They should be outlawed from buying back their shares and retiring them

Why?

Because it is nothing but the artificial manipulation of the stock price. And the reason behind it is executive compensation that is based on that stock price. Two things happened during the Reagan administration. First, stock options as a means of compensation were allowed to be "off the books". If a company gave their executives an option at x price and the price increased to y the company did not have to list y - x on their balance sheet, nor did they have any expense to list on the income statement until the option was exercised. Then the ban on corporate buybacks was lifted. Now you see what happened.

And I mentioned Sears earlier in this thread. Sears spent 4 billion dollars on stock buybacks over the last several years. Now they are bankrupt. Had they spent that four billion on upgrading their brick and mortar stores maybe they wouldn't be in the position they are in today. All that stock buyback did was inflate the incomes of the executives, and that was the purpose behind them. Honestly, both stock buybacks and the EITC lead to economic inefficiencies as can be seen by the Sears example and the unproductive employees at Walmart.

Because it is nothing but the artificial manipulation of the stock price.

Why do you feel it is manipulation? Why is a purchase "artificial"?

And the reason behind it is executive compensation that is based on that stock price.

The reason is also increasing earnings per share and efficient return of capital to shareholders.

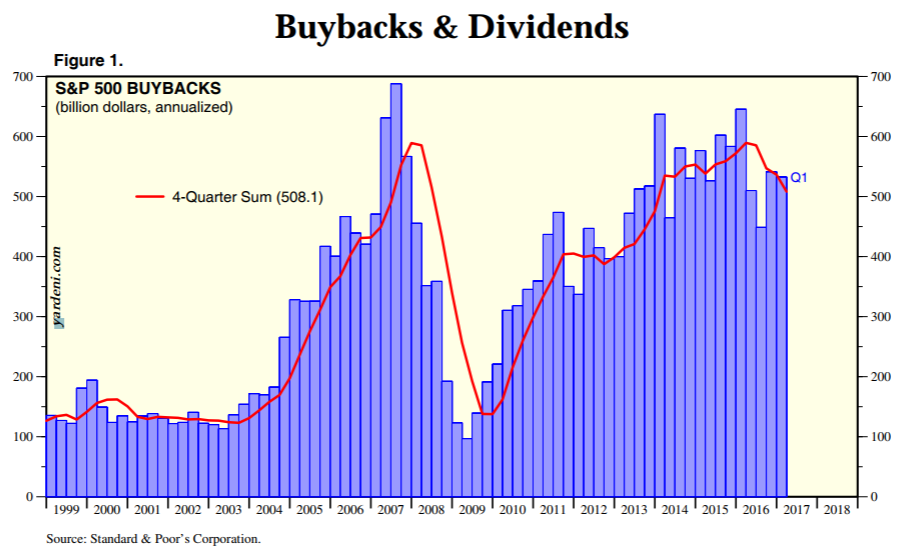

Then the ban on corporate buybacks was lifted. Now you see what happened.

The Dow went from below 1000 to over 25000. Awful, just awful.

And I mentioned Sears earlier in this thread. Sears spent 4 billion dollars on stock buybacks over the last several years. Now they are bankrupt.

Sometimes companies go bankrupt.

Had they spent that four billion on upgrading their brick and mortar stores maybe they wouldn't be in the position they are in today.

And maybe they would.

All that stock buyback did was inflate the incomes of the executives,

And the wallets of anyone who sold their stock back to the company.

First, no one has explained to me how it is "investing" in anything when a company indulges in stock buybacks, well other than investing in ARTIFICALLY inflating the stock price. It is artificial because it has no basis in the performance of the company. Your claim that it increases the earnings per share is proof positive of how it is artificial. There is no change in the performance of the company, there is no expansion, no capital investment, no increased market share for the companies products, no increased efficiency in the operations of the company, NOTHING but a bit of pencil pushing and poof, an increased earnings per share. I mean if I exchange four quarters for a dollar have I increased anything? Stock buybacks are the same damn thing. And that return of capital to the shareholders, well yeah, like a severance package is a return to an employee. The only way you get that severance package is if you leave the company, the only way you get that return on capital is if you sell your stock, same thing.

Like I said, for the long term investor a stock buyback is not a good thing. It is a sign of a company giving up. They have no acceptable capital investment opportunities so they use their cash to buy back stock. Hell sometimes they actually borrow money to buy back stock. Hell yeah, I would be selling my stock back to that company. If they want to return money to their shareholders why not increase the dividend or provide a temporary "bonus" as a dividend. Does that not increase the value of the stock? Does the dividend yield not mean anything anymore? Oh wait, executive compensation is not based on the dividend yield of a stock now is it?

Stock buybacks should be banned because, in the larger scheme of things, they do far more damage than any temporary benefit they might provide. They are one of the root causes of the increased wealth inequality, a driving force behind lackluster wage growth, a principal factor in the lack of capital investment over the last generation, and the driving force behind ballooning executive compensation. Not to mention a contributing factor in the bankruptcies of not just Sears, but many other now failed companies.

First, no one has explained to me how it is "investing" in anything when a company indulges in stock buybacks,

Not your company, not your money. Why would anyone have to explain anything to you?

well other than investing in ARTIFICALLY inflating the stock price.

Yeah, I hate it when my stock prices go up.

It is artificial because it has no basis in the performance of the company.

Well, the company did well enough to earn this extra money that they used to retire shares...….

Your claim that it increases the earnings per share is proof positive of how it is artificial.

A company earns $1,000,000 with 1,000,000 outstanding shares. Earnings are $1 per share.

They buy back 200,000 shares and next year they earn $1,000,000. Earnings are $1.25 per share.

Explain how my math is "artificial".

NOTHING but a bit of pencil pushing and poof, an increased earnings per share.

You should definitely sell your shares in that case.

And that return of capital to the shareholders, well yeah, like a severance package is a return to an employee. The only way you get that severance package is if you leave the company, the only way you get that return on capital is if you sell your stock, same thing.

Wait, you said they are "

ARTIFICALLY inflating the stock price".

Sounds like I don't have to sell my stock to benefit.

Like I said, for the long term investor a stock buyback is not a good thing.

Like I said, don't like it, sell your shares.

Hell sometimes they actually borrow money to buy back stock.

Hell, if interest rates are low enough and they think the stock price and dividend will be higher in the future, that could be a great investment.

If they want to return money to their shareholders why not increase the dividend or provide a temporary "bonus" as a dividend.

Because dividends are taxed at a higher rate than capital gains.

Stock buybacks should be banned because, in the larger scheme of things, they do far more damage than any temporary benefit they might provide.

You should never buy shares back in your company, if that's how you feel.

They are one of the root causes of the increased wealth inequality, a driving force behind lackluster wage growth,

Boohoo.