David_42

Registered Democrat.

- Aug 9, 2015

- 3,616

- 833

- 245

This is a problem we need to address...

Americans Already Spent A Shocking Amount On Rent, But It Just Got Worse

Americans Already Spent A Shocking Amount On Rent, But It Just Got Worse

It’s the worst time in 36 years to be a renter in America. The median rent nationwide now takes up 30.2 percent of the median American’s income, the highest cost burden recorded by Zillow since the real estate firm began tracking the figure in 1979.

In the late 1980s and throughout the 1990s, the median American looking to lease a home could expect to spend a little less than a quarter of what she earned on rent. Last year at this time, the median cost burden for renters was 29.5 percent of income. The new figure cracks the formal 30 percent threshold economists and housing experts use to define rent affordability. Because it’s calculated based on median income and median rent rather than using data about what actual renters earn and pay, the figure inevitably smooths out some of the lived experience of the rental crisis in America. But if rent is now unaffordable even for that hypothetical median renter, that suggests a problem that was once acute to certain low-income communities has now become a mainstream tenant experience.

Zillow’s newest number attempts to give a snapshot of the situation renters face nationwide. In particular pockets of America, the situation is even more dire according to separate Zillow figures from 2014. New Orleans tenants can expect to spend 35 percent of what they earn on rent, two-and-a-half times the historical average for the city. The median New York City rent gobbles up almost 40 cents of every dollar the median New Yorker earns. Los Angeles residents face a rental market where the median home will cost nearly half the median income. Even smaller communities like Ithaca, NY, and Flagstaff, AZ, were well above the 30.2 percent national median rent burden figure the firm now reports as an all-time high.

Looking at individual tenants instead of abstract estimates produces an even more startling sense of how actual Americans are faring in those markets. Census data suggest that half of all tenants nationwide are paying more than 30 percent of their actual income in rent, according to a 2013 analysis from Harvard’s Joint Center for Housing Studies. One in every four renting households spends at least 50 cents of every dollar they earn on rent, the report said. Even among renter families with household income as high as $75,000, nearly one in five are paying rents higher than the 30 percent of income that housing experts define as affordable.

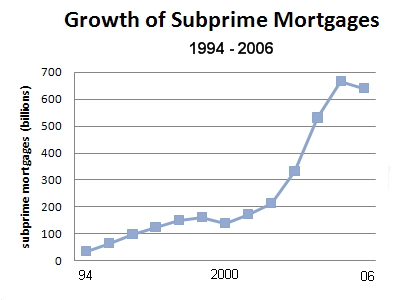

In theory, it shouldn’t be possible for rents to accelerate this far while incomes stagnate. As Zillow’s newest report indicates, the monthly costs of homeownership are now roughly half the monthly cost of rent. Normally that would help cool the rental market. But while it’s been almost seven years since the financial crisis, these are still far from normal times.