Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CNBC: Trump Boasts "The Reason our stock market is so successful is because of me"

- Thread starter NightFox

- Start date

I realize that Trump can't help himself when it comes to self-promotion, but he's really asking for trouble when he tries this.

ThoughtCrimes

Old Navy Vet

With all that power to make the market rise so effortlessly, I reckon that when the Market crashes his magical Orange Ass will be responsible for the downturn also! BTW, Obama's 8th annual budget ended on Sept 30th and the rotund One had absolutely nothing to do with the underpinnings of the economy enabling that rise to be effected, and the first Orange budget has only been in play for 37 days now...that Fiscal Year thingy, don't cha know!Source: CNBC.COM

Trump boasts: 'The reason our stock market is so successful is because of me'

"The reason our stock market is so successful is because of me," the president said. "I've always been great with money, I've always been great with jobs, that's what I do. And I've done it well, I've done it really well, much better than people understand and they understand I've done well."

ROFLMAO!!! 10 months in office and he's single handedly managed to invent the late business cycle and the attendant bull market in equities; shoot we don't need entrepreneurs, innovation and great companies anymore, we've got the Donald and his twitter account.

Our politicians just kick ass, first it was Al Gore and the Internet and now Donald Trump and his innovations in capitalism. Although I'm not sure DT is going to be so quick to take credit when the inevitable equities bear market rears its ugly head.

Now If we could just convince him to work a couple of extra hours a week I'll bet he'll lick that cure for cancer thing and the completely out of control public debt accumulation in no time.

JoeMoma

Platinum Member

- Nov 22, 2014

- 22,943

- 10,667

- 950

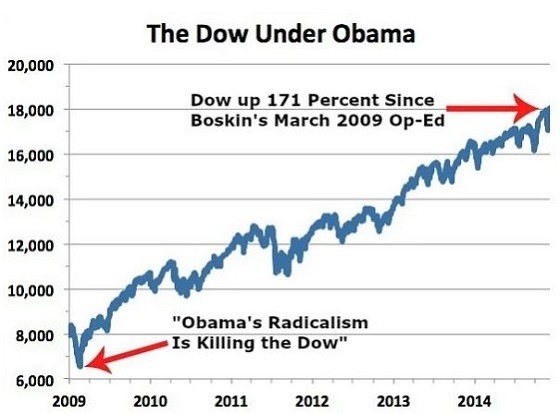

The market climbed 350% under Obama.....are you sure about that?Let me know when the market has climbed 350% under Trump like it did under Obama.

JoeMoma

Platinum Member

- Nov 22, 2014

- 22,943

- 10,667

- 950

Yes, he is asking for trouble bigly. If he is taking credit for the market going up, then he will get the blame when it crashes...and it will.I realize that Trump can't help himself when it comes to self-promotion, but he's really asking for trouble when he tries this.

Obama's great achievement on the stock market was standing back and letting the Fed pour $4 TRILLION into the economy.

Trump has done nothing specific to merit the increase, as well.

Partisans are so freakin' simplistic on this stuff.

.

Trump has done nothing specific to merit the increase, as well.

Partisans are so freakin' simplistic on this stuff.

.

Well, it may just have a correction, which is a normal part of the cycle. I'd welcome that. But this laying all blame or credit on any President for the stock market is crazy.Yes, he is asking for trouble bigly. If he is taking credit for the market going up, then he will get the blame when it crashes...and it will.I realize that Trump can't help himself when it comes to self-promotion, but he's really asking for trouble when he tries this.

.

Correction, 300 percent.The market climbed 350% under Obama.....are you sure about that?Let me know when the market has climbed 350% under Trump like it did under Obama.

Get back to me when Trump has done the same.

He most probably has a point. The gains in the market coincide to his election.

If during the upcoming administration of President-elect Donald Trump, the stock market were to replicate the success it enjoyed under Obama, rising by a factor of 2.5, then the Dow Jones industrial average — which currently stands at just under the 20,000 level — would have to climb all the way up to 50,000.

Obama & the Stock Market: How Stocks Have Performed

Good luck with that "Dumb Ass Donnie"

DrLove

Diamond Member

Now watch the tards say Obama had nothing to do with tripling the Dow while Trump gets credit for 18 percent.

Notice that not one of them acknowledged the bull market actually starting in 2009 when Obama actually DID inherit a "mess"?

Trumplings aren't particularly bright

He most probably has a point. The gains in the market coincide to his election.

I bought a new radiator for my truck, and within 2 weeks, I got a huge raise, and the woman I had been dating agreed to move in with me. My new radiator had just as much effect on me as you claim Trump had on the stock market.

NightFox

Wildling

- Thread starter

- #33

Nor does it preclude it. Read it and weep snowflake.He most probably has a point. The gains in the market coincide to his election.

