxed progressive economies are higher. as a macroeconomic argument this is certain. it makes america a better place to do business when looking at the big picture. on a microeconomic level, i have a higher tax liability and higher wage costs and burden because of all that. i dont appreciate that. in the end, it is easier to accrue wealth in a country which has all of that than one which does not. the plurality of americans on the forbes list might be a testament to this fact.

The trend of upward mobility is being stifled. With rare exception, only the favored and the connected are now being allowed to accrue wealth. I'll break with most of my conservative fellows and say that I do favor a progressive tax. Ideally, I favor the FairTax as proposed, with prebates for those living at the poverty level.

However, a concept is completely different than the actual implementation. The tax code is becoming less of a funding model and more of a means to control the economy.

politics are often campaigned on microeconomic bases for their populist shine, when the bottom line is that a responsible government will affect a better service to the economy by concerning itself with macroeconomics. that is the realm of governments.

I disagree again, because I've seen the abject incompetence the government has in macroeconomics. All centrally planned economies have failed by our standards. Even China has failed. 66% of our GDP with 4 times our population?

take out the micro-states and hydrocarbon oligarchies from the per cap gdp(ppp) and you've got japan, western/northern europe, canada and the US.... ok australia probably. nothing dramatic between these countries.GDP at Purchasing Power Parity per capita is a very good measure... It is difficult to directly compare the different environments, I agree. That's also why it's not necessarily accurate to limit the factors of prosperity to just regulation either. I'm not sure if I agree, but my Macroeconomics Professor argued that the overall tax burden as a percentage of GDP encompasses regulation.

I don't agree, there is a huge disparity.

all along, i have tried to mix the tax and regulations picture. i dont think they are quite the same thing, but i believe that tax is crucial to currency, the distribution of buying power and market liquidity. these are not regulations, but they regulate the flow of cash (fuel) in the economy (engine).

what your professor suggested is interesting. initself this could be misleading, however. it draws back on your comment on sustainability: if this ratio is low, but the public largess is habitually underfinanced, isn't the government hiding the burden in debt?

That's what I think he was getting at, that all regulation can be summed up into the power of the government in the economy.

As to debt, that is another dynamic. What would happen if the debt disappeared tomorrow? Would the elected officials just start borrowing again?

this is the status quo in the US.

Not true. The debt is increasing massively without any corresponding growth.

looking deeper into sustainability, i think that the whole character of economies must tack intermittently to maintain course. sometimes they need to bear off wind altogether. hopefully you sail, and that wasn't gibberish, but my point is that we switch up our economy with macro solutions to macro concerns: the progressive response to the depression, the supply-side response to double digit interest and stagflation, the xxxxxx response to multi-trillion dollar debt and basement interest rates. i think these responses have to come from the government in the form of policy packages, and classify them as crucial management of an economy. if we maintained course at any of these junctures like many before, our economy would not have made it through the decades to follow each.

There are too many assumptions there to respond to. Let's start with the first one:

The progressive response to the depression made things worse, and it did so for a long long time.

antagon

The Man

- Dec 6, 2009

- 3,572

- 295

- 48

- Thread starter

- #60

when the government moved to take a stake in automakers, i felt that was a move to support the industry. if this is not the case, how would a let them fail approach better support automakers?

in the case of the banks, this is one way which the US has shown heavier-handed regulation than the UK, despite our financial services sector outperforming theirs. in the US, the stake in at-risk 'too big to fail' banks was a mandatory position, while in the UK there was an option to get bailed out. nevertheless, can this policy be seen as non-supportive of industry on aggregate. you've characterized the US as a referee who takes snaps in the game. can this position be shown to be more than an axiomatic no-no? is the government a player-coach or team captain?

the fair tax. is a federal sales tax on all commerce constitutional? is it sensible to tax consumption when that is the basis of our economy? it is not savings, uninvested retained earnings or the accrual of wealth which makes the united states the world's biggest economy. sales tax is naturally regressive, then is patched up by this prebate concept. how do conservative policies always end up resulting in greater government dependency than the status quo? while conservatives deride anything european, what's up with imposing a euro-style VAT in the US? our tax system has transitioned to a value-added characteristic since reagan, i believe that the value-added income taxation is more effective than value-added sales tax: one of the ways which american policy is superior to what's going on over there.

pigovian taxation. what's wrong with tax-based coercion? i propose that more is invested in our economy and more donated to charity because of this nature of our tax system. the only testament to this is the extent to which americans invest and give to charity. that alone is not enough to support my opinion, but i take it anyhow: i take this to the extreme of there being a greater propensity to invest in capital and donate charitably in the status quo because of deductibility than there would be if there was no tax whatsoever. none. what coercive force does sales tax create? what is the value of inflation without profit?

whether or not you maintain a philosophical presumption that some governments control national economic policies and others don't, that is not the case. the folks who print the currency do moderate the economy and set up the systems which run within it. there is no escaping that. of course, my take on china's economic performance is that they have had no progressive reform, and have only had a market based economy for the last 20 years or so.

