eagleseven

Quod Erat Demonstrandum

Greg Mankiw's Blog: The Poverty Trap

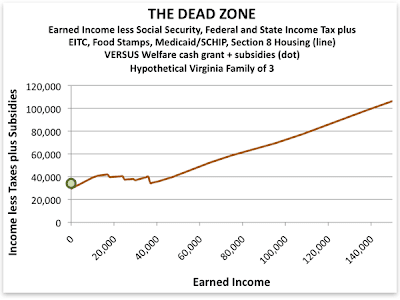

Chapter 20 of my favorite textbook has a section on antipoverty programs and work incentives. One basic point is that when multiple income-based programs are piled on top on one another, the implicit marginal tax rate can reach or even exceed 100 percent.

The chart above (source, via Kling) illustrates this phenomenon. It shows income after taxes and transfers as a function of earned income. Notice that as earned income rises from about $15,000 to $30,000, income after taxes and transfers is roughly flat. Indeed, it could even fall. The bottom line: If you are poor, the government is inadvertently ensuring that you have little incentive to try to improve your condition.

After taxes/government handouts, everyone in Virginia with pay less than $45k takes home the same amount. In other words, the McDonald's worker who is promoted to management will see no change in his real (after-government) pay.

Lenin would be proud.