Hey oldfart, (I just like saying that)

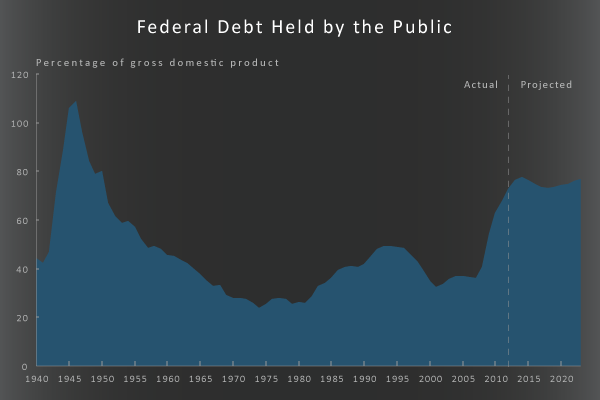

Can one do an analogy of household debt as, for example, mortgage + car loan + credit cards against household income as a comparison to national debt and GDP or is that too far a stretch?

Thanks,

ES

I think balance sheet comparisons of households, businesses, and government are appropriate. Everybody talks about national debt, but what about national assets? People who assert that the federal government is going "bankrupt" have a duty to show that the liquidation value of the public assets is less than the public debt; so how much would the Japanese pay for Yellowstone? The Chinese for the oil reserves on public land?

As you note, a comparison of debt to ability to service the debt is appropriate for all three cases.

But the big fallacy of households/businesses/government comparisons is the foundation of macroeconomics. My spending is your income and your spending is my income. Eventually spending and income will reach an equilibrium, but at what level? 5% unemployment or 40% unemployment? Not all equilibria are created equal. So if national income tends to fall toward national spending (a shortage of aggregate demand) in a downturn, and everybody tries to retrench, it's a death spiral to the zero bound. If consumer spending, business investment, and net exports are all falling the only thing left is the excess of government spending over tax receipts. If the government tries to balance the budget in this situation (which the US did 1929-1933) you get Europe today.

Conservatives think that the confidence fairy will inspire businesses to invest and thus save the economy, but it doesn't happen. Would you expand a business when the demand for your products was falling?