BrokeLoser

Diamond Member

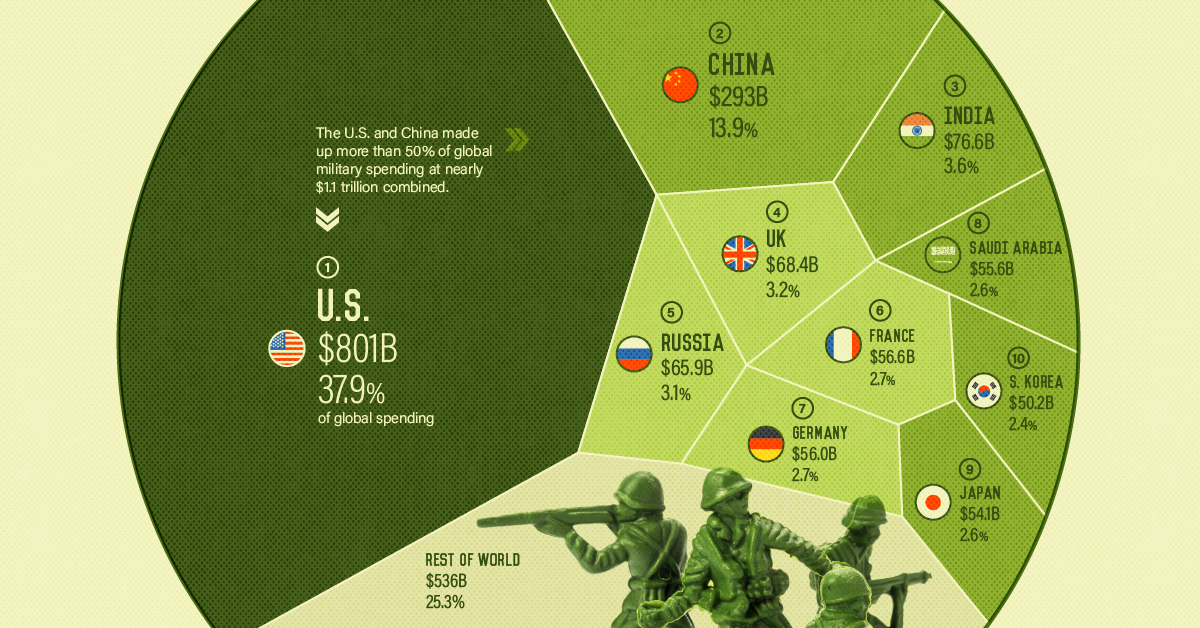

I wonder if Ukraine wishes they would have spent more on their military?As long as the War Department`s budget is untouchable, spending cuts are meaningless because we would be cutting nickels and dimes. I want the government to stop spending on anything that doesn`t affect me.I`m sure we all can agree on that. Our military spending makes up nearly 38% of the world`s total. Friendly neighbors north and south and 2 big oceans protecting east and west coasts. Are we suckers or cowards?

Ranked: Top 10 Countries by Military Spending

As geopolitical tensions began to heat up around the world, which nations were the top military spenders in 2021?www.visualcapitalist.com

It’s always easy to say “we should spend less on defense” when you know you don’t have to worry about being attacked.

The real problem is….spending on people like you doesn’t offer an ROi. We have spent trillions trying to improve blacks and degenerates…they don’t improve.