bendog

Diamond Member

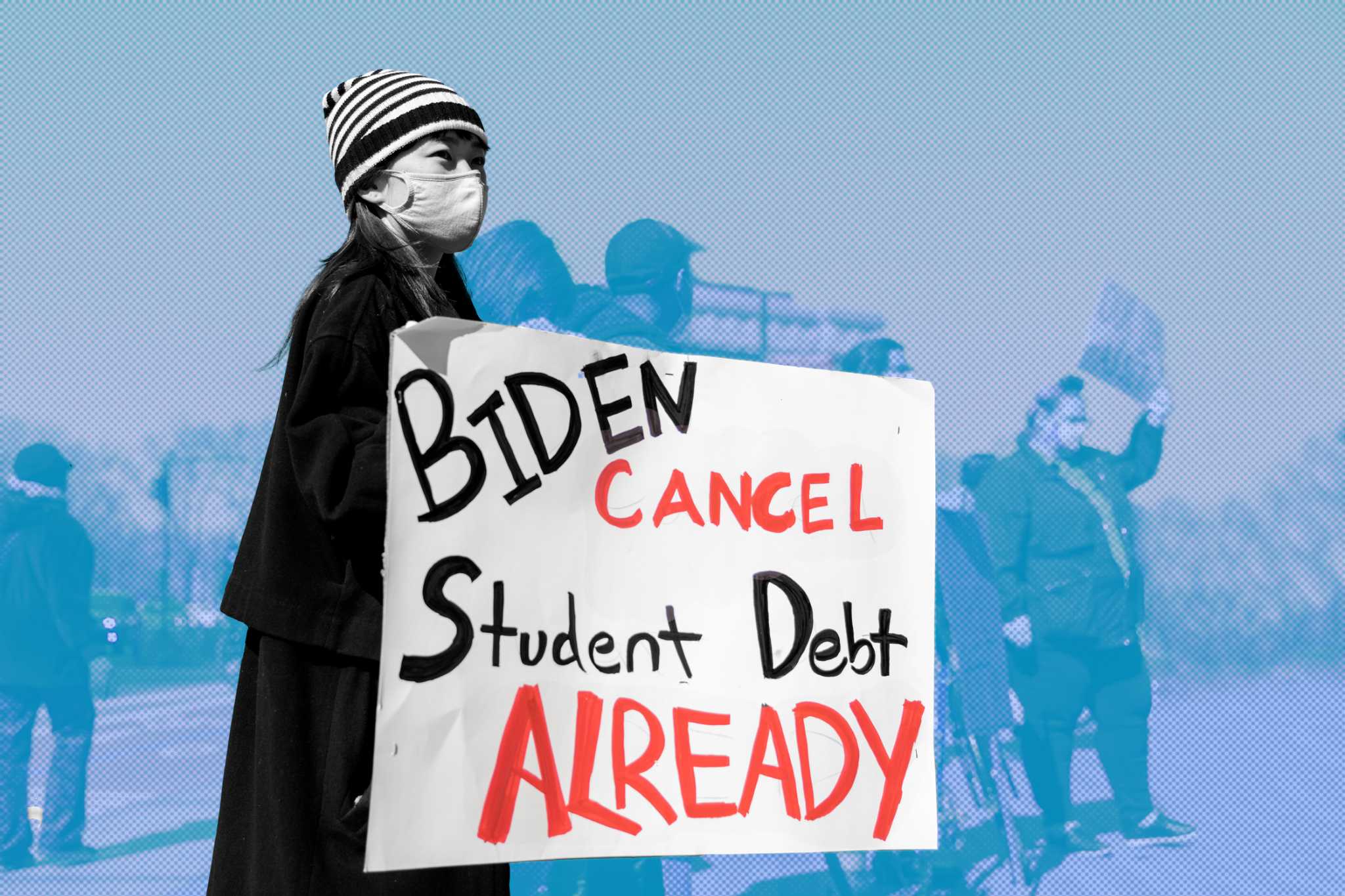

Student Loan Forgiveness Is an Idea Whose Time Has Gone

Student Loan Forgiveness Is an Idea Whose Time Has Gone

OR

Is Student Loan Forgiveness Finally Coming? Here’s What We Know for Sure

Separating the facts from mere speculation and rumors about debt cancellation.

Since people aren't making the payments now, I don't see how forgiveness would add to consumer demand. But it would increase the overall debt if the govt would just assume the "dollars." But the fed is trying to reduce consumer lending without killing corporate ability to raise private loans with issuing bonds. The Fed CAN raise the amount of funds banks hold and that takes money "out" of the economy.

so, and this is jmo, anyone taking on debt to buy a new boat or car or whatever that they don't REALLY need is absolutely NUTs given the economy and Ukraine. Seinna tells us we can't raise taxes even a few %pts on people making 500K a year. IF someone can show they're working 40 hours a week, kill the loans. Maybe they'll do the sensible thing and put anything extra in the bank, or godforbid get married to somebody and someday buy a house with 30 year mortgage and have a kid.