colfax_m

Diamond Member

- Nov 18, 2019

- 38,988

- 14,843

- 1,465

They are allowed to depreciate the entire value over 20 years, correct?The depreciation is greatly overstated on their taxes, giving them a huge tax savings when in reality the depreciation is very very small, making it a huge loophole. Toddster doesn't want to admit this thoughWith this loop hole yes, man you are just stupid...AHAHAHA so you think it is fair and smart policy to have millionaires and billionaires pay a much smaller percentage in taxes than the middle class. This excuse is so pathetic and does not age well.By "MASSIVE tax give away" you mean.....THEY GET TO KEEP MONEY THEY EARNED???

Wealthy real estate developers like Trump score a huge tax break in the stimulus bill

The $2 trillion coronavirus stimulus bill passed by the Senate provides aid for average consumers and small businesses -- but there's also a lucrative tax break for wealthy real estate developers.edition.cnn.com

Bonanza for Rich Real Estate Investors, Tucked Into Stimulus Package (Published 2020)

A small change to tax policy could hand $170 billion in tax savings to real estate tycoons.www.nytimes.com.

Currently if you own real estate and other businesses, you get to use depreciation AND improvement/upgrade expenses to write off the profits on your other businesses/income. Meaning If I make $1 million or $1 billion trading stocks or any other business, and I own real estate I can make tax deductions on that $1 million/billion profit by claiming depreciation on real estate or upgrade expenses. This is already a pretty big scam and windfall for real estate investors.

BUTTTTTT

This is capped at $500k, so you could only deduct $500k of that $1 million/billion or whatever the income is... BUTTTTT in this stimulus bill, republicans quietly slipped a provision in that removes the cap completely!!!!

Meaning now you can deduct any amount that you can come up with (even Billions)!!! So basically you can make millions/billions on non-real estate income and pay no taxes on it, by claiming depreciation and upgrades of your real estate investments!!!!

BUTTTT it gets even worse!!! They also made the removal of the cap retroactive for the past 3 years!!! So that means you can deduct the depreciation etc etc from 2018 and the government will send them a massive refund check!!!!

This is estimated to cost the government $180 Billion!! That $180 billion could go to hard working Americans, but it is going to the ultra wealthy. This is indefensible, but we know that Trumpers will somehow defend it, because they are sheep!! Stop crying about being over taxed, because you gladly support policy that lets the ultra wealthy pay no taxes on their millions/billions...

IT'S NOT YOUR FUCKING MONEY, YOU COCKSUCKING COMMUNIST PIECE OF SHIT!!!

.

AHAHAHA so you think it is fair and smart policy to have millionaires and billionaires pay a much smaller percentage in taxes than the middle class.

You think millionaires and billionaires pay a much smaller percentage in taxes than the middle class?

Your elevator doesn't go all the way to the top floor, does it?

If they have $1,000,000 in gains and $1,000,000 in depreciation, their income is zero.

How does that make them a millionaire? How much tax should someone pay with $0 income?

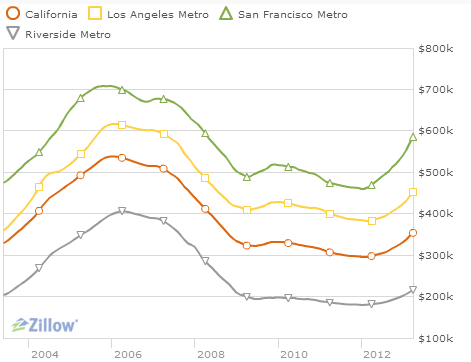

Depreciation of real estate seems weird to me. I mean, buildings don’t really depreciate like that. They go up in value.

buildings don’t really depreciate like that.

Three identical buildings, one is ten years old, one is five years old, one is brand new.

Are they identical in value?

That depends, doesn’t it. If they’re identical, then why wouldn’t they be?