There is so much fail in your latest response, RGR, I hardly know where to begin. But it is clear your goal here is to just throw as many pins in the air for me to juggle, while dancing around the central question.

The ultimate challenge put to you is "where is the oil, going forward?"

And your pathetic answer is "same place it's always been!"... Which is about as mature and intellectually honest as replying with "if it was up your ass, you'd know it," or "it's where you left it!"... For all your blather, and your own denialist dogma, you are utterly unable to answer the question. That's because no one knows.

Oh. You mean...like a nation grows wheels...and...transports itself? Silly me, not understanding that one, can't say I've ever seen a nation doing this so my experience with them is limited.

You knew exactly what I was talking about - nations through which land-locked energy is transported. Unfortunately, it's a common practice of you to both feign ignorance in order to stall, AND proclaim intellectual superiority, simultaneously.

Well, that and past peaks, claims of peak decades ago, and countries which don't give a whit about Hubbert's method for NOT predicting their production rates. Its usually called "reality".

OK, well, I'll call your latest bullshit extrapolation bluff. Quantify that claim then. Link to what was actually said back then, by whom, about what? Global supply/demand shortfall? Or regional? Did it take into account exponential demand growth? Was the claim the exact same as today, or conditional? Most important, how much of the planet was explored back then compared to today, where the seismology reports have pretty much scoured the entire planet, and the USGS and IEA have a much firmer grasp of remaining global reserves?

If your argument simply rests upon "that's the way it's always been," you've already lost. Tell me, flat-earther: When 16th century ships kept getting lost at sea, was that further proof they fell off the edge of the world?

Also, your tactic of attempting to dismiss ASPO based on nothing, while ignoring the direct quote of the former chief geologist of British Petroleum in an ASPO interview is rather transparent. It's a little like saying "I was not convinced the markets were crashing in Sept. of '08, because I had to watch coverage of it on MSNBC."

Oops. You're gonna need to work a bit harder. Objecting to the production of the story is not the same as the source of the story. You understand how that works, do you not, junior Friedman? You're not countering what Jeremy Gilbert has said in the opening statement of that video, you're merely punting to "ASPO can't be trusted!".... LOL.

FAIL!

You're more than welcome to present a video denying peak. And I'll go ahead and focus on what they actually said, not my surface beef with the producers who interviewed them.

Here it is again, pumpkin. How are these industry insiders wrong or lying? Try to focus on what these independent sources say, not your pretentious narrative regarding ASPO.

[ame]http://www.youtube.com/watch?v=VUVY2qrEfd8[/ame]

Ok, again. Support that claim. In what context? Who in the military? Did they claim global shortfall of 10 million barrels per day within 5 years? Did they put out a report on the ramifications of such a condition? Somehow I doubt it, but far be it from you to extrapolate something you "heard" emanating from 95 years ago.

Regardless, here's what they are saying today, from the PDF provided before on the JOE:

"During the next twenty-five years, coal, oil, and natural gas will remain indispensable to meet energy requirements. The discovery rate for new petroleum and gas fields over the past two decades (with the possible exception of Brazil) provides little reason for optimism that future efforts will find major new fields.

At present, investment in oil production is only beginning to pick up, with the result that production could reach a prolonged plateau. By 2030, the world will require production of 118 MBD, but energy producers may only be producing 100 MBD unless there are major changes in current investment and drilling capacity.

By 2012, surplus oil production capacity could entirely disappear, and as early as 2015, the shortfall in output could reach nearly 10 MBD.

Must just be baseless fear mongering by people in our military who don't understand geology as awesome as you claim to.

"Nothing to see here!!! Please!! Stand back!!"

"Nothing to see here!!! Please!! Stand back!!"

You're still kinda new here, so I'll forgive you for not having a clue of my post history, which includes several links to the U.S. Dept. of Energy's corroboration. Nevermind that a simple user search would give you the information you're pretending doesn't exist.

Do you prefer the

Hirsch Report of 2005, or the more recent April 2009 DoE round-table, entitled Meeting the Growing Demand for Liquid (fuels)?" (

pdf)

Either way, here's a

LeMonde story covering the issue. Undoubtedly, you'll find fault in LeMonde, and pretend the facts can't be trusted because it's LeMonde. It's what you guys do:

The DoE April 2009 round-table, untitled Meeting the Growing Demand for Liquid (fuels), was semi-public. Yet it remained unnoticed and unjustly, as it put forward forecasts that are far more pessimistic than any analysis the DoE has ever delivered.

