What's your viewpoint regarding inflation and government spending? Does an increase in spending always cause inflation or does it depend exclusively on how the government spends the money? Are there any other factors which could act as dampers or increase its effect?

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Does government spending cause inflation?

- Thread starter Mexicano

- Start date

Michael1985

Platinum Member

I consider it one factor among many.

themirrorthief

Diamond Member

when gov taxes business, consumer costs go up and up so said business can maintain its profit and stay in business...duhWhat's your viewpoint regarding inflation and government spending? Does an increase in spending always cause inflation or does it depend exclusively on how the government spends the money? Are there any other factors which could act as dampers or increase its effect?

- Oct 20, 2013

- 55,734

- 17,709

- 2,250

When a POTUS declares war on the fossil fuel industry (now who could that ever be ?), and cancels drilling, thereby reducing supply, prices go up. When prices of gas and deisel go up, it costs more for manufacturer to transport their goods to stores.

This increase in transport cost to manufacturers, get passed on to consumers in the form of higher prices in the stores. If you vote for Biden, you're voting for higher prices on just about everything.

This increase in transport cost to manufacturers, get passed on to consumers in the form of higher prices in the stores. If you vote for Biden, you're voting for higher prices on just about everything.

Too much money chasing too few goods and services, and the government controls the money supply.

Correct.

So you focus on the "goods" end of it & make it easier for companies to produce more...Just like Trump did! (supply side economics).

If the goods are there to buy with that excess money...no inflation, When that excess money buys up all the goods...BIG INFLATION!

2 sides to this coin...GOODS and MONEY SUPPLY,

- Thread starter

- #7

Too much money chasing too few goods and services, and the government controls the money supply.

So yes.