Even in this crazy country correlation doesn't imply causation and the business cycle still follows predictable patterns regardless of which clown the sheeple put in the oval office.

The equities markets and the broad economy are doing well in spite of Donald Trump and the cadre of fuck ups in Congress not because of them.

If/When Trump and his merry band of miscreants-R actually DO something to help sustain the economic recovery cycle (like for example passing tax reform that makes sense or getting ready of Obama Don't CARE) then he'll deserve some credit, until then he's just providing comic relief.

Apparently correlation does not imply causation is an alien concept to some.

LOL, you're the one that's assuming correlation does imply causation since you have provided NOTHING but correlation to support your attempt at an argument. Sorry but reason and evidence form the foundation of an actual argument not superstition and idol worship.

Provide some evidence that he's directly responsible for the rise in the major indices that have occurred since he assumed the mantle and we'll talk; or you can choose option B : continue with this display of ignorance and thus provide a source of mild amusement for those of us that understand how markets and price discovery actually work.

Last edited:

iceberg

Diamond Member

- May 15, 2017

- 36,788

- 14,919

- 1,600

seems to if it makes trump look bad.He most probably has a point. The gains in the market coincide to his election.

Even in this crazy country correlation doesn't imply causation and the business cycle still follows predictable patterns regardless of which clown the sheeple put in the oval office.

The equities markets and the broad economy are doing well in spite of Donald Trump and the cadre of fuck ups in Congress not because of them.

If/When Trump and his merry band of miscreants-R actually DO something to help sustain the economic recovery cycle (like for example passing tax reform that makes sense or getting ready of Obama Don't CARE) then he'll deserve some credit, until then he's just providing comic relief.

Apparently correlation does not imply causation is an alien concept to some.

NightFox

Wildling

- Thread starter

- #35

He most probably has a point. The gains in the market coincide to his election.

If during the upcoming administration of President-elect Donald Trump, the stock market were to replicate the success it enjoyed under Obama, rising by a factor of 2.5

President Nimrod doesn't deserve any credit either (the major indices rose in spite of him not because of him), the only agency associated with the federal government that could remotely claim any credit would be the Fed and its historically easy monetary policy, however excessive money printing over long periods of time pursuant to papering over structural problems in the economy comes with terrible risks and those still remain to be dealt with.

I guess we'll see how the Fed balance sheet unwind and interest normalization play out.

AntonToo

Diamond Member

- Jun 13, 2016

- 31,200

- 9,102

- 1,340

Dow under Trump:View attachment 158944He most probably has a point. The gains in the market coincide to his election.

Been going up for eight years

NOOOOO!! The Obama economy was in complete shambles -

Trump inherited a MESS!

He most probably has a point. The gains in the market coincide to his election.

Even in this crazy country correlation doesn't imply causation and the business cycle still follows predictable patterns regardless of which clown the sheeple put in the oval office.

The equities markets and the broad economy are doing well in spite of Donald Trump and the cadre of fuck ups in Congress not because of them.

If/When Trump and his merry band of miscreants-R actually DO something to help sustain the economic recovery cycle (like for example passing tax reform that makes sense or getting ready of Obama Don't CARE) then he'll deserve some credit, until then he's just providing comic relief.

Liar.

here is the rest of the picture:

Get back to us when DOW hits 38,000 under Trump, because at that point he'll match stock market growth under Obama.

Last edited:

AntonToo

Diamond Member

- Jun 13, 2016

- 31,200

- 9,102

- 1,340

does anyone recall the DOW ever coming close to 20,000 in 2009 ?

NO idiot, no one recalls DOW hitting highs in the MIDDLE OF GREAT RECESSION.

Meanwhile, the partisans will keep playing this ridiculous game.He most probably has a point. The gains in the market coincide to his election.

If during the upcoming administration of President-elect Donald Trump, the stock market were to replicate the success it enjoyed under Obama, rising by a factor of 2.5

President Nimrod doesn't deserve any credit either (the major indices rose in spite of him not because of him), the only agency associated with the federal government that could remotely claim any credit would be the Fed and its historically easy monetary policy, however excessive money printing over long periods of time pursuant to papering over structural problems in the economy comes with terrible risks and those still remain to be dealt with.

I guess we'll see how the Fed balance sheet unwind and interest normalization play out.

.

iceberg

Diamond Member

- May 15, 2017

- 36,788

- 14,919

- 1,600

yep. they are the ones doing it.seems to if it makes trump look bad.Apparently correlation does not imply causation is an alien concept to some.

Only in the minds of imbeciles.

Similar threads

- Replies

- 109

- Views

- 1K

- Replies

- 8

- Views

- 261

- Replies

- 4

- Views

- 172

- Replies

- 316

- Views

- 3K

Latest Discussions

- Replies

- 39

- Views

- 189

Forum List

-

-

-

-

-

Political Satire 8307

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 477

-

-

-

-

-

-

-

-

-

-