CrusaderFrank

Diamond Member

- May 20, 2009

- 148,628

- 71,933

- 2,330

Stimulus saved mankind

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Stimulus saved mankind

Before they jettisoned that piece of rock toward the Earth where we saw the skeleton?Stimulus saved mankind

If only it could have saved the Martians from extinction.

Saved the WHAT?!!!!It definitely saved my job.

And I don't work for the government.

You do know that half the stimulus was tax cuts, right?

how did it save your job, exactly?

The first time home buyers tax incentive.

It saved the real estate industry.

And I haven't read a cogent explination what gubmint and Obama mean by 'saved jobs'...I would have thought it was between 1 and 800,000,000,000,000,000,000,000,000,000,000,000,000,000 jobs saved.

*Try*And I haven't read a cogent explination what gubmint and Obama mean by 'saved jobs'...I would have thought it was between 1 and 800,000,000,000,000,000,000,000,000,000,000,000,000,000 jobs saved.

It doesn't matter. You'd reject it anyway.

And I haven't read a cogent explination what gubmint and Obama mean by 'saved jobs'...I would have thought it was between 1 and 800,000,000,000,000,000,000,000,000,000,000,000,000,000 jobs saved.

That translated..You have nothing.And I haven't read a cogent explination what gubmint and Obama mean by 'saved jobs'...I would have thought it was between 1 and 800,000,000,000,000,000,000,000,000,000,000,000,000,000 jobs saved.

It doesn't matter. You'd reject it anyway.

Saved the WHAT?!!!!how did it save your job, exactly?

The first time home buyers tax incentive.

It saved the real estate industry.

Shit ,you must be in one of the few markets where homes are selling. They are not selling here. Average days on market is well over 365.

My friend in Downstate NY 35 miles north of NYC has had her condo on the market for over a year with ONE offer. And that was a low ball offer just $5k above what she paid for it 17 years ago. This after the identical unit below hers sold for $216K just four years ago.

Don't tell me a taxpayer funded tax credit saved anything. It COST us money. And benefited the few. Same as that idiotic Cash for Clunkers deal. All that did was COST the taxpayers money and gave the few people who NEEDED a car a taxpayer funded gift. The unintended consequences is a used car market here prices are now 30% higher than before that stupid program. Yeah, THIRTY PERCENT......No good government deed goes unpunished.

Correct..The only segment of the home construction industry that is doing well is disaster/restoration reconstruction. I know this because that is my business.thats not what Keynes said, he didn't trumpet CONSUMER stimulus....but you knew that right?

...you are whacked dude.....seriously over the hill whacked. the real estate market is FUCKED.

And it would have been much worst without the incentive.

You don't work in the industry, so you have no idea what you are talking about.

I do. The housing market is toast. I've had several of my builders go under and the remodel industry is also crippled.

good grief. between 5to 25 million..

couldn't they come UP WITH A NUMBER or are we suppose to pick one.

So yeah sure...I believe it, really..

I think it is much closer to the 25 million figure.

