RDD_1210

Forms his own opinions

- May 13, 2010

- 18,981

- 1,817

- 265

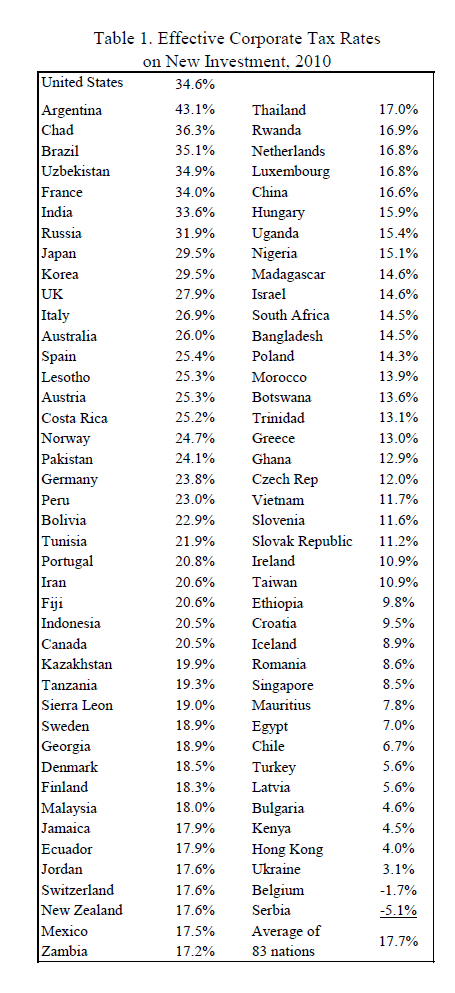

Dumbasfuck... I'm not going to bother explaining basic economics and taxation to you. You're too blinded by dogma.I still say ideally we need a flat tax for all brackets on domestically earned income no higher than 10-15% for both individual and corporate income tax with no exemptions or credits... even income based.

You willing to stand up and say that?

I sure as hell won't. That's a massive cut for the wealthy and for corporations while a massive hike for the working poor. While at the same time leaving in place the payroll taxes, which the poor pay a higher percentage of their income on than the wealthy.

Basically, your plan would have it so that the more money you make the LESS is taken out in taxes.

I really don't think you're qualified in the least bit to explain basic economics. We've established before you can't figure out what a payment plan looks like.