Thank you for the graph. This made my day. What an awesome example of twisting data to attempt to prove a point. It's textbook! I sometimes go to the Paul Krugman blog to have a good laugh, but I hadn't seen this.

On a serious note:

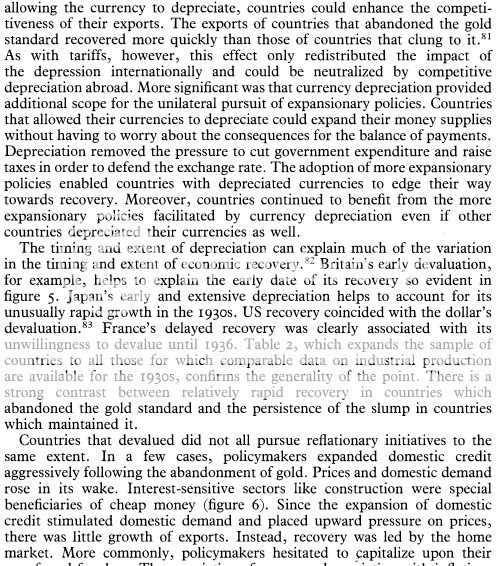

In a study covering many decades in a large sample of countries, Federal Reserve Bank economists found that "money growth and inflation are higher" under fiat standards than under gold and silver standards. Nor is the gold standard a source of harmful deflation.

Money, inflation, and output under fiat and commodity standards

Here's a chapter from a book (The Gold Standard: Perspectives in the Austrian School By Llewellyn H. Rockwell, Jr.) that should be required reading on the subject of the Gold Standard.

The Gold Standard: Perspectives in ... - Google Books

Ah yes, the anti-empirical ideologues of the moldy Austrian School, a school of thought which essentially contends that all advancements in our understanding of economics came to an end in c1915. How quaint. It is akin to when I was a wee lad, going over to my great-grandmothers, whose house was filled with dusty remnants from another era, long forgotten by society that had passed them by except by those who had a sentimental attachment to it. While the world listens to iPods, the Austrian ideologues listen to phonographs.

Now, I do agree with much of what the Austrians say. Not everything Austrian is wrong. Adherence to

everything Austrian, however, is wrong.

Ideologues always contend that their religion is not the cause of bad things, that it is always others which are responsible for our ills. Rather than focus on what

should happen, as ideologues do, lets focus on what

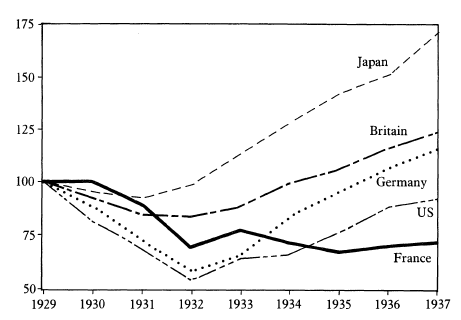

did happen. And indeed, the gold standard was very much a deflationary force during the Great Depression. This is from the scholarly work by Barry Eichengreen. My apologies for not being able to C&P the relevant posts. Thus, I will take screenshots of the important parts.

For those who couldn't be bothered to read it all, I'll give a synopsis: The gold standard threatened the stability of the global economy.

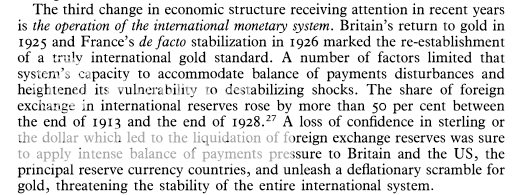

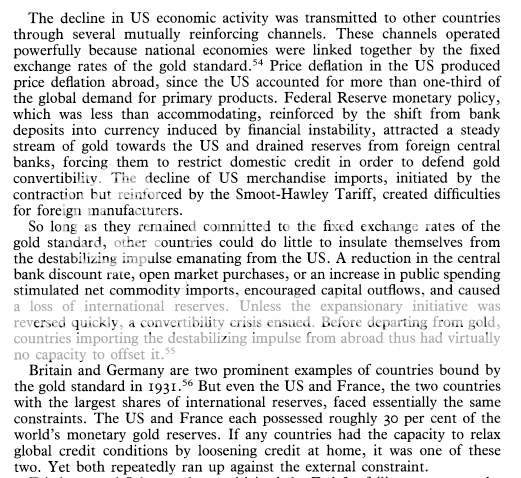

The gold standard was inflexible and led to shocks in the international flow of capital, destabilizing countries outside the United States. Price deflation in the US caused price deflation in other countries, even when there was little deflationary pressure.

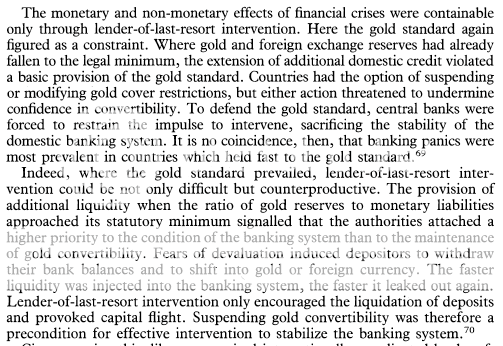

Countries that remained on the gold standard experienced more banking panics. This is not surprising given that the gold standard required the banks maintain a deflationary policy. This deflation caused people to fear bank collapses, which caused them to pull their deposits, precipitating bank collapses. In the Austrian school, this type of behavior is not supposed to happen, but it did.

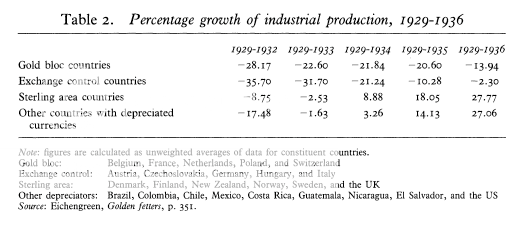

Going off the gold standard was expansionary. Countries that went off the gold standard began expanding before those that did not. This is to be expected as the gold standard was a restrictive policy.

Here is the empirical data showing this to be the case.

http://posterous.com/getfile/files....0rPtmDydkX/Eiichengreen_Origins_and_Natur.pdf

It is interesting, xsited, that you respond by saying the data is being manipulated, yet you dont actually show how, nor do you explain why the data would be wrong. You just assume that it is without offering any explanations nor any references to the real world.

I do appreciate your link that fiat currency systems cause inflation. No contention there. But thank you, that is the point. By removing the monetary system from the gold standard, the Fed and the government could implement inflationary policies to counter the enormous deflationary forces in the economy.

As Rabbi stated, when credit is restrictive, economic activity is constrained, as it was under the gold standard. When countries are no longer bound by those restrictions, credit and economic activity are no longer constrained by this anchor. When countries left the gold standard, their economies began to rise again.