Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

REVEALED: Only ONE member of failed SVB's board had a career in investment banking - and the rest were Obama, Clinton mega-donors

- Thread starter MAGA Macho Man

- Start date

frigidweirdo

Diamond Member

- Mar 7, 2014

- 50,458

- 12,291

- 2,180

Given the dependency of banking we have in our personal and business lives, I place trust in bankers like I do doctors, nurses, lawyers, engineers, IT infrastructure managers.

And yet, these bankers, the high level ones at the very least, are doing risky business, and help cause recessions.

frigidweirdo

Diamond Member

- Mar 7, 2014

- 50,458

- 12,291

- 2,180

Well here is a prime opportunity for us as taxpayers to complain, and unite left and right. We join in the chorus of Rightwing objecting to the bailouts, and in unison demand that the candidates receiving the documented donations from these banks deduct that from what the taxpayers are LENDING. The banks donors and recipients are only receiving LOANS that must be paid back to taxpayers, who will hold real property as collateral on the debts.

Liberal protestors of conservative bailouts can add equivalent demands to reimburse Taxpayers for corporate loans instead of handouts or welfare, and also claim ownerships of property or programs as collateral on these loans extended at taxpayers expense.

Let's turn the tables on govt, where taxpayers claim collateral and interest in these loans we are being charged for like handouts. We cannot be held to a contract unless we sign it voluntarily. So let's layout the terms of these loans by which we agree to be financially responsible, which means giving us enough collateral, credit or interest to make it worth the investment and get our consent as taxpayers footing the costs

Well, I've been posting for years in favor of Proportional Representation which would change the system and allow people to actually have a choice and a voice.

Most people ignore me because they haven't been told to like PR, in fact they've been told not to like it, so they don't like it.

frigidweirdo

Diamond Member

- Mar 7, 2014

- 50,458

- 12,291

- 2,180

That is missing the point and not directly the issue. The problem is if the system was run as a network for leftist interests to pool together collective capital for political agenda.

Had the board been professional bankers interested in long-term banking services and relations with the public on a profitable sustainable basis, not only would investment and loan decisions be made differently (and not the short term goals of funding political allies even at great risk and loss of the money), but investors and business partners would give this network "greater credibility" and bring more capital and business there due to long-term productivity.

As is, it looks hardly different from a pyramid scheme similar to Enron having its top officials and investors get all the money and profits they could get out of the deal, and let the rest crash at the expense of other people and taxpayers to bail out the huge profiteers at the top.

So that's where the complaints are coming from, that Democrat political interests basically laundered money they could afford to lend or give away, through these bank and financial institutions, so when the pyramid crashes, the taxpayers foot the bill and basically fund and cover all the loans and donations made to profiteers for their political careers and campaigns.

Reminds me of the failed SNL bailouts of junk bonds under Reagan where corporate raiders like MAXXAM got bailed out at $1.6 billion if you include est. Interest at taxpayer expense, for bonds abused to takeover companies like Pacific Lumber (and later Kaiser Aluminum), crash them after liquidating their assets and pension funds, then declaring bankruptcy so taxpayers are left holding the bag of debts while the boards and top shareholders ran off with the profits sucked out before the crash.

So, it was a business trying to make money

How's that different from other businesses?

And if they were doing "money laundering", I'd assume the Republicans are doing the same thing.

H

Harpy Eagle

Guest

Had the board been professional bankers interested in long-term banking services and relations with the public on a profitable sustainable basis, not only would investment and loan decisions be made differently (and not the short term goals of funding political allies even at great risk and loss of the money), but investors and business partners would give this network "greater credibility" and bring more capital and business there due to long-term productivity.

The board had extensive financial and venture capital experience. One is the current CEO of Rite Aide.

It should also be pointed out that the only 2 member out of 10 on the board for Exxon have any gas or oil experience.

