That uppity bitch is as snotty as her husband.

Wow, that much hate usually means fear. Are you afraid that if Obama doesn't get elected the economy might improve and you'll have to move out of your Mommy's basement and stand on your own two feet?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

That uppity bitch is as snotty as her husband.

Yeah right. Obama and the Dumbos in Congress would rather see another credit downgrade then cut things they won't like to cut (welfare).

Welfare, as of 2000, is 1.7% of the ENTIRE FEDERAL BUDGET, asswipe.

You can't continue to try to balance the whole household budget by ever cheaper brands of kitty litter and toilet paper. Sooner or later the champagne and caviar has to go.

booze and cigs are something people on welfare always seem to be able to afford

Yeah right. Obama and the Dumbos in Congress would rather see another credit downgrade then cut things they won't like to cut (welfare).

Welfare, as of 2000, is 1.7% of the ENTIRE FEDERAL BUDGET, asswipe.

You can't continue to try to balance the whole household budget by ever cheaper brands of kitty litter and toilet paper. Sooner or later the champagne and caviar has to go.

booze and cigs are something people on welfare always seem to be able to afford

There are going to be cuts, people aren't going to like them. That's a fact. Even if Obama wins, by year 2, there will be cuts. He won't like them, neither will those effected. That is a fact. It's unavoidable, regardless of who wins.

There are going to be cuts, people aren't going to like them. That's a fact. Even if Obama wins, by year 2, there will be cuts. He won't like them, neither will those effected. That is a fact. It's unavoidable, regardless of who wins.

I agree, there will be cuts.

And there will probably be tax increases no matter who wins.

But then it becomes a question of why you are making cuts and who is effected by them.

I have no problem trimming the growth of medicare to ensure it is there in 15 years when I'm going to need it.

I have a huge problem with gutting it and turning it into an inadquate voucher plan so that a few rich people can get even more tax breaks.

There are going to be cuts, people aren't going to like them. That's a fact. Even if Obama wins, by year 2, there will be cuts. He won't like them, neither will those effected. That is a fact. It's unavoidable, regardless of who wins.

I agree, there will be cuts.

And there will probably be tax increases no matter who wins.

But then it becomes a question of why you are making cuts and who is effected by them.

I have no problem trimming the growth of medicare to ensure it is there in 15 years when I'm going to need it.

I have a huge problem with gutting it and turning it into an inadquate voucher plan so that a few rich people can get even more tax breaks.

I agree w/ you. Repubs never liked it anyway. They say they want to "save it" but what they mean is they want it to be a mere shadow of its former self.

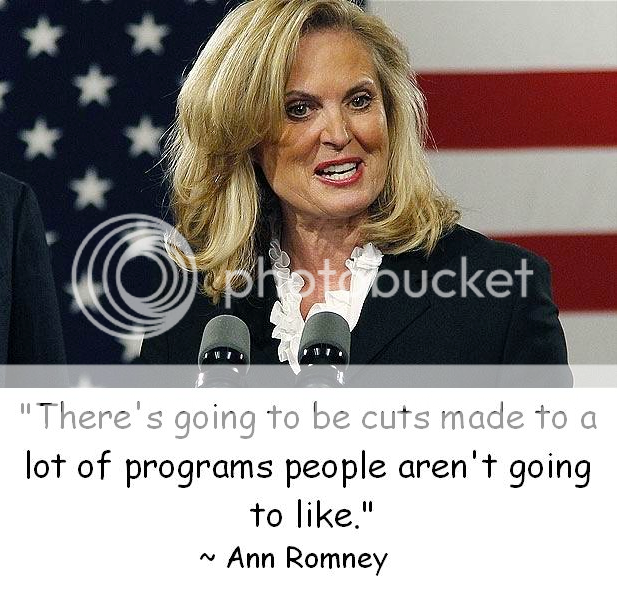

It is like a bad dream come true, Ann Romney explaining the policies that will be put in place, should her husband win the election in November. Theres going to be cuts, in programs and people wont like it.

