The 70 year period began with the GSE's and the timeline includes the various incarnations including and up to Frank and Dodd blocking regulation.

"It was Fannie Mae and Freddie Mac, the two so-called Government Sponsored Enterprises (GSEs), that lay behind the crisis. After regulatory changes made to the Community Reinvestment Act by President Clinton in 1995, Fannie and Freddie went into hyper-drive, channeling literally trillions of dollars into the housing markets, using leverage and implicit taxpayers' guarantees.

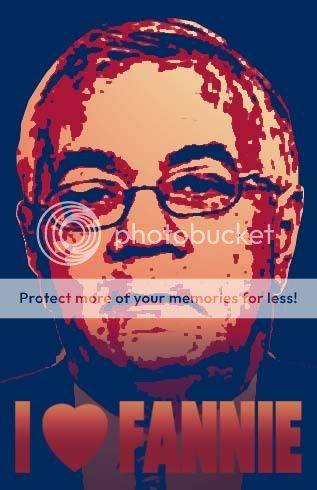

President Bush pushed for what the New York Times then called "the most significant regulatory overhaul in the housing finance industry since the savings and loan crisis a decade ago."… led by Frank, Democrats stood as a bloc against any changes."

IBDeditorials.com: Editorials, Political Cartoons, and Polls from Investor's Business Daily -- Let The Inquisition Start With Frank

Didn't you already cite this editorial?

I'll repeat as well, since you've not responded to this basic question raised by the assertion of the article you repeatedly have cited:

2. And most importantly, please explain how Frank, as a member of a then minority party of the House of Representative, was able to supposedly "stand as a bloc" against changes, presumably sought by the Republicans, who controlled majorities in the House of Representatives, Senate, and White House.

Even better, let's see the bill Bush sponsored that went for a vote in the HOR, so we can see how Frank and the minority Democratic party were able to block it.

So, let's have you be the second on this thread to answer the question: Would there be a mortgage meltdown today is there had been no GSE's, CRA, Clinton, Cuomo, Dodd and Frank?

If you have to agree that if folks had to put down a larger portion of home prices, and the government if did not take a paternal role in 'helping' people to own homes, then there would have been reason to have more stringent control of financial institutions, thus less chance of the trillions of dollars that have been lost...then welcome to the Conservative Party.

And in the 2006 elections, Democrats took a small majority of 51-49 in the senate and 233-202 in the House of Representatives which they held for the two years leading up to the 2008 election.

You think I should answer your question when you refuse to respond to mine?

I'll give the answer for you. Contrary to the assertions in conservative editorials, there is no way Frank could have "blocked" a bill in the HOR that was sponsored by Bush and the Republicans. The Republican majority could have passed any bill it wanted in the House.

And the *only* bill passed in the House in this time frame to regulate Fannie was a bipartisan bill in 2005 which Frank in fact supported.

Furthermore, the fact that Fannie/Freddie has been around for decades without causing meltdown is evidence they are not at fault for the current crisis. And if current policies in their operations had an effect, the principal blame can only be levided against the party that had complete control of the Govt, including the agency with specific responsibility to oversee Fannie/Freddie (OFHEO), from 2000-06.

For the record, I did respond to your question, post #58.