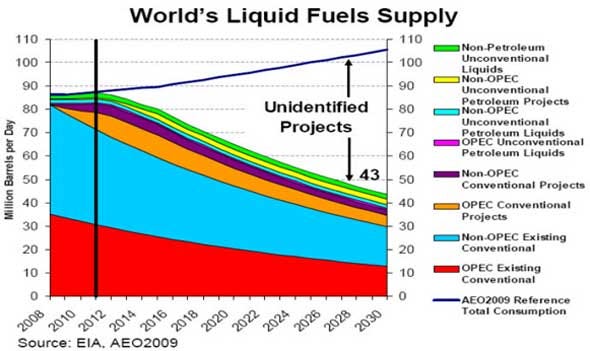

Page 8 of the presentation document of the round-table, a graph shows that the DoE is expecting a decline of the total of all known sources of liquid fuels supplies after 2011.

The graph labels as unidentified the additional supply projects needed to fill in a gap that is expected to grow after 2011 between rising demand and decline of known sources of supply that the DoE supposes will start that year. The declining production foreseen by the DoE concerns the total of existing sources of liquid fuels plus the new production projects that are supposed to come on-stream before 2012.

The DoE predicts that the decline of identified sources of supply will be steady and sharp : - 2 percent a year, from 87 million barrels per day (Mbpd) in 2011 to just 80 Mbpd in 2015. At that time, the world demand for oil and other liquid fuels should have climbed up to 90 Mbpd, according to the presentation document.

And here's the graph in question, the "as yet unidentified" future supply portion of which you punt to "it's where it's always been" emptiness. ...

Now, surely, if you bother to read it, you'll cling to the passage in the story that offers a contingency that says this will come true "if investment is not there," which is what they have to say or face putting world markets into immediate panic. But with the world in perpetual recession, anyone being honest with themselves is well aware that the trillions in needed investment to maintain this growth is NOT there, and won't be.

Here's some more reading on the subject for you to pretend says something else, or merely can't be trusted:

Why The EIA?s Energy Outlook For 2010 Reveals Some Disturbing Figures

Straw man. Who said that? In what context? They said we were at global peak? Please link to where you're making your claim. I have little doubt it can easily be put into proper perspective, and NO DOUBT it's completely irrelevant to today's data.

"Limits to Growth" never gave a date for peak, only that is was coming. What some groups erroneously derived from "Limits to Growth" does not make that paper wrong in the least.

Do better.

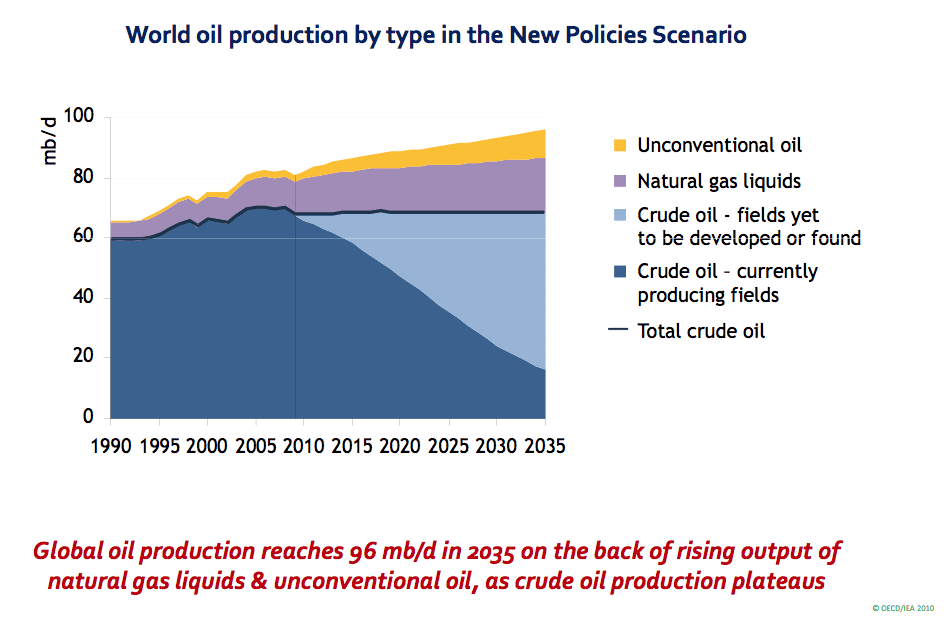

LOL!!!! Are you sure you're reading it correctly, genius? How does it say we're "good to go" until 2035? Once again, what represents the light blue portion? Surely the IEA and Big Oil as a whole would love to hear from you. Unfortunately, you don't have an answer. Because no one knows.

Hope is not a policy. Pragmatism is, based on known mathematics and geology. You claim you're such as esteemed analyst of geology, but when challenged to provide where the oil is going to come from going forward to fill that ever-expanding wedge, your awesome answer is: "where it's always been!"

EPIC FAIL.

Most of the places it's been "coming from for decades" are all in decline. This is not disputed. At least not by anyone with any data and weight behind their claim. You would know this if you watched the video of industry insiders saying so, including the chief consultant from Saudi-Aramco, the source of your denialist claim below.

The U.S., North Sea, Russia, Indonesia, Venezuela, Kuwait, Iran, and on and on and on. About the only major country claiming to have surplus production capacity is Saudi Arabia, and that's impossible to verify, considering they don't allow independent field analysis. But that won't stop you from resting your entire tired premise on their claims:

It's interesting that you would question ASPO, yet take Saudi Arabia's word as bond. Unlike you, I'm happy to list the many specific reasons your source sucks. Nevermind that your link forwards all inquiries to a Halliburton e-mail address. LOL.

Look at your link. You know, beyond the headline. ... What do you see there in their claim of some "next trillion?" Half of it is heavy, unconventional oil. The kind that is enormously expensive to extract and refine, and will NEVER sustain 5-7% growth, upon which the global economy must have to run in it's current form. Heck, he references the USGS survey from 10 years ago!!! FAIL!

In fact, from your own link, here's a wonderful passage that really puts your link of choice in perspective:

The point is not so much to argue for the veracity or the feasibility of these figures. Instead, the intent is to highlight vast possibilities...

Well, hooray for everything!! Let's just pull a figure out of our ass, and wonder at the possibilities!

There are no hard figures here of proven reserves. Not even a comprehensive analysis of technically recoverable reserves.

What your link essentially says is: "Trust technology." ... But again, hope is not a policy. ... and tar sands will not save us. Neither will shale gas. The industry, knowing this day would come, has been trying to perfect unconventional oil production for decades, and have made about a 1-yard gain. Well, it's 4th-and-25, and goofy people like you insist an inside run is the way to go.

So, your essay there, by a Saudi-Aramco executive, comes from a company that has been telling the world "everything is fine" for 15 years, but their actions tell a different story from their press releases, altogether. They haven't proven they can ramp up production capacity, only claimed they can, and no one can see their data. Meanwhile, they're

injecting sea water into their biggest fields in a desperate attempt to maintain pressure - the

death knell of any field. They're also pouring investment into vastly-more-expensive offshore infrastructure (surely the sign of "plenty" of the abundant stuff onshore

)

Linking to the Saudis claiming "there's plenty" is about as convincing as the U.S. government investigating itself and announcing to its citizens "we found nothing nefarious."

In short, do better.

Rich irony here, DUCY?

Here you are, sunshine:

That's a lot of pre-emptive guessing on your part. Based on how pathetic your earlier pap is, it's completely ineffectual. Punting to your guess of my grasp of EROEI is doing nothing for your flat refusal to quantify the central question.

Anyhow, "I'll play along," as you so arrogantly put it:

It's energy returned on energy invested. How much energy it costs to find, extract, refine and deliver that energy to market vs. how much energy is actually brought to market. It's a basic ratio figure that anyone can grasp, and no one needs to have an advanced physics degree, whatsoever, like you arrogantly act as if you have.

Light crude? The kind our empire is utterly built upon? That stuff returned anywhere from 200:1 down to 20:1 today.

Unconventional, heavy oils, the kind that you are squawking will save us all? About 2:1 or at best, 5:1. Now, how is that return going to maintain growth? That's right, it's not.

Here are the best known assessments of tar sands EROEI, and oops... it's not pretty:

But of course, if we listen to drones like you and select executives at Saudi-Aramco, the technology will be along any day now to improve those paltry figures. We need only invest and wait patiently

Poetic irony here, DUCY?

That's because you've painfully straw manned my statement. You will not move the goalposts and demand I kick through it or else you "win." ... LOL.... Tool.

What I said was discoveries are not keeping up with dying existing capacity. Not unless you can magically find a way to flat-line the exponential growth curve in demand. And even if you did manage to halt demand growth (via war, depression, disease, etc.), you've merely underlined the ramifications of peak, you have NOT refuted it.

It's interesting that your epic spin on that discoveries chart said nothing of demand growth going forward, which is ever expanding, like a snowball rolling down hill.

Hubbert said peak production comes roughly 40 years after peak discovery. That was the case for U.S. peak, that is the case for global peak. Discovery of global finds peaked in the mid 1960s. It is axiomatic, and in fact global production has flat-lined since 2004.

If you can show how global liquids production somehow

hasn't flatlined since roughly the middle of the last decade, I'd love to see how you're arriving at your figures.

I'm quite confident you can't.

Witty. Spin it back, when clearly your argument is treading water badly, and represents nothing different from the legion of drones before you who also can't allude to where the energy is going to come from while maintaining necessary growth for the global economy that is dying before our very eyes.

Actually, I defend every one of them. It's just that you change the game and yell "see!!!?" Grow up.

One yields bitumen, the other kerogen. Both have exceedingly slow flow rates, and are grossly expensive and no where near being economically viable. Nevermind their destructive affects on the environment, which ALSO factors into EROEI, even though you clowns wish to deny it.

As does "Twilight in the Desert" by Simmons. I have little doubt I possess a far more versatile reading library on this subject matter than you do.

Evidenced by your juvenile and empty response to the ultimate question, "it's where it's always been!!"

Carter didn't base his running out in the 80's on the Limits to Growth. And of course Carter was wrong, do you know what the Fuel Use Act was? And why it proves Carter was wrong? Or isn't that Carter in Peaker U. either?

First, I'll need to you expand on what you believe Carter was wrong about. Surely, you'll take one sentence and extrapolate it to represent his overall premise, but I'm willing to take that challenge.

Overall, the man was quite correct. And you conceded it the moment you joined this forum.

No going backwards now.

And if you can't do anything but parrot peaker dogma, I'm not about to explain the use of exponential growth in ANY model, and what a natural outcome to such modeling might be.

More irony. You've provided nothing but denialist dogma, and short-sighted graphs representing half the equation.

I have little doubt you'd fail regarding "exponential growth model" as well, spinning it into some convenient irrelevancy. You appear to be learning about this stuff as you go along, evidenced by your pathetic link to a Saudi-Aramco essay with a Halliburton email address.

You can run your mouth as long you want with personal insinuation that makes up some 90% of your material. The rest of your blather is nothing we haven't handled before by much better posters than you at ToD and CapitalHillBlue. But your central argument is both vague, and floundering.

To you, apparently, unconventional oil will somehow fill the gap and maintain stasis for complex societies, and/or technology will save the day. But every model provided by international energy monitoring entities (oops, not dogma) shows unconventional oil will represent no more than a tiny fraction of what is needed. More important, technological advances are painfully slow and require substantial investment. But peak is here now.

I'll give you the opportunity to man up and show once more, beyond "where it's always been!"

- If there's plenty of light crude, where is it going forward? What region? In what proven amount? Under land or deep water? How has the oil industry somehow "missed" this enormous new series of fields the past 100 years?

Or have you given up the light crude component of this debate? If you're now just retreating to the tar sands/shale gas/shale oil albatross, please say so. In fact, if you could even flesh out what you even mean overall, after conceding oil is a finite resource, that would be helpful. Hiding behind personal jabs of how dumb everyone is on our side of the fence is doing ZERO for your position here.

Plenty of your allies have tried that already, and ultimately retreated from the forum.

Where is the oil for our 86 million barrel per day appetite? If everything is seamless as your guys insist, that appetite will soon be 95 million, 100 million, 110 million each and every day ... in OUR lifetime. Where is that going to come from?