The Wall Street Campaign to Stop Elizabeth Warren Officially Began on September 10, 2019

"Yesterday, that Wall Street campaign officially began. CNBC’s Jim Cramer and David Faber discussed on TV how they are hearing from Wall Street bank executives that Warren must be stopped..."

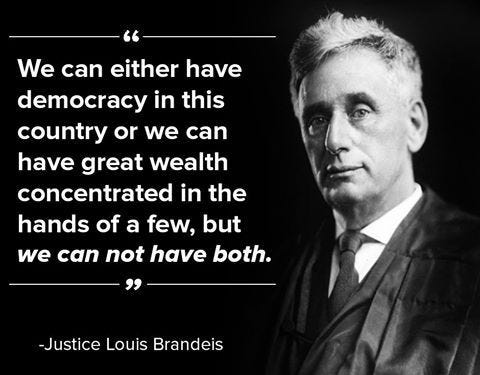

Can you guess why Wall Street's trolls have a problem with Liz?

Bloomberg Knows:

"On the same day, September 10, 2019, Bloomberg News, which is majority owned by billionaire Michael Bloomberg, whose $52.4 billion net worth derives from leasing his data terminals to thousands of Wall Street trading floors around the globe, ran this headline: '

Richest Could Lose Hundreds of Billions Under Warren’s Wealth Tax.'

"Obviously, that wouldn’t sit too well with Michael Bloomberg, who has frequently penned his own OpEds for his financial news empire..."

"The opinion piece was titled '

Warren’s Assault on Retiree Wealth,' and was written by Phil Gramm and Mike Solon. Gramm is the former Republican Senator whose name appears on the Gramm-Leach-Bliley Act, the legislation that repealed the Glass-Steagall Act."

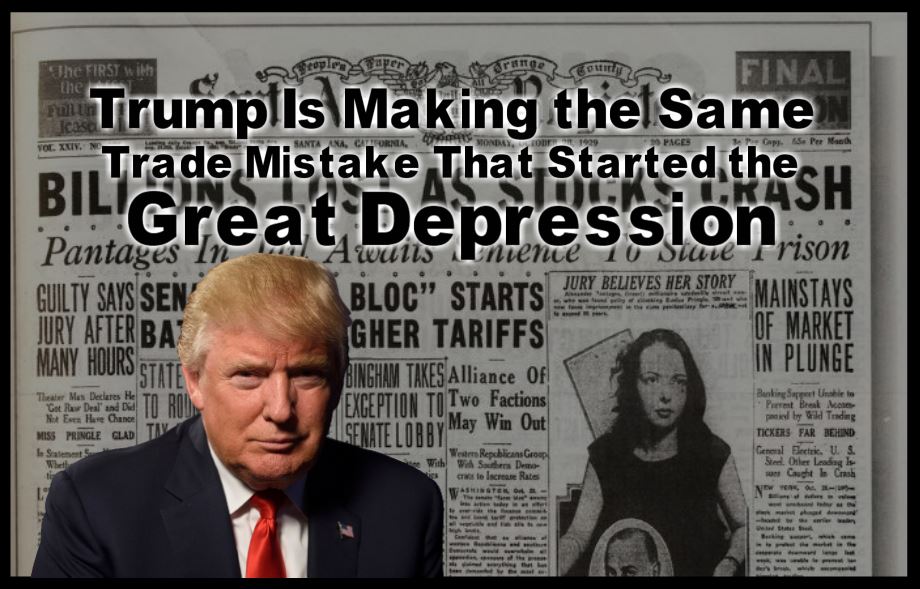

"t was that repeal that allowed Wall Street’s casino investment banks to merge with commercial banks holding Federally-insured deposits.

"And it was this dangerous combo that led to the epic crash on Wall Street in 2008 and the ensuing economic collapse in the U.S. – the greatest collapse since the Great Depression."

There are economic events on the horizon (like negative interest rates) that pose a legitimate threat to savers and retirees; Liz Warren is not among them.

What Negative Interest Rates Mean For Your Retirement

God Bless Phil Gramm for watching our investments. (sarcasm)

God Bless Phil Gramm for watching our investments. (sarcasm)

Enron Phil has been one of our greatest Americans:

The Wall Street Campaign to Stop Elizabeth Warren Officially Began on September 10, 2019

"Gramm was not only a registered lobbyist for the global investment bank, UBS, but he formed his own lobbying firm, Gramm Partners.

"Gramm’s wife is Wendy Lee Gramm, the former Chair of the Commodity Futures Trading Commission (CFTC) from 1988 to January 1993, who gave Wall Street exactly what it wanted in leaving its dangerous derivative contracts free from Federal regulation until the crash...."

"According to a report from Public Citizen:

"'In 1992, as the first step in its business plan to profit on the speculation of energy, Enron petitioned the CFTC to make regulatory changes that would limit the scope of the commission’s authority over certain kinds of futures contracts.'

"'Immediately before leaving the CFTC, Gramm muscled through approval of an unusual draft regulation that would do just that – it narrowed the definition of futures contracts and excluded Enron’s energy future contracts and swaps from regulatory oversight.'

"Although her actions were criticized by government officials who feared the change would have severe negative consequences (as, in fact, it did), Gramm was rewarded five weeks after she left the CFTC with a lucrative appointment to Enron’s Board of Directors. Between 1993 and 2001, when the company declared bankruptcy, Enron paid Gramm between $915,000 and $1.85 million in salary, attendance fees, stock option sales, and dividends.'"

/cdn.vox-cdn.com/uploads/chorus_asset/file/11839467/Screen_Shot_2018_07_29_at_10.27.09_AM.png)