LeftofLeft

Diamond Member

- Oct 18, 2011

- 26,178

- 16,598

- 1,405

so get rid of all banks and turn it all over to the central government? Or, keep all banks and make them an extension of the central government? Define “risky business” when it comes to bankers? Risky business is when the government knowingly eases mortgage requirements TO THE LEVEL where people are getting loans they know they will struggle to pay.And yet, these bankers, the high level ones at the very least, are doing risky business, and help cause recessions.

frigidweirdo

Diamond Member

- Mar 7, 2014

- 50,458

- 12,291

- 2,180

so get rid of all banks and turn it all over to the central government? Or, keep all banks and make them an extension of the central government? Define “risky business” when it comes to bankers? Risky business is when the government knowingly eases mortgage requirements TO THE LEVEL where people are getting loans they know they will struggle to pay.

Or, how about have sensible regulations for banks, allow banks to run as they wish within those regulations.

LeftofLeft

Diamond Member

- Oct 18, 2011

- 26,178

- 16,598

- 1,405

Ok… define “sensible regulations”? I’m not proposing regulation free but regulations can go over the top to the point that ability to compete and grow is limited. Risk is necessary to grow. I still don’t see how and where social and political causes should be integrated with risk assessment.Or, how about have sensible regulations for banks, allow banks to run as they wish within those regulations.

frigidweirdo

Diamond Member

- Mar 7, 2014

- 50,458

- 12,291

- 2,180

Ok… define “sensible regulations”? I’m not proposing regulation free but regulations can go over the top to the point that ability to compete and grow is limited. Risk is necessary to grow. I still don’t see how and where social and political causes should be integrated with risk assessment.

Well, that's the thing isn't it?

Sensible regulations will come from sensible government. The US doesn't have that.

So, for anything sensible to happen the US needs to change the way it elects its "representatives" so they represent the people and not the rich who control everything.

The thing here is that you're talking about growth. The US has too much growth, it does boom and bust far too much. Who benefits from boom and bust? The rich.

The 2008 financial crisis saw 7 million people lose their homes, people at the bottom of the pile, while the rich got richer, as if they need to get richer.

That growth of the early 2000s didn't benefit the country, it benefited the rich.

Growth needs to be regulated, it needs to be modest growth so that boom and bust is limited.

Risk is still a part of capitalism, however some of the risks that are allowed might be too much of a risk if they risk EVERYTHING.

LeftofLeft

Diamond Member

- Oct 18, 2011

- 26,178

- 16,598

- 1,405

Name an economy where the rich don’t get richer? In North Korea, the rich get richer. In Cuba, the rich get richer. In Mexico, the rich get richer. In China and Russia, the rich get richer. Compared to the US, which economy offers more opportunity or name an economy where the rich don’t get richer and /or offer more opportunity?Well, that's the thing isn't it?

Sensible regulations will come from sensible government. The US doesn't have that.

So, for anything sensible to happen the US needs to change the way it elects its "representatives" so they represent the people and not the rich who control everything.

The thing here is that you're talking about growth. The US has too much growth, it does boom and bust far too much. Who benefits from boom and bust? The rich.

The 2008 financial crisis saw 7 million people lose their homes, people at the bottom of the pile, while the rich got richer, as if they need to get richer.

That growth of the early 2000s didn't benefit the country, it benefited the rich.

Growth needs to be regulated, it needs to be modest growth so that boom and bust is limited.

Risk is still a part of capitalism, however some of the risks that are allowed might be too much of a risk if they risk EVERYTHING.

Frankeneinstein

Gold Member

Okay, what's the issue here?

A huge path of corruption seems to follow leftist everywhere they go.

frigidweirdo

Diamond Member

- Mar 7, 2014

- 50,458

- 12,291

- 2,180

Name an economy where the rich don’t get richer? In North Korea, the rich get richer. In Cuba, the rich get richer. In Mexico, the rich get richer. In China and Russia, the rich get richer. Compared to the US, which economy offers more opportunity or name an economy where the rich don’t get richer and /or offer more opportunity?

