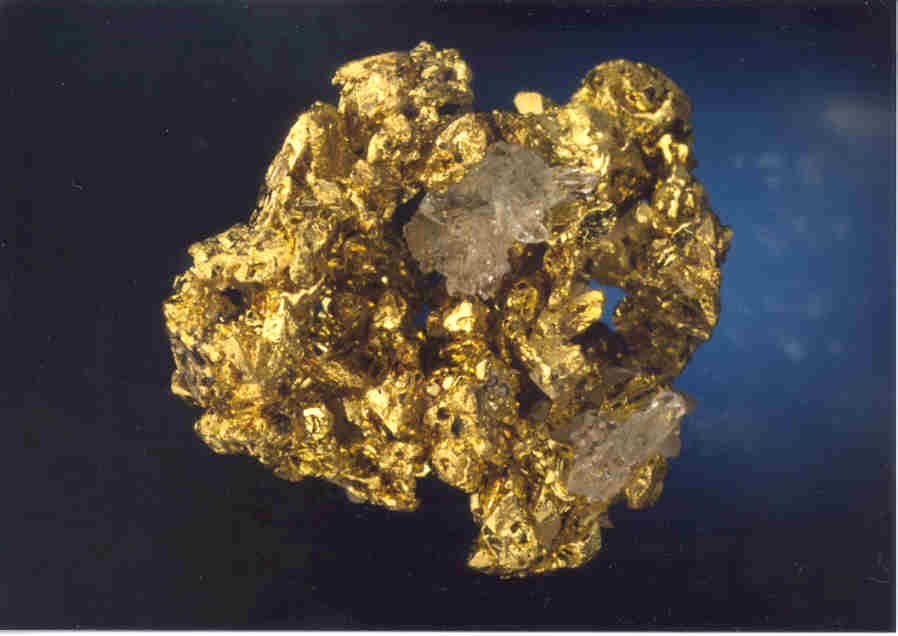

Some of you are under the impression that capital creates wealth. And as long as there is a system in place, a society that agrees that capital (gold or fiat money, doesn't much matter) then YES capital is the expression of past labor, and YES people will accept that specie as though it represented wealth.

But why is capital (or gold) something of value to us?

Because, by mutual agreement, onecan exchange it for the fruits of somebody's past labor.

Doubt me?

You are alone on a dessert island. You have a pile of gold. You have a pile of fiat currency.

What good are they to you?

Probably nothing at all.

Why not?

There are no laborers to buy anything from, folks.

That gold has gone from a mutally agreed upon representation of wealth, to a bit of metal that may have value to you but only IF YOUR LABOR CAN MAKE IT VALUABLE TO YOU.

All human wealth is the end product of some human labor. (even if that human labor is making a horse, another worker or a machine do the actual work)

Whether it is the labor of the human imagination and the mind, or the labor the human back and hand, it is human labor that is created soemthing of wealth.

EVen an apple on a tree has NO VALUE until a human hand picks it, folks.

But why is capital (or gold) something of value to us?

Because, by mutual agreement, onecan exchange it for the fruits of somebody's past labor.

Doubt me?

You are alone on a dessert island. You have a pile of gold. You have a pile of fiat currency.

What good are they to you?

Probably nothing at all.

Why not?

There are no laborers to buy anything from, folks.

That gold has gone from a mutally agreed upon representation of wealth, to a bit of metal that may have value to you but only IF YOUR LABOR CAN MAKE IT VALUABLE TO YOU.

All human wealth is the end product of some human labor. (even if that human labor is making a horse, another worker or a machine do the actual work)

Whether it is the labor of the human imagination and the mind, or the labor the human back and hand, it is human labor that is created soemthing of wealth.

EVen an apple on a tree has NO VALUE until a human hand picks it, folks.

Last edited: