Indeependent

Diamond Member

- Nov 19, 2013

- 73,633

- 28,500

- 2,250

Exxon Mobil, Wall Street and Big Pharma ....nobody is safe from this terrible young woman's wrath.

AOC GRILLS Jamie Dimon & Bank Executives On Jailing Law Breaking Bankers.

Rep. Alexandria Ocasio-Cortez questions Chase CEO Jamie Dimon and other megabuck executives on their behavior since the 2008 mortgage crisis.

Because they didn't break any laws.

In fact most were following the laws, in creating the sub-prime crash. Idiotic left-wingers like AOC, don't even remember that it was their own policies that pushed bankers to make sub-prime loans. In fact, the government under Bill Clinton, was taking banks to court, to force them to make sub-prime loans.

Effectively, what idiots like AOC are asking is..... "Why didn't we throw you into prison for following our rules?"

I know many brokers who lost business because they didn’t do what the big lenders did...bypass the software rejections and rubber stamp a bad loan “Approved”.

The Directors should have been divested of their ill gotten gain and sent to prison.

Yeah, and the reason the smaller brokers did not take risky loans, might also have to do with the fact they were not the targets of lawsuits forcing them to make such risky loans.

This is the problem I have with this entire discussion....

If Obama was NOT on a lawsuit to force Citigroup to make bad loans....

If Clinton was NOT suing banks to make bad loans....

If Freddie Mac was NOT guaranteeing bad loans....

If Maxine Waters was NOT saying that Fannie Mae was doing an "outstanding job" of providing risky loans....

If it was NOT the general policy of the government to push sub-prime loans since at least 1997....

Then I would be on your side of this argument. I don't know if I'd be in favor of prison, but I would most certainly ban all of them from the banking industry.

But the problem there is, if the government didn't push sub-prime loans, I doubt any of these bankers would have been making them. After all, prior to 1997, Sub-prime loans were a niche market with little to no, growth.... because they were risky.

Something caused them to make those loans. And that something was government. You should be demanding that the Democrats be tossed in prison if anything. They are the ones that instigated the economic crash.

Nah...

Not one Director was even investigated.

7 CEOs paid a pitiful penalty.

And I know way too many people who made a killing.

Both parties engaged in the GW farce.

GW, to this day, brags that he was the “Home Ownership” President.

Not to mention that Warren Buffet, who ordered Alan Greenspan to change the Mark to Market ratio, made 15 billion dollars on the day of the crash.

You know, the “charitable” Warren Buffet who cares so much about people.

I do not know much about this claim with Buffet and Mark to Market.

However, I have seen no evidence that it was involved in the sub-prime crash directly.

And I would agree that GWB was also supportive of more home ownership. That is true. Both parties were. That is true.

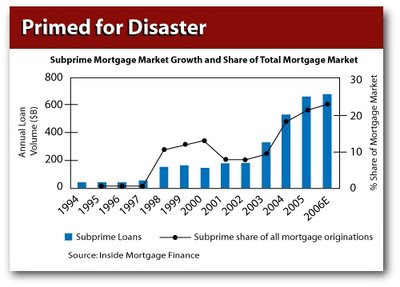

However, the sub-prime crash's origins were in 1997. This is clearly documented.

In 1997, the housing prices started to spike up.

This increase in housing prices coincides directly with the increase in sup-prime mortgages that happened in 1997.

Before 1997, sub-prime loans were a niche market, specifically because they were risky.

So what happened on or before 1997 that caused the dramatic increase in sub-prime loans?

Two things..... First Freddie Mac started guaranteeing sub-prime loans.

Wachovia Press Releases

First Union Capital Markets Corp. and Bear, Stearns & Co. Inc. have priced a $384.6 million offering of securities backed by Community Reinvestment Act (CRA) loans - marking the industry's first public securitization of CRA loans.

The $384.6 million in senior certificates are guaranteed by Freddie Mac and have an implied "AAA" rating. First Union Capital Markets Corp. is the investment banking subsidiary of First Union Corporation.

First Union became Wachovia, which means the two original companies involved in Freddie Mac's guarantee of sub-prime loans, both ended up crashing spectacularly during the sub-prime crash.

So to recap, the government through Freddie Mac was pushing sub-prime loans.

At the exact same time, the government was taking banks to court, for not making risky sub-prime loans.

Andrew Cuomo, then part of the Clinton administration, forced banks through the court, to make sub-prime loans.

Between the government using Freddie Mac to guarantee sub-prime loans, and giving them implied AAA ratings, and the Government suing banks in court for not making sub-prime loans....

This is what caused the sub-prime crash.

Nope...

600K loans to minorities and non-minorities were rejected by the software and were stamped “Approved” on cheesy pieces of paper.

I know as I got one and plenty of my friends got theirs.

A complete Greed Feast.