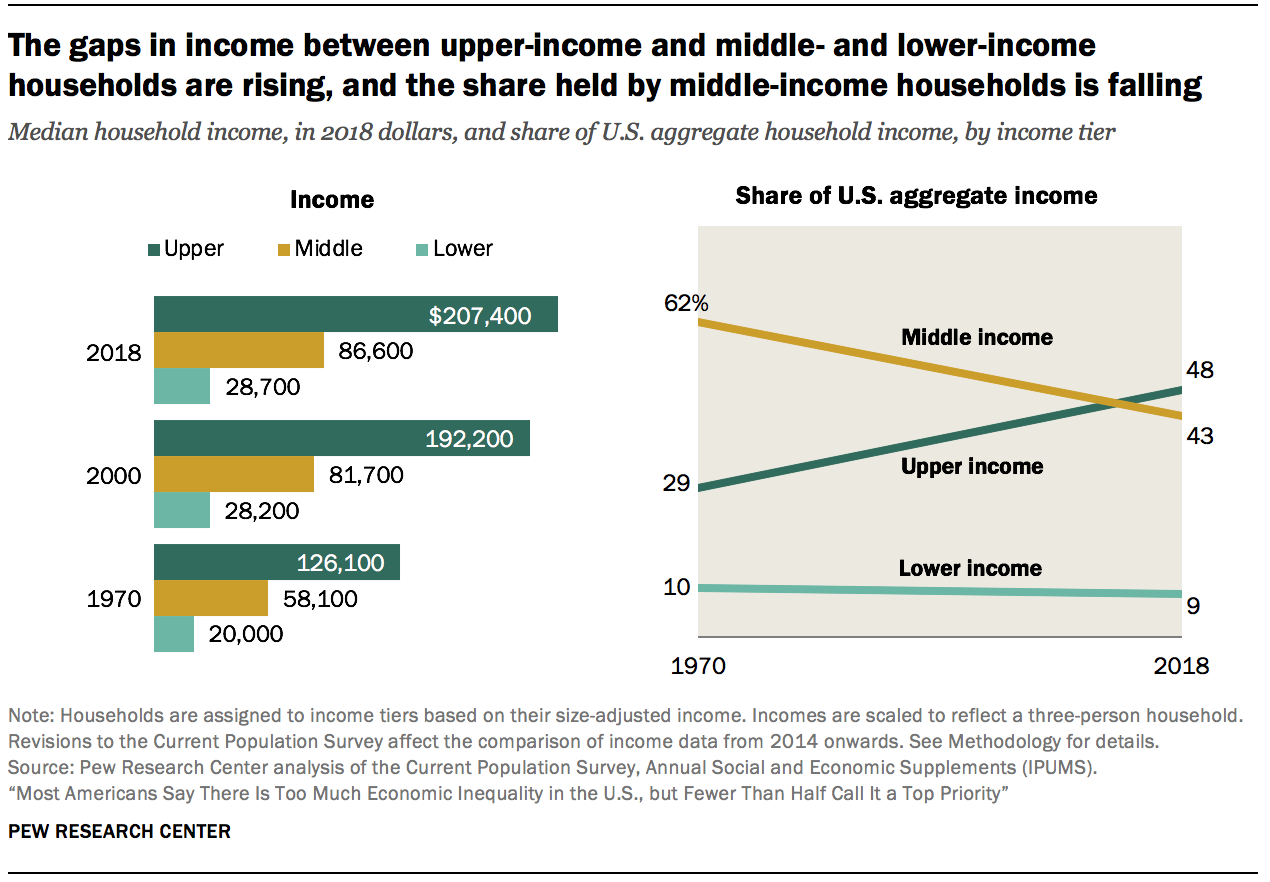

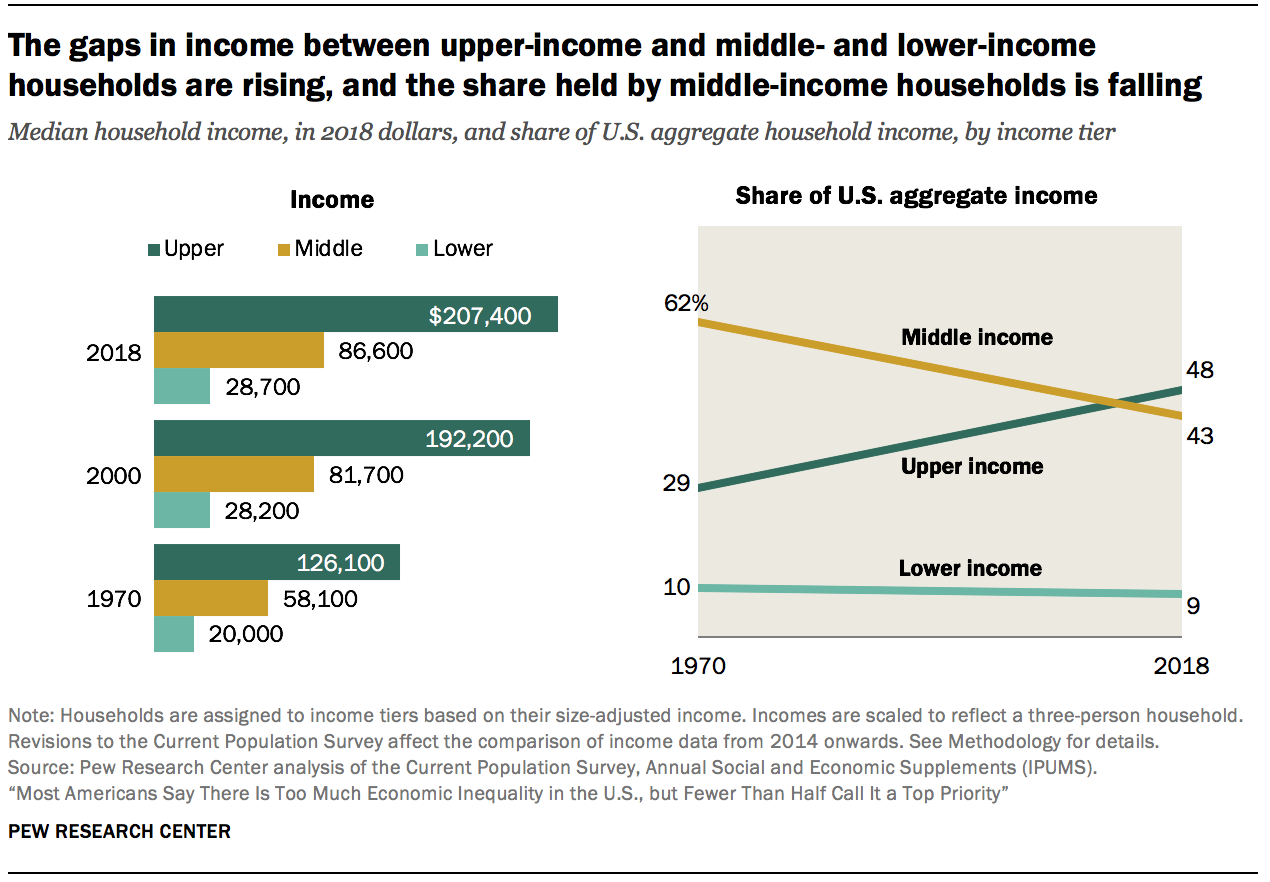

Well, we're not talking about totally stopping rich people from getting rich. Obviously rich people will get rich, HOWEVER, what we're really talking about is income inequality.

1. Trends in income and wealth inequality

Barely 10 years past the end of the Great Recession in 2009, the U.S. economy is doing well on several fronts. The labor market is on a job-creating

www.pewresearch.org

www.pewresearch.org

Upper income went from having 29% of all wealth, to 48% of all wealth in 48 years.

Middle income lost 19% in that time. Lower income lost 1%

That's not right.

Wealth and its distribution in Germany, 1895-2018

German history provides unique insights into how country-specific shocks can shape long-run wealth dynamics. This column presents the first comprehensive study of wealth and its distribution in Germany since the 19th century. The authors find the concentration of wealth in the hands of the...

See the difference?

LeftofLeft

Diamond Member

- Oct 18, 2011

- 26,178

- 16,598

- 1,405

Nope. Income inequality exists everywhere. Who offers the best Opportunity?Well, we're not talking about totally stopping rich people from getting rich. Obviously rich people will get rich, HOWEVER, what we're really talking about is income inequality.

1. Trends in income and wealth inequality

Barely 10 years past the end of the Great Recession in 2009, the U.S. economy is doing well on several fronts. The labor market is on a job-creatingwww.pewresearch.org

Upper income went from having 29% of all wealth, to 48% of all wealth in 48 years.

Middle income lost 19% in that time. Lower income lost 1%

That's not right.

