DontBeStupid

Look it up!

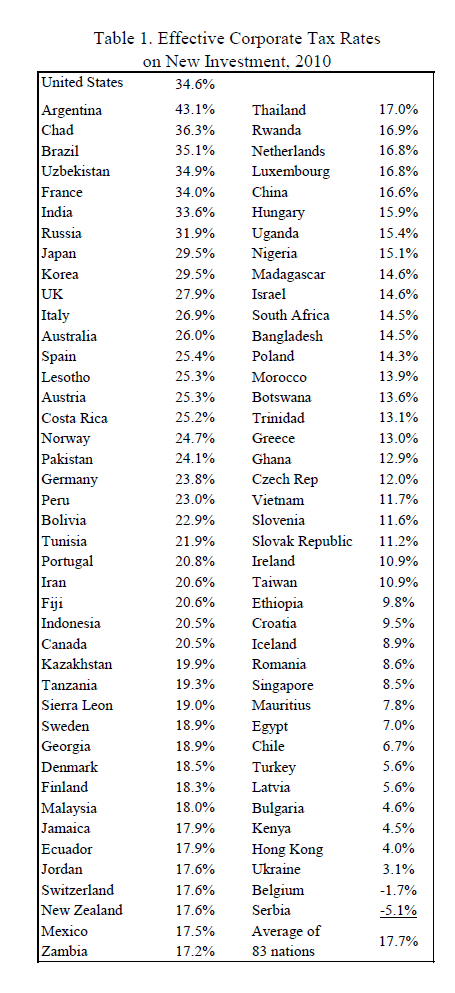

America has some of the highest corporate tax rates in the world.

How will raising taxes on those bastard rich people create jobs? How will it spur economic growth?!?!?!?

That chart is for new investment. And p.s., a corporation is not a person.

In its August 2008 report, the GAO estimated that "[t]he average U.S. effective tax rate on the domestic income of large corporations with positive domestic income in 2004 was an estimated 25.2 percent."

WSJ ignored effective tax rate in claiming U.S. corporate tax rate "is higher than in all of Europe" | Media Matters for America