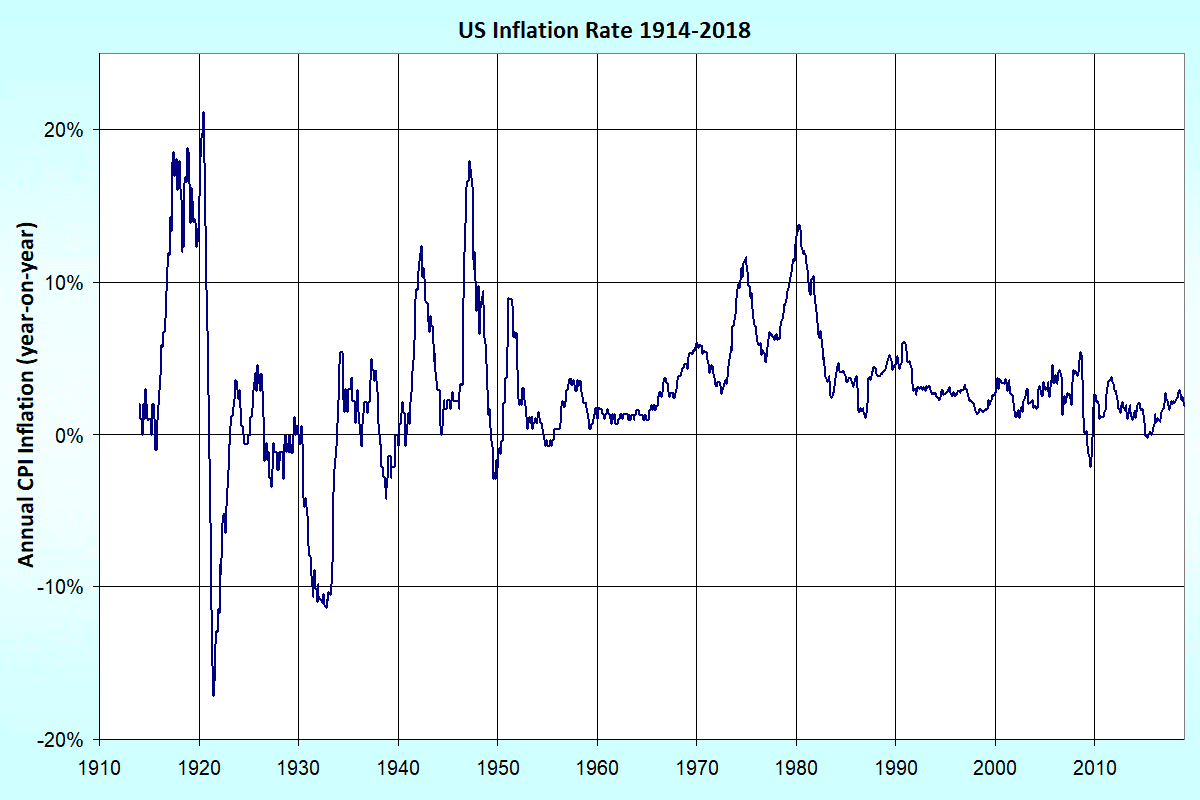

The country was headed into a deflationary spiral before the stimulus.

The stimulus saved us from another Great Depression.

4th time- how did it save your job?

Once the first time home buyers tax incentive kicked in, people started buying again.

Holy shit!Notice how the stimulus kicked in Feb 2009?

I thought it was supposed to keep unemployment below 8%?

Was it a Stock Market stimulus?

It was indeed.

Look at the chart!

Nice try.....paying yourself is a disqualification.I thank the president and the Democrats AND Republicans in Congress who voted for it.

And the Chamber of Commerce for supporting it.

SO, you REFUSE TO THANK THE TAXPAYERS...I guess THE Obama and Congress has a damn MONEY TREE they plucked all that money off of.

Stephanie... Chris IS a taxpayer.

Umm that's a nice try there sweetheart. The same mumbo jumbo that the fed chairman from the Chicago Federal Reserve Office in Chicago tried to spew.He said( I'm paraphrasing) "yes gas prices are up, energy, utilities, staple foods, dairy, coffee and other consumer goods had risen in price well ahead of the rate of inflation." He went on to say the rate of inflation was measured by a market basket of goods which had not risen significantly overall. He then used the example of flat panel tv's and computers which have fallen in price over the last few years. I yelled at the tv, " You jerk, we don't eat tv's and computers and we don't use them to fuel our cars!!!!!!...What an asshole.. Here is this prick that makes $300,000 per year plus expenses off the backs of the taxpayers telling us everything is fine and dandy.The Consumer Price Index for All Urban Consumers (CPI-U) decreased

0.1 percent in October on a seasonally adjusted basis, the U.S.

Bureau of Labor Statistics reported today

Consumer Price Index Summary

Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Ave

2011 1.63% 2.11% 2.68% 3.16% 3.57% 3.56% 3.63% 3.77% 3.87% 3.53% NA NA NA 2010 2.63% 2.14% 2.31% 2.24% 2.02% 1.05% 1.24% 1.15% 1.14% 1.17% 1.14% 1.50% 1.64% 2009 0.03% 0.24% -0.38% -0.74% -1.28% -1.43% -2.10% -1.48% -1.29% -0.18% 1.84% 2.72% -0.34% 2008 4.28% 4.03% 3.98% 3.94% 4.18% 5.02% 5.60% 5.37% 4.94% 3.66% 1.07% 0.09% 3.85% 2007 2.08% 2.42% 2.78% 2.57% 2.69% 2.69% 2.36% 1.97% 2.76% 3.54% 4.31% 4.08% 2.85% 2006 3.99% 3.60% 3.36% 3.55% 4.17% 4.32% 4.15% 3.82% 2.06% 1.31% 1.97% 2.54% 3.24% 2005 2.97% 3.01% 3.15% 3.51% 2.80% 2.53% 3.17% 3.64% 4.69% 4.35% 3.46% 3.42% 3.39% 2004 1.93% 1.69% 1.74% 2.29% 3.05% 3.27% 2.99% 2.65% 2.54% 3.19% 3.52% 3.26% 2.68% 2003 2.60% 2.98% 3.02% 2.22% 2.06% 2.11% 2.11% 2.16% 2.32% 2.04% 1.77% 1.88% 2.27% 2002 1.14% 1.14% 1.48% 1.64% 1.18% 1.07% 1.46% 1.80% 1.51% 2.03% 2.20% 2.38% 1.59% 2001 3.73% 3.53% 2.92% 3.27% 3.62% 3.25% 2.72% 2.72% 2.65% 2.13% 1.90% 1.55% 2.83% 2000 2.74% 3.22% 3.76% 3.07% 3.19% 3.73% 3.66% 3.41% 3.45% 3.45% 3.45% 3.39% 3.38%

Current Inflation

Well that's a jumbled mess. Cut n paste is a bitch on this phone. Check the link

Here's a clear picture:

Where's stimulus-inflation you were talking about?