Germany, with Proportional Representation, had the wealth share around 25% for the top 1% in and around the 1970s, now it's at about 27% there and there abouts.Wealth and its distribution in Germany, 1895-2018

German history provides unique insights into how country-specific shocks can shape long-run wealth dynamics. This column presents the first comprehensive study of wealth and its distribution in Germany since the 19th century. The authors find the concentration of wealth in the hands of the...cepr.org

See the difference?

frigidweirdo

Diamond Member

- Mar 7, 2014

- 50,458

- 12,291

- 2,180

Nope. Income inequality exists everywhere. Who offers the best Opportunity?

I didn't say income inequality doesn't exist everywhere, of course it exists everywhere.

The difference is in some countries income inequality is really high, meaning the rich are screwing the poor like crazy. In other places it's much more sensible and things are better for most people.

LeftofLeft

Diamond Member

- Oct 18, 2011

- 26,178

- 16,598

- 1,405

In the countries where the income inequality is “more sensible”, yes, the spread or delta is less than US but there is less opportunity and I would argue more of a locked in 1 percent.I didn't say income inequality doesn't exist everywhere, of course it exists everywhere.

The difference is in some countries income inequality is really high, meaning the rich are screwing the poor like crazy. In other places it's much more sensible and things are better for most people.

frigidweirdo

Diamond Member

- Mar 7, 2014

- 50,458

- 12,291

- 2,180

In the countries where the income inequality is “more sensible”, yes, the spread or delta is less than US but there is less opportunity and I would argue more of a locked in 1 percent.

Well, it depends what you mean by "more opportunity"

In the US large companies are making it harder and harder to be an independent business person. Small businesses are disappearing.

Why is Small Business in America Dying?

A lot of people are saying small business is dying in America. An article on Brookings charted data from the U.S. census of the bureau, which tells us: 1978 had a ~14% firm entrance rate and a ~11% firm exit rate 2011 had an ~8% firm entrance rate and a ~9.5% firm exit rate In […]

thecapitalist.com

thecapitalist.com

"In short, the U.S. is now losing more businesses than its creating. This trend developed slowly over three to four decades."

Why?

"Big companies are taking up the market"

Simply said, large companies are bribing the government to give them preferential treatment, this is making them uber competitive and small businesses are suffering.

Companies like Walmart, Starbucks, Amazon are literally KILLING small businesses.

And these large business literally control government.

emilynghiem

Constitutionalist / Universalist

I will work with you on this!Well, I've been posting for years in favor of Proportional Representation which would change the system and allow people to actually have a choice and a voice.

Most people ignore me because they haven't been told to like PR, in fact they've been told not to like it, so they don't like it.

Are you connected with any Green or independent progressive political activists on this or other reforms?

The Duke

Diamond Member

- Jul 30, 2022

- 37,517

- 47,995

- 2,788

All Americans have to pay for their fucking up, no?Okay, what's the issue here?

I'll fight you tooth and nail.I will work with you on this!

Are you connected with any Green or independent progressive political activists on this or other reforms?

ONE man, ONE vote.

frigidweirdo

Diamond Member

- Mar 7, 2014

- 50,458

- 12,291

- 2,180

I will work with you on this!

Are you connected with any Green or independent progressive political activists on this or other reforms?

Nope, I'm not connected with any political party at all.

Similar threads

- Replies

- 25

- Views

- 895

- Replies

- 0

- Views

- 445

- Replies

- 5

- Views

- 339

- Replies

- 25

- Views

- 2K

New Topics

-

Fifth Circuit Court of Appeals chastises SCOTUS For Dissing President Trump

- Started by Contumacious

- Replies: 5

-

Syrian Christians Warned to "Convert to Islam or Pay the Jizya [islamic apartheid tax]

- Started by Pastelli

- Replies: 6

-

Moron Almost Dies Doing A Wheelie On His ATV Through An Intersection

- Started by RhodyPatriot

- Replies: 3

-

Stunning testimony at the JFK assassination hearings.

- Started by DonGlock26

- Replies: 6

-

Latest Discussions

-

Homeland Security revokes Harvard’s ability to enroll international students

- Latest: NewsVine_Mariyam

-

-