oh it had a lasting effect. It's called inflation and we are paying for it everyday.

The Consumer Price Index for All Urban Consumers (CPI-U) decreased

0.1 percent in October on a seasonally adjusted basis, the U.S.

Bureau of Labor Statistics reported today

Consumer Price Index Summary

Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Ave

2011 1.63% 2.11% 2.68% 3.16% 3.57% 3.56% 3.63% 3.77% 3.87% 3.53% NA NA NA 2010 2.63% 2.14% 2.31% 2.24% 2.02% 1.05% 1.24% 1.15% 1.14% 1.17% 1.14% 1.50% 1.64% 2009 0.03% 0.24% -0.38% -0.74% -1.28% -1.43% -2.10% -1.48% -1.29% -0.18% 1.84% 2.72% -0.34% 2008 4.28% 4.03% 3.98% 3.94% 4.18% 5.02% 5.60% 5.37% 4.94% 3.66% 1.07% 0.09% 3.85% 2007 2.08% 2.42% 2.78% 2.57% 2.69% 2.69% 2.36% 1.97% 2.76% 3.54% 4.31% 4.08% 2.85% 2006 3.99% 3.60% 3.36% 3.55% 4.17% 4.32% 4.15% 3.82% 2.06% 1.31% 1.97% 2.54% 3.24% 2005 2.97% 3.01% 3.15% 3.51% 2.80% 2.53% 3.17% 3.64% 4.69% 4.35% 3.46% 3.42% 3.39% 2004 1.93% 1.69% 1.74% 2.29% 3.05% 3.27% 2.99% 2.65% 2.54% 3.19% 3.52% 3.26% 2.68% 2003 2.60% 2.98% 3.02% 2.22% 2.06% 2.11% 2.11% 2.16% 2.32% 2.04% 1.77% 1.88% 2.27% 2002 1.14% 1.14% 1.48% 1.64% 1.18% 1.07% 1.46% 1.80% 1.51% 2.03% 2.20% 2.38% 1.59% 2001 3.73% 3.53% 2.92% 3.27% 3.62% 3.25% 2.72% 2.72% 2.65% 2.13% 1.90% 1.55% 2.83% 2000 2.74% 3.22% 3.76% 3.07% 3.19% 3.73% 3.66% 3.41% 3.45% 3.45% 3.45% 3.39% 3.38%

Current Inflation

Well that's a jumbled mess. Cut n paste is a bitch on this phone. Check the link

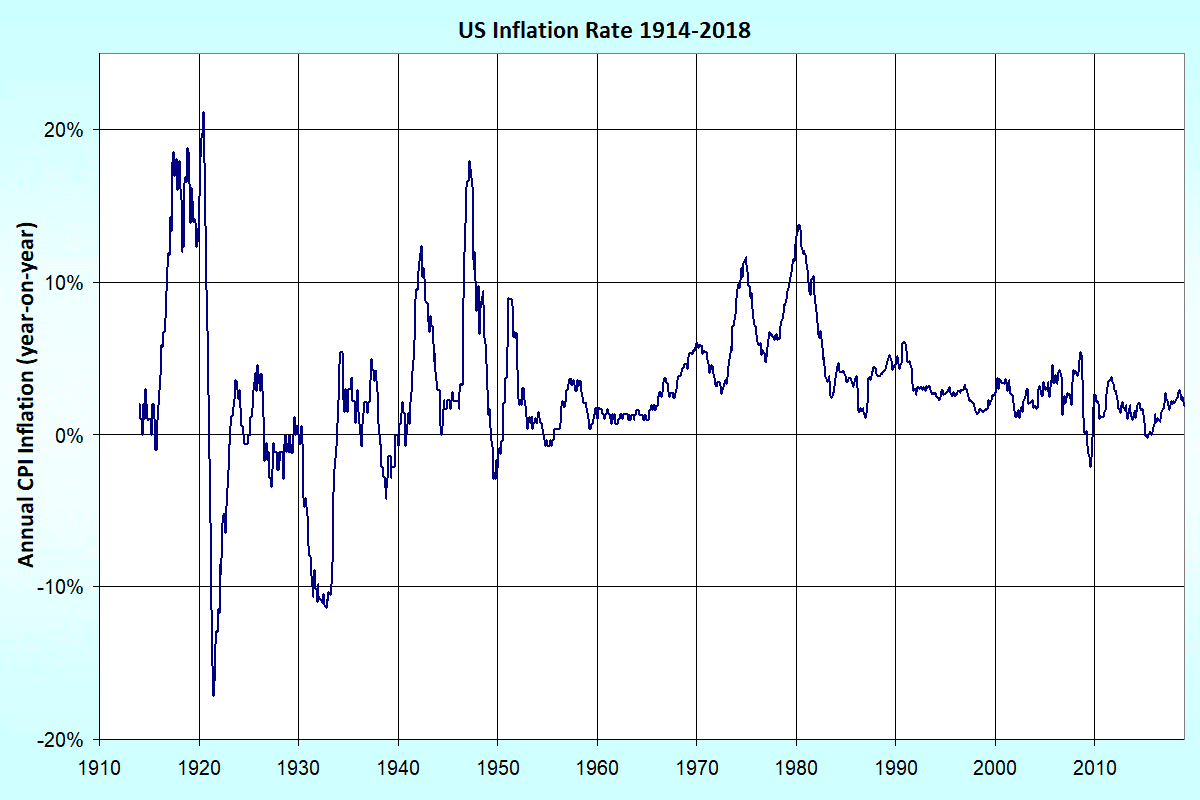

Here's a clear picture:

Where's stimulus-inflation you were talking about?