Yeah in 2009.....Because of the taxpayer funded subsidy. Now it's down to 37%. A precipitous drop.First-time home buyers reached the highest market share on record during the past year, according to the latest consumer survey of home buyers and sellers. The study was released here today at the 2009 REALTORS® Conference & Expo.

The 2009 National Association of Realtors® Profile of Home Buyers and Sellers is the latest in a series of large national NAR surveys evaluating demographics, preferences, marketing and experiences of recent home buyers and sellers. Among national surveys, NARs Profile of Home Buyers and Sellers is unprecedented in size and scope.

Paul Bishop, NAR vice president of research, said several factors have been at play. Tax incentives, record high affordability conditions and a pent-up demand brought a record share of first-time home buyers into the market, he said. These buyers are critical to housing and a general economic recovery because the market always heals from the bottom up they absorb inventory, free existing owners to make a trade and stimulate related goods and services.

The number of first-time home buyers rose to 47 percent of all home sales from 41 percent of transactions in last years study, and was the highest on record dating back to 1981. The previous high was 44 percent in 1991. Its interesting to note the last cyclical peak of first-time home buyers was during the last noteworthy economic downturn, with first-time buyers starting the chain reaction that led the nation out of recession, Bishop said.

NAR Survey Shows First-Time Home Buyers Set Record in Past Year

My son being of those counted. Guess what? It wasnt the buyer credit. It was the fallen prices. KEEP FISHING.......... The overwhelming majority were existing homes.

Who said anything about new homes or why your son bought?

The fact is that almost HALF the buyers in 2009 were first time home buyers many of whom bought because of the incentive.

What flavor of Kool -Aid is it today?Stephanie... Chris IS a taxpayer.

yeah and?

And... the whole point of the stimulus is getting people working, creating goods and services, adding real wealth to the economy, creating more jobs for others, and paying taxes.

What's so hard to understand?

You dumb DittoTards need to stop parroting your MessiahRushie and learn to think for yourselves.The Federal Government has "poofed" away 2 and a half million jobs because they are just gone. This is what keeps the unemployment rate at about 9%.

By reducing the number of jobs thought to be available, the convoluted system to figure the unemployment rate also is reduced. If the number of jobs thought to be available was held at the level it was in 2008, the unemployment rate would be closer to 12.5%.

Any figure from the government is a politically motivated one. Reliance on them is delusional.

That said, where i live, and this could be a seasonal anomaly, the economy seems to be picking up. Many of my customers are hiring, not spectacularly, but with some consistency.

We may have cause for some cautious optimism.

November 22, 2011

RUSH: Well, I think the numbers are manipulated, but do you realize that since January of 2009 when Obama was immaculated, from then 'til now the number of jobs that are available to be filled in this country has been reduced by two and a half million. The regime has just erased them. They've just wiped them off the books. They have just said those jobs, they've not identified what they are, they said those jobs are gone. So if the universe of total jobs available has shrunk by two and a half million, then you can play some games with the unemployment numbers, the unemployment rate. The unemployment rate, if the number of jobs was constant today as it was when Obama was immaculated, the unemployment rate, the reported unemployment rate would be 12.3%. The only reason it's nine is because they just erased two million jobs from the total.

BREAK TRANSCRIPT

RUSH: It's the workforce participation rate that the Department of Labor plays around with. That's the total number of available jobs, workforce participation rate. It is the lowest it's been since 1983, or the worst, and it's just arbitrarily arrived at. They just say, "Okay, this is the number of jobs available." They erase jobs when businesses shut down, stores close, factories move and so forth.

HA! You lefties and Obama sycophants are the owners of having it both ways.Gold at $1700I gave you a chart that shows that inflation is low by historical standards, that it fell sharply just as the stimulus was kicking in, and that it is lower than it normally is. What are you seeing?

Silver at $32

Oil hovering at $100

Gas at the pump still well over $3.00

Grocery prices going through the roof.

You going to believe some chart put out by people with a vested interest in lining their own pockets or your own lying eyes?

It's my observation that you people always believe charts that support your preconceived notions, and reject them whenever they don't.