Brick Gold

Gold Member

- Jan 30, 2022

- 1,234

- 360

- 208

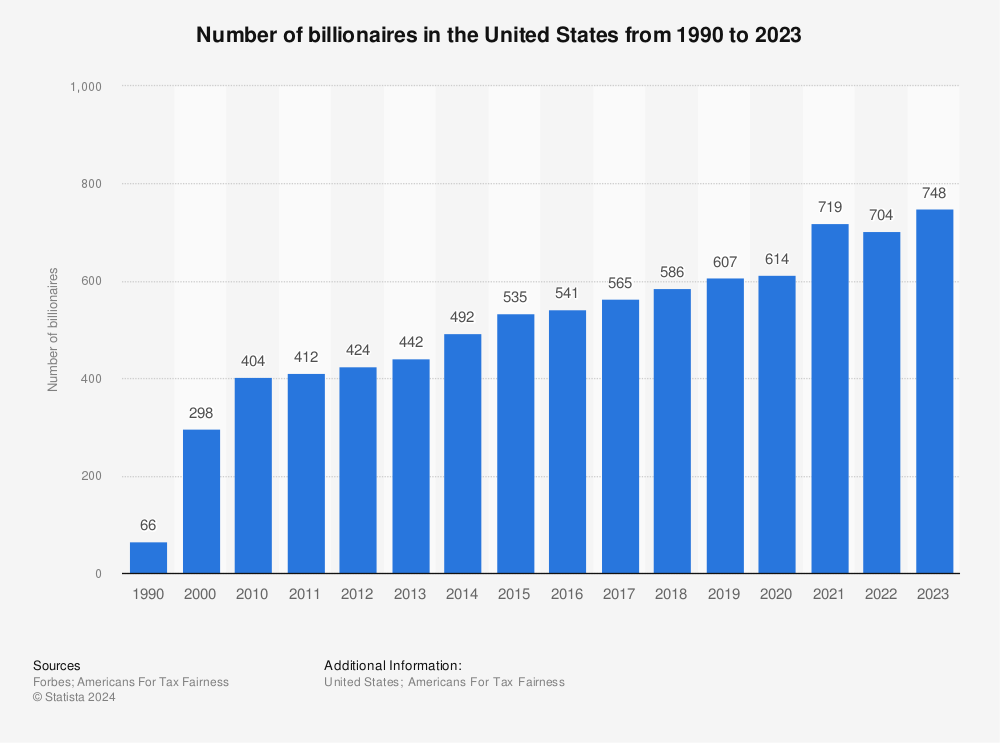

A lot of these hot billionaires are measured by Forbes according to asset value rather than real income, they use terminology such as liquid and equity. Because this value is determined by how well the company is turning business in real time they can gain and lose "billions" of dollars of value in a single day. This seems ridiculous in many ways and points at being a largely imaginary value. So, say a person with a 100 billion dollar company sold off all physical assets and discontinued the brand name, would they truly have 100 billion dollars at the end of it?

You've also got cold billionaires whose wealth isnt tied up in companies riding on trends and new technology to stay on top, their assets are highly stable and at low risk of fluctuating no matter what they do.

How do you measure the unstable largely imaginary wealth against the hardened unfluctuating stable wealth?

You've also got cold billionaires whose wealth isnt tied up in companies riding on trends and new technology to stay on top, their assets are highly stable and at low risk of fluctuating no matter what they do.

How do you measure the unstable largely imaginary wealth against the hardened unfluctuating stable wealth?