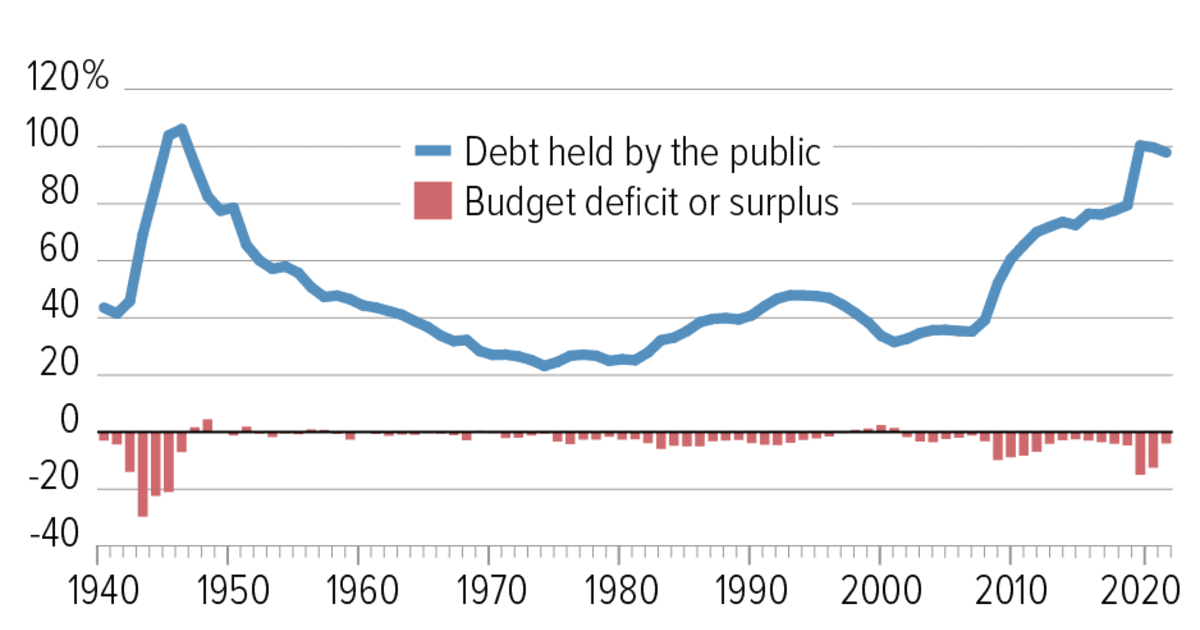

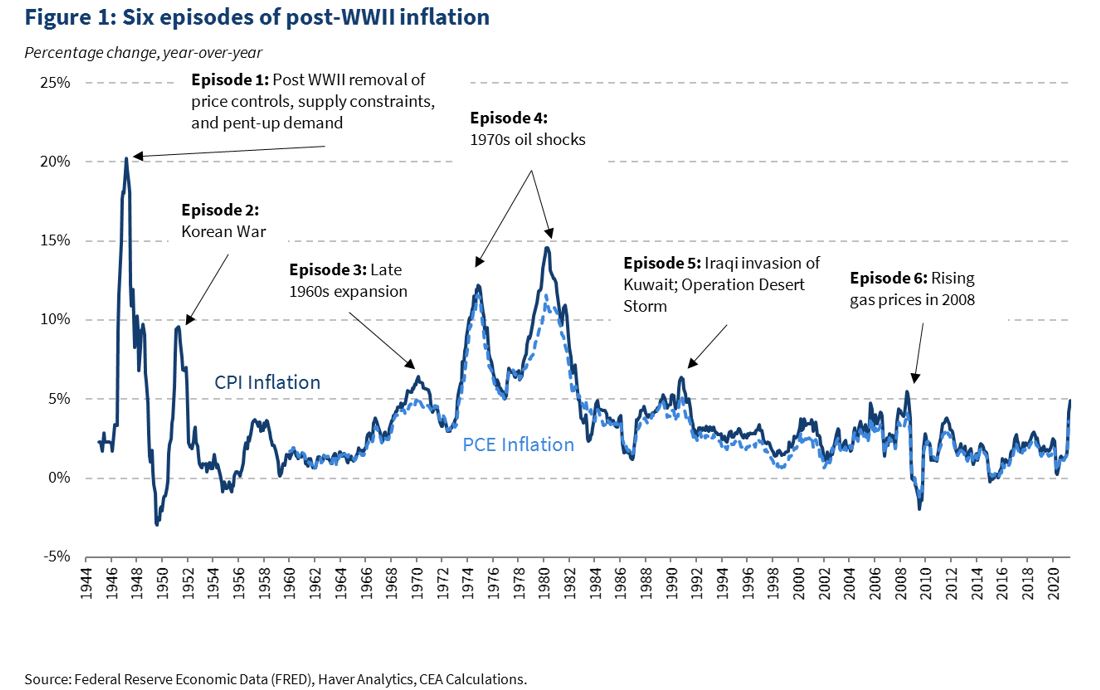

There doesn't seem to be a strong correlation between these two charts. The period between 2008 and 2020 saw a continuous increase in spending with a very low inflation.

It might be a factor that can contribute to inflation, but it doesn't seem to be the main factor driving inflation.

- Thread starter

- #8

That could probably be the case in a closed economy ( with no foreign trade). In an opened economy producers face competition not only from local firms but from foreign firms. So even if they would like to hike prices to compensate for every penny they pay in taxes in reality not every sector can do that.when gov taxes business, consumer costs go up and up so said business can maintain its profit and stay in business...duh

Certainly retailers , located in the end point of the supply chain can do that, but that is hardly true for the rest of the supply chain.

- Thread starter

- #9

Cost-push inflation is probably a more important player than government spending.When a POTUS declares war on the fossil fuel industry (now who could that ever be ?), and cancels drilling, thereby reducing supply, prices go up. When prices of gas and deisel go up, it costs more for manufacturer to transport their goods to stores.

This increase in transport cost to manufacturers, get passed on to consumers in the form of higher prices in the stores. If you vote for Biden, you're voting for higher prices on just about everything.

Concerned American

Diamond Member

Like any commodity, when the supply goes up, the value goes down. If the government bases its spending on an increasing deficit to pump more money into the economy, the value of the money goes down and it buys less so prices increase--inflation. Balance in economics is optimal in gov. spending. Not too much money in the system, but not too little. Currently there are way too many dollars in the system and the value is sliding since about Oct. last year against the Euro, GBP and the Japanese Yen.What's your viewpoint regarding inflation and government spending? Does an increase in spending always cause inflation or does it depend exclusively on how the government spends the money? Are there any other factors which could act as dampers or increase its effect?

Concerned American

Diamond Member

That is classic inflation. Costs increase for everyone because there is lower value to the money. So everyone in that economy is affected (not necessarily foreign producers) but within the US economy. That is why the end point sale is where you see the increase because everyone who touched that product demanded more (because their $$ were buy less as well). Its a vicious circle that feeds on itself and it takes real economic discipline to keep it in line--We need that today, but the current fed and admin are not up to the task.Certainly retailers , located in the end point of the supply chain can do that, but that is hardly true for the rest of the supply chain.

- Thread starter

- #12

Imagine Walmart sells some canned fruits. They can source them either locally or from a foreign vendor.That is classic inflation. Costs increase for everyone because there is lower value to the money. So everyone in that economy is affected (not necessarily foreign producers) but within the US economy. That is why the end point sale is where you see the increase because everyone who touched that product demanded more (because their $$ were buy less as well). Its a vicious circle that feeds on itself and it takes real economic discipline to keep it in line--We need that today, but the current fed and admin are not up to the task.

let's say income taxes are increased 5% .

