JustAGuy1

Diamond Member

- Aug 18, 2019

- 16,900

- 14,817

- 2,290

"

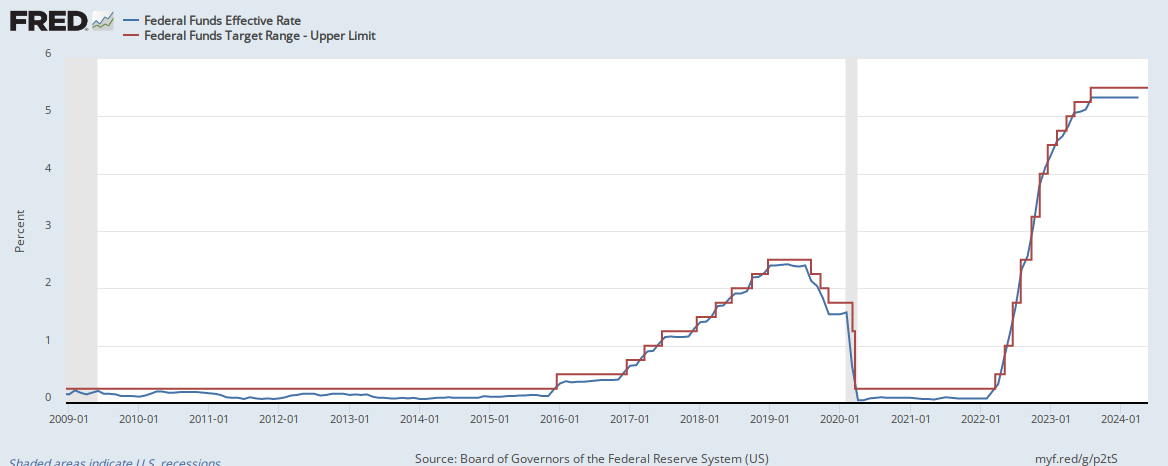

Everybody better start paying attention, it isn't all "sunshine and lollipops" out there.

- The Federal Reserve on Wednesday sold another $75 billion in market repurchase agreements, or repos, in a continued effort to calm money markets and bring interest rates within its intended range.

- The round was oversubscribed, as banks requested nearly $92 billion in overnight repos, signaling strong demand for the asset.

- The bank began a streak of repo offerings last week, marking the first time such assets were sold since the 2008 financial crisis. The central bank said the offerings would continue through early October."

Everybody better start paying attention, it isn't all "sunshine and lollipops" out there.