georgephillip

Diamond Member

What do you get when a crony-capitalist POTUS and his Foreclosure King Treasury Secretary responds the latest of capitalism's many epic failures?

"The New York Fed’s own playbook involves dangling a shiny object for mainstream media in a 'look here but not there' operation.

"During the 2008 financial collapse on Wall Street that took down the U.S. economy in the worst crisis since the Great Depression, the shiny object was a four-letter acronym called TARP, short for Troubled Asset Relief Program...."

"This time around, the Fed and New York Fed have brazenly upped their game because they have a much bigger shiny object: a deadly pandemic that is dominating the news and effectively eliminating any network or newspaper coverage of what is happening behind the scenes at the New York Fed...."

"Even worse, in what is beginning to resemble a conspiracy of silence, no mainstream news outlet has reported on the more than $9 trillion in super cheap repo loans the New York Fed has pumped into Wall Street trading houses or the fact that those loans began on September 17, 2019 – four months before the first coronavirus case was reported in the United States and at a time when President Trump was bragging on TV about the unprecedented robustness of the U.S. economy."

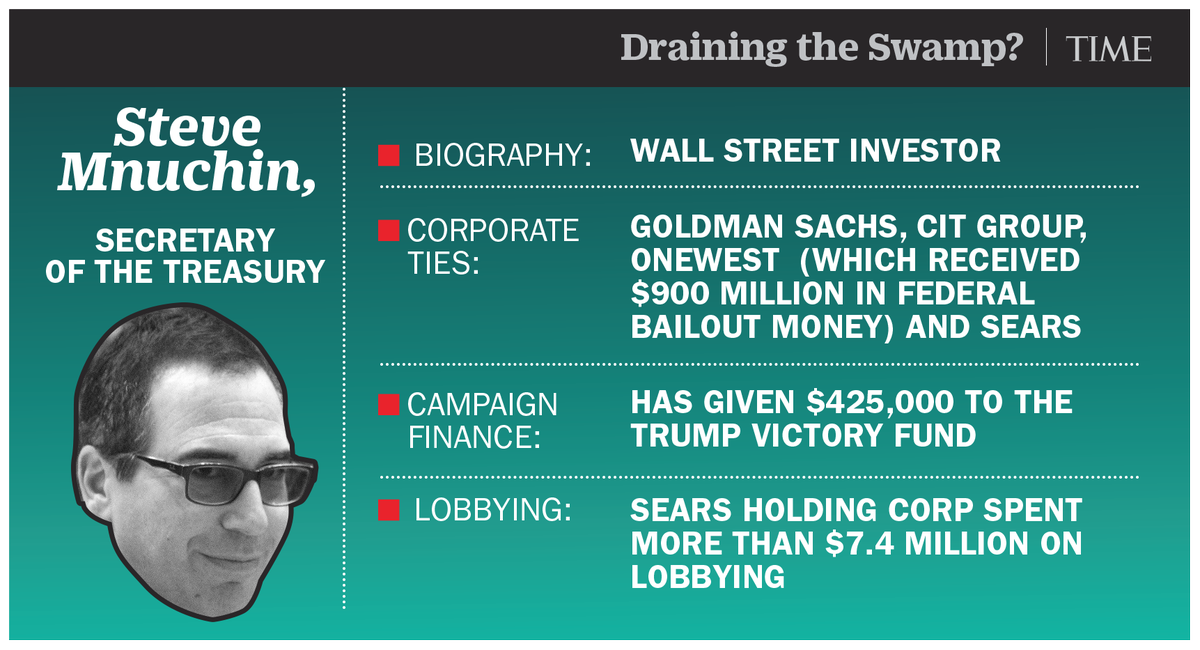

Instead of Draining the Swamp, the Swamp Is Draining the U.S. Treasury via the New York Fed

"There is nothing in any law governing the Federal Reserve that says that if the taxpayer puts up $454 billion it is allowed to leverage that up by 10 to 1 to $4.54 trillion and use that money to buy up toxic waste from the banks and trading houses on Wall Street.

"The New York Fed has simply decided that this is what it needs to do to prop up Wall

Street and eat their bad bets."

"The New York Fed’s own playbook involves dangling a shiny object for mainstream media in a 'look here but not there' operation.

"During the 2008 financial collapse on Wall Street that took down the U.S. economy in the worst crisis since the Great Depression, the shiny object was a four-letter acronym called TARP, short for Troubled Asset Relief Program...."

"This time around, the Fed and New York Fed have brazenly upped their game because they have a much bigger shiny object: a deadly pandemic that is dominating the news and effectively eliminating any network or newspaper coverage of what is happening behind the scenes at the New York Fed...."

"Even worse, in what is beginning to resemble a conspiracy of silence, no mainstream news outlet has reported on the more than $9 trillion in super cheap repo loans the New York Fed has pumped into Wall Street trading houses or the fact that those loans began on September 17, 2019 – four months before the first coronavirus case was reported in the United States and at a time when President Trump was bragging on TV about the unprecedented robustness of the U.S. economy."

Instead of Draining the Swamp, the Swamp Is Draining the U.S. Treasury via the New York Fed

"There is nothing in any law governing the Federal Reserve that says that if the taxpayer puts up $454 billion it is allowed to leverage that up by 10 to 1 to $4.54 trillion and use that money to buy up toxic waste from the banks and trading houses on Wall Street.

"The New York Fed has simply decided that this is what it needs to do to prop up Wall

Street and eat their bad bets."