The local producer might be tempted to mark-up its price. Indeed he may do so. But foreign vendors are not subjected to such tax. So they have no reason to mark up their prices.

Normally this means you would see locally canned fruits at $10.50 and a foreign brand at $10.00

The VAT tax is a different case: both products (local or foreign ) are affected in the same percentage.

Concerned American

Diamond Member

Certainly, the foreign vendor is not affected--but from the time the item enters this country, every hand that touches it is asking for more money (due to $ devaluation because of excess money supply). This causes an inevitable price increase on all goods at the consumer level. That is inflation. It also sends more dollars to the treasury because as prices increase so do percentage based sales taxes and fees. Re: your point about taxes on imports--I understand your point but at any given moment in time, import taxes can change as was the case when Trump countered China with tariffs. The reason was to artificially increase the price of the imported goods so that American goods could compete in price.Imagine Walmart sells some canned fruits. They can source them either locally or from a foreign vendor.

let's say income taxes are increased 5% .

The local producer might be tempted to mark-up its price. Indeed he may do so. But foreign vendors are not subjected to such tax. So they have no reason to mark up their prices.

Normally this means you would see locally canned fruits at $10.50 and a foreign brand at $10.00

The VAT tax is a different case: both products (local or foreign ) are affected in the same percentage.

the watcher

Diamond Member

- Dec 31, 2016

- 1,582

- 1,354

- 1,938

The government doesn't control the money supply, they turned that function over to a privately owned bank patriotically named the Federal Reserve in 1913. The head of the fed is designated by the bankers and dutifully installed by the "government".Too much money chasing too few goods and services, and the government controls the money supply.

So yes.

- Mar 9, 2011

- 70,216

- 84,032

- 3,635

The government doesn't control the money supply, they turned that function over to a privately owned bank patriotically named the Federal Reserve in 1913. The head of the fed is designated by the bankers and dutifully installed by the "government".

The Federal Reserve's policies are usually influenced by the administration in power. And though the Biden administration does not directly control the Fed, it was Biden himself who appointed five of its seven board members to their current positions.

- Thread starter

- #16

The government has to actually spend the money for that money to be put into circulation in the form of deposits at the recipient's bank accounts.The government doesn't control the money supply, they turned that function over to a privately owned bank patriotically named the Federal Reserve in 1913. The head of the fed is designated by the bankers and dutifully installed by the "government".

Since the economy is a set of interleaved balance sheets , the negative financial equity of the government is the positive equity of the other sectors.

- Thread starter

- #17

Many imported goods are finished goods. So it is not an unavoidable situation that income taxes create inflation.Certainly, the foreign vendor is not affected--but from the time the item enters this country, every hand that touches it is asking for more money (due to $ devaluation because of excess money supply). This causes an inevitable price increase on all goods at the consumer level. That is inflation. It also sends more dollars to the treasury because as prices increase so do percentage based sales taxes and fees. Re: your point about taxes on imports--I understand your point but at any given moment in time, import taxes can change as was the case when Trump countered China with tariffs. The reason was to artificially increase the price of the imported goods so that American goods could compete in price.

VAT taxes on the other hand are usually just passed down the line to consumers. Also some firms will either cut operating expenses or improve their efficiency. Rising prices is not the only way around income tax, although it is the easiest one.

Concerned American

Diamond Member

ALL taxes and any other operating costs are passed down to the consumer. If they weren't, there would be no profit for the mfr. or retailer.VAT taxes on the other hand are usually just passed down the line to consumers.

- Thread starter

- #19

But they are not pushed down uniformly . Products have a different cost structure and this is reflected in the pricing. Since there is competition not all competitors will hike their prices uniformly.ALL taxes and any other operating costs are passed down to the consumer. If they weren't, there would be no profit for the mfr. or retailer.

Concerned American

Diamond Member

Competition is over rated. Government controls competition in nearly every aspect through taxes, fees and tariffs.But they are not pushed down uniformly . Products have a different cost structure and this is reflected in the pricing. Since there is competition not all competitors will hike their prices uniformly.

Similar threads

- Replies

- 17

- Views

- 381

- Replies

- 93

- Views

- 2K

Latest Discussions

- Replies

- 176

- Views

- 1K

- Replies

- 414

- Views

- 2K

- Replies

- 25

- Views

- 142

Forum List

-

-

-

-

-

Political Satire 8102

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 471

-

-

-

-

-

-

-

-

-

-