Did anyone READ the article? The bill would have busted the spending caps approved by both sides. I notice when ever the dems deny a bill because of that there is no whining and crying claiming they are mean people. Last I checked the Government made a deal to abide by the budget restrictions and when ever anyone tries on the republican side to get an exemption you turds are all in here screaming like maniacs that it is not allowed. So which is it? Are certain bills allowed to be exempt?And exactly who gets to decide which ones are and which ones aren't?

If the Ds are so willing to ignore spending caps on this where are they willing to cut to compensate?

Take the money from the California High Speed Rail........and put that 65 BILLION into the VA.............

There's a place to get the funds..........California can build their own dang rail and pay for it......

California is already one of the states that send more tax funds to Washington DC than they get back in return. Why should they be the one to pay the bill. How about if we do like Trump says and make Wall Street Hedge Fund dealers pay the same rate of taxes as hourly workers instead of half the rate the rest of us have to pay on income taxes. Or how about if we follow the advice of the Koch brothers and stop handing out Wall Street welfare in the form of bail outs and tax loopholes.

California has a larger population............

Secondly, the Red State Rant BS includes Federal money for military bases, and military construction of ships and the like..............to say look how these states are fleecing America as they add BILLION DOLLAR SHIPS into the picture........................

Biased, misguided rants from the left and nothing more...................they also add in places like NASA for the bs propaganda as well..................just typical liberal nonsense.

Cali larger? Don't understand what percentage are huh? lol

CALI DOESN'T HAVE MILITARY BASES HUH? LOL

Red States Feed at Federal Trough, Blue States Supply the Feed

Top Ten (Source: Tax Foundation):

1.

New Mexico Indian reservations,

military bases, federal research labs, farm subsidies, retirement programs

2.

Mississippi Farm subsidies,

military spending, nutrition and anti-poverty aid, retirement programs.

3.

Alaska Per capita No 1 recipient of federal benefits; infrastructure projects, DOT and pork projects.

4.

Louisiana Disaster relief, farm subsidies, anti-poverty and nutrition aid,

military spending.

5.

W. Virginia Farm subsidies, anti-poverty and nutrition aid.

6.

N. Dakota Farm subsidies, energy subsidies, retirement and anti-poverty programs, Indian reservations.

7.

Alabama Retirement programs, anti-poverty and nutrition aid,

federal space/military spending, farm subsidies.

8.

S. Dakota Retirement programs, nutrition aid, farm subsidies,

military spending, Indian reservations.

9.

Virginia Civil service pensions,

military spending, veterans benefits, retirement, anti-poverty aid.

10.

Kentucky Retirement programs, nutritional and anti-poverty aid, farm subsidies.

Now consider the bottom 10, i.e., the ones that give more to the federal government in taxes than they get in return. From 1 to 10, they are:

New Jersey, Nevada, Connecticut, New Hampshire, Minnesota, Illinois, Delaware, California, New York, Colorado.

Anything strange about that list? Yes, they are all blue states (or the deepest of purple).

THEY DON'T HAVE MILITARY RIGHT?

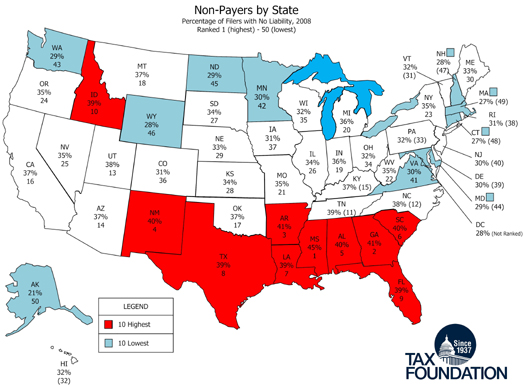

Adding to this fallacy are the assumptions surrounding Mitt Romney’s now infamous comments about the indolent “47 percent” of Americans who regard themselves as victims and therefore pay no taxes.

As the American Conservative magazine (no less) pointed out recently, nine of those 10 states are in the red-as-ruby Old Confederacy.*

Blue State, Red Face: Guess Who Benefits More From Your Taxes?

for spreading LIES!!!!

for spreading LIES!!!!