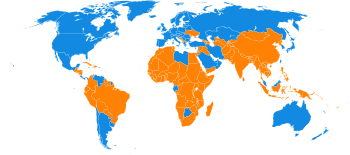

List of countries by GDP (PPP) per capita - Wikipedia, the free encyclopedia

this is a map which indicates what i am talking about with the gdp(ppp) per capita. after the resource exporters are removed, you are left with a map of developed nations in blue and developing and underdeveloped nations in orange. between the blues is not what i would call vast disparity as you have. i have family and have lived in london and have visited nanjing for a month and a half. the 10k difference between the US and GB does not compare with the 40k difference between the US and china -- not on the street. except for the resource exporters, the one thing that the blue countries all have in common is that they have progressive reforms. every last one. the one thing the orange ones have in common is that they dont. none of them.

i think the US writes the book on macroeconomics and geopolitics. this is why we are at where we are at. this thread is about reading that book, rather than criticizing it with extreme left or right wing proposals which cant be said to perform better than our economy does.

where to next? a discussion about the great depression or about the conservative presumption that a lower tax to gdp ratio will spur growth rather than merely spur debt? growth.

in the case of the banks, this is one way which the US has shown heavier-handed regulation than the UK, despite our financial services sector outperforming theirs. in the US, the stake in at-risk 'too big to fail' banks was a mandatory position, while in the UK there was an option to get bailed out. nevertheless, can this policy be seen as non-supportive of industry on aggregate. you've characterized the US as a referee who takes snaps in the game. can this position be shown to be more than an axiomatic no-no? is the government a player-coach or team captain?

the fair tax. is a federal sales tax on all commerce constitutional? is it sensible to tax consumption when that is the basis of our economy? it is not savings, uninvested retained earnings or the accrual of wealth which makes the united states the world's biggest economy. sales tax is naturally regressive, then is patched up by this prebate concept. how do conservative policies always end up resulting in greater government dependency than the status quo? while conservatives deride anything european, what's up with imposing a euro-style VAT in the US? our tax system has transitioned to a value-added characteristic since reagan, i believe that the value-added income taxation is more effective than value-added sales tax: one of the ways which american policy is superior to what's going on over there.

pigovian taxation. what's wrong with tax-based coercion? i propose that more is invested in our economy and more donated to charity because of this nature of our tax system. the only testament to this is the extent to which americans invest and give to charity. that alone is not enough to support my opinion, but i take it anyhow: i take this to the extreme of there being a greater propensity to invest in capital and donate charitably in the status quo because of deductibility than there would be if there was no tax whatsoever. none. what coercive force does sales tax create? what is the value of inflation without profit?

whether or not you maintain a philosophical presumption that some governments control national economic policies and others don't, that is not the case. the folks who print the currency do moderate the economy and set up the systems which run within it. there is no escaping that. of course, my take on china's economic performance is that they have had no progressive reform, and have only had a market based economy for the last 20 years or so.

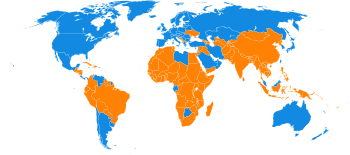

List of countries by GDP (PPP) per capita - Wikipedia, the free encyclopedia

this is a map which indicates what i am talking about with the gdp(ppp) per capita. after the resource exporters are removed, you are left with a map of developed nations in blue and developing and underdeveloped nations in orange. between the blues is not what i would call vast disparity as you have. i have family and have lived in london and have visited nanjing for a month and a half. the 10k difference between the US and GB does not compare with the 40k difference between the US and china -- not on the street. except for the resource exporters, the one thing that the blue countries all have in common is that they have progressive reforms. every last one. the one thing the orange ones have in common is that they dont. none of them.

i think the US writes the book on macroeconomics and geopolitics. this is why we are at where we are at. this thread is about reading that book, rather than criticizing it with extreme left or right wing proposals which cant be said to perform better than our economy does.

where to next? a discussion about the great depression or about the conservative presumption that a lower tax to gdp ratio will spur growth rather than merely spur debt? growth.

Similar threads

- Replies

- 4

- Views

- 218

- Replies

- 5

- Views

- 142

- Replies

- 9

- Views

- 521

- Replies

- 67

- Views

- 939

Latest Discussions

- Replies

- 118

- Views

- 534

- Replies

- 589

- Views

- 4K

Forum List

-

-

-

-

-

Political Satire 8870

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 492

-

-

-

-

-

-

-

-

-

-