Why on earth would the wife of a so-called experienced businessman, who claims he has a reputation for creating jobs when in reality he outsourced them to China, be speaking to American families and digging in the knife?

Why would Ann Romney love rubbing salt in the wounds of many bankrupt Americans, many homeless Americans, the jobless, the disabled and the elderly in an almost boastful fashion say this to you people?

More: Ann Romney Theres Going to Be Cuts -People Arent Going to Like | Politicol Commentary News

It is like a bad dream come true, Ann Romney explaining the policies that will be put in place, should her husband win the election in November. Theres going to be cuts, in programs and people wont like it.

Why on earth would the wife of a so-called experienced businessman, who claims he has a reputation for creating jobs when in reality he outsourced them to China, be speaking to American families and digging in the knife?

Why would Ann Romney love rubbing salt in the wounds of many bankrupt Americans, many homeless Americans, the jobless, the disabled and the elderly in an almost boastful fashion say this to you people?

More: Ann Romney Theres Going to Be Cuts -People Arent Going to Like | Politicol Commentary News

Yes - that's called leadership. This is how you know that the GOP are the only adults in the room. As a parent, you constantly have to make decisions that your children don't like, but which are good for them.

The same with ending the nation collapsing gravy train for the parasite class...

Welfare, as of 2000, is 1.7% of the ENTIRE FEDERAL BUDGET, asswipe.

You can't continue to try to balance the whole household budget by ever cheaper brands of kitty litter and toilet paper. Sooner or later the champagne and caviar has to go.

booze and cigs are something people on welfare always seem to be able to afford

Ya that's a plan! Take away the cigarettes! You are going to have a whole lot of pissed off people with THAT plan. I can't wait to see how that works out.

We've got hundreds of unnecessary overseas bases staffed by 10's of 1000's of military. Close the bases, bring home the men. It saves billions of dollars and we get the added benefit of those soldiers spending their paychecks HERE, stimulating OUR economy rather than someone else's.

I'm sure we could use 50,000 or more of them on our southern border stopping the influx of illegal aliens, saving what few jobs we have left for LEGAL American citizens.

Looks like a win/win to me...

AGAIN PEOPLE, OBAMA PLEDGED not to raise your TAXES and he LIED to you and did it as soon as he BECAME PRESIDENT

--------------------------------

"One of President Barack Obama's campaign pledges on taxes went up in puffs of smoke Wednesday.

"The largest increase in tobacco taxes took effect despite Obama's promise not to raise taxes of any kind on families earning under $250,000 or individuals under $200,000.

"This is one tax that disproportionately affects the poor, who are more likely to smoke than the rich."

Obama's no-taxes pledge was most often made in the context of income taxes. But consider this: "'I can make a firm pledge,' he said in Dover, N.H., on Sept. 12. 'Under my plan, no family making less than $250,000 a year will see any form of tax increase. Not your income tax, not your payroll tax, not your capital gains taxes, not any of your taxes.'...

the rest at

White House Watch - Obama's Tax on the (Smoking) Non-Rich

I agree, there will be cuts.

And there will probably be tax increases no matter who wins.

But then it becomes a question of why you are making cuts and who is effected by them.

I have no problem trimming the growth of medicare to ensure it is there in 15 years when I'm going to need it.

I have a huge problem with gutting it and turning it into an inadquate voucher plan so that a few rich people can get even more tax breaks.

I agree w/ you. Repubs never liked it anyway. They say they want to "save it" but what they mean is they want it to be a mere shadow of its former self.

If Obama wins re-election Medicare will be gutted and run by a panel of 15 un-elected appointees who will get to decide how to continue skimming from Medicare to fund Obamatax. LOL.. That's amusing that you think it will be there for you if Obama has his way. The competition introduced by the Romney plan will start to lower costs and make programs responsive to consumers again.

u seriously goin to vote for Willard Stephanie?