Let me answer for you, you coward: no.

Bankters created a WORLD WIDE CREDIT BUBBLE AND BUST

Jun 16th 2005

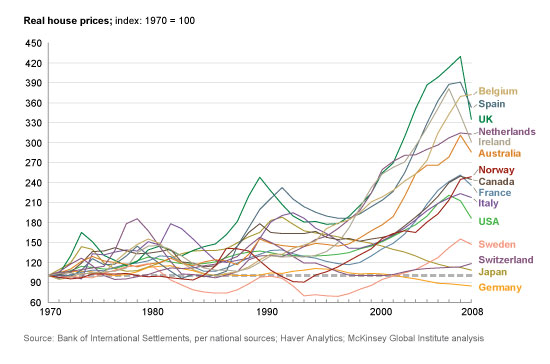

The worldwide rise in house prices is the biggest bubble in history. Prepare for the economic pain when it pops

The global housing boom: In come the waves | The Economist

DUBYA ALLOWED A SUBPRