Econ4Every1

Active Member

- Aug 7, 2017

- 177

- 5

- 31

- Thread starter

- #21

I didn't, but tell me then, what other kinds of deposits are there

You cut me deep....lol

No, I just want to know what you think.

_____________________________

Sure...I never said banks didn't lend deposits.

There is a distinction here, you are either missing or ignoring, and I can't figure out which.

Now go back and re-read what I wrote.

I said "Banks don't lend customer deposits to other customers"

If you don't understand the distinction, I'm not surprised you can't grasp what I'm trying to tell you.

If banks don't loan customer deposits to other customers, where do banks get the money they lend?

They create the money out of thin air. The loan is secured by the note which is deposited as an asset. The "backstop" (if you will) is the underlying asset (collateral) the borrower purchased (houses and cars as an example) that can be reclaimed and sold to cover the loan taken. If there is no collateral or it wasn't worth what it takes to repay the loan, the bank must withdraw from its capital to cover the loss. If the bank's liabilities exceed its capital, the bank is insolvent.

_______________________________

So deposits are useful, in a Pre-2008 world, bank deposits are the lowest cost reserve a bank usually had.

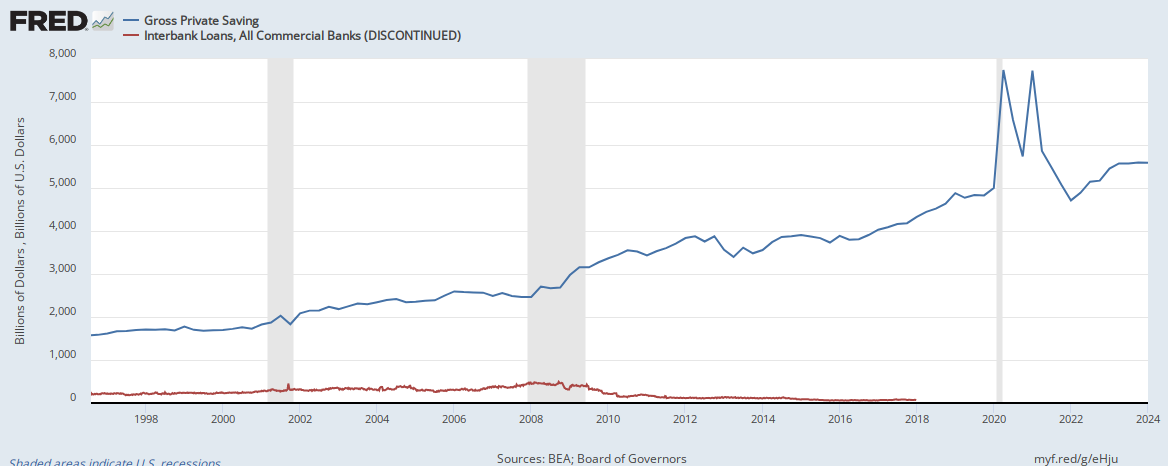

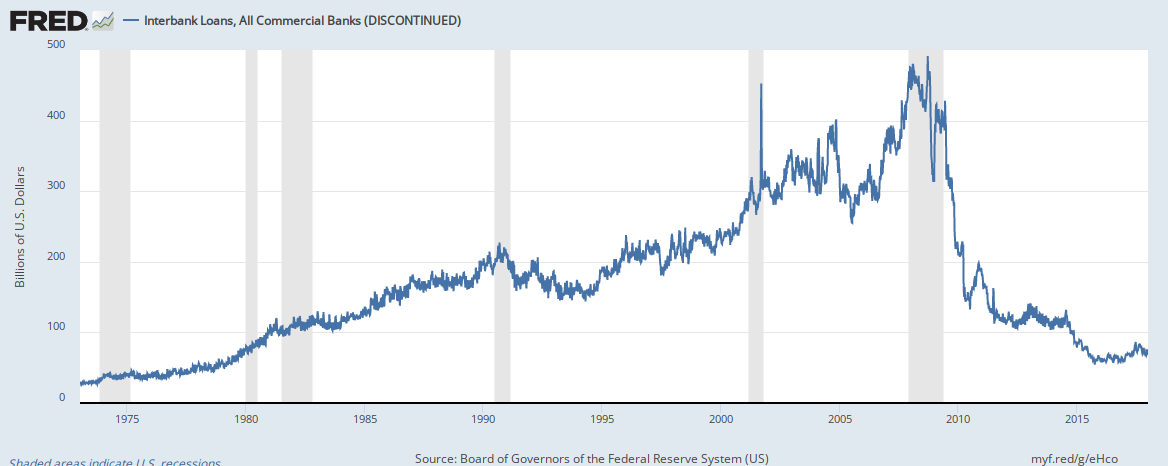

Yet we see interbank lending levels at rates we having seen since early 1980's. So they aren't as useful as they were pre-2008...Beeeeeeecasuse the excess reserve level is so high.

Yep, that was a mistake. Today we're just over 100 basis points.

Funny, because I provided several sources that say the opposite. What were your sources?

Just to be clear....Fed bank=Fed member bank. The regional banks and Federal reserve are settlement banks.

Again, pre-2008 the Fed target rates through open market operations. Those operations added or removed reserves in the system overall and thereby maintained a certain liquidity level, and thereby maintained the desired level of scarcity of reserves which helped the Fed target a certain "window" for interest rates. Loans create deposits and deposits are reserves thus the reserve level would continually increase (in a growing economy) without OMO removing excess reserves in exchange for securities.

Banks lend to other banks because some banks had excess reserves and other banks had a deficit of reserves. The banks with deficits would borrow reserves (usually overnight) from those that had an excess. Since banks weren't paid interest on excess reserves, then lending them to other banks (Perhaps you've heard of interbank lending?). If there was a deficit in the system overall, bank could borrow directly from the Fed.

This is why banks desire savers. So they can meet their reserve requirements without having to borrow from other banks or the Fed. In the best case, a bank would have enough reserves to meet their requirement and enough to lend to other banks.

Banks do not lend customer deposits to other customers, only to other banks. Reserves do not circulate in the economy.

_______________________

The $1 is created out of thin air

Banks don't "print" money, they create money electronically. If a bank needs physical dollars it trades them to the Fed for reserves.

You don't know? Still in school, eh?

You cut me deep....lol

No, I just want to know what you think.

_____________________________

Sure...I never said banks didn't lend deposits.

Ummm....So, no, loans do not come from deposits.

Were you lying then, or are you lying now?

There is a distinction here, you are either missing or ignoring, and I can't figure out which.

Now go back and re-read what I wrote.

I said "Banks don't lend customer deposits to other customers"

If you don't understand the distinction, I'm not surprised you can't grasp what I'm trying to tell you.

If banks don't loan customer deposits to other customers, where do banks get the money they lend?

They create the money out of thin air. The loan is secured by the note which is deposited as an asset. The "backstop" (if you will) is the underlying asset (collateral) the borrower purchased (houses and cars as an example) that can be reclaimed and sold to cover the loan taken. If there is no collateral or it wasn't worth what it takes to repay the loan, the bank must withdraw from its capital to cover the loss. If the bank's liabilities exceed its capital, the bank is insolvent.

_______________________________

So deposits are useful, in a Pre-2008 world, bank deposits are the lowest cost reserve a bank usually had.

[Deposits are] Still are lowest cost. Still useful.

Yet we see interbank lending levels at rates we having seen since early 1980's. So they aren't as useful as they were pre-2008...Beeeeeeecasuse the excess reserve level is so high.

Wow! So wrong. Just for fun, prove it.

Yep, that was a mistake. Today we're just over 100 basis points.

Yes, I pointed out you were wrong when you said that.

Funny, because I provided several sources that say the opposite. What were your sources?

Really? Why would a Fed bank wish to borrow from another Fed bank? Spell out their logic in doing so.

Just to be clear....Fed bank=Fed member bank. The regional banks and Federal reserve are settlement banks.

Again, pre-2008 the Fed target rates through open market operations. Those operations added or removed reserves in the system overall and thereby maintained a certain liquidity level, and thereby maintained the desired level of scarcity of reserves which helped the Fed target a certain "window" for interest rates. Loans create deposits and deposits are reserves thus the reserve level would continually increase (in a growing economy) without OMO removing excess reserves in exchange for securities.

Banks lend to other banks because some banks had excess reserves and other banks had a deficit of reserves. The banks with deficits would borrow reserves (usually overnight) from those that had an excess. Since banks weren't paid interest on excess reserves, then lending them to other banks (Perhaps you've heard of interbank lending?). If there was a deficit in the system overall, bank could borrow directly from the Fed.

This is why banks desire savers. So they can meet their reserve requirements without having to borrow from other banks or the Fed. In the best case, a bank would have enough reserves to meet their requirement and enough to lend to other banks.

Banks do not lend customer deposits to other customers, only to other banks. Reserves do not circulate in the economy.

_______________________

The $1 is created out of thin air

Cool.

View attachment 142643

Did they print it?

Because I need to hit the vending machine down the hall.

Banks don't "print" money, they create money electronically. If a bank needs physical dollars it trades them to the Fed for reserves.

Last edited: