Toro

Diamond Member

I have no idea if the Great Fiat Monetary Experiment ends well or not. But what we do know is that the economy and financial markets have been less volatile under the Federal Reserve system than prior to its creation in 1913.

http://economix.blogs.nytimes.com/2014/01/07/200-years-of-american-financial-crises/?_r=2

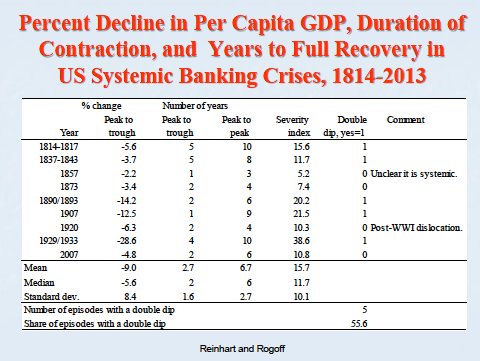

The table below, taking from a presentation Professor Reinhart gave last Friday, shows the track record of the nine systemic financial crises the United States has experienced in the last two centuries. It lists total peak-to-trough decline in per-capita gross domestic product following a systemic financial crisis, the time it takes for a country to snap back to its precrisis peak and whether there was a double-dip recession, among other data points.

http://economix.blogs.nytimes.com/2014/01/07/200-years-of-american-financial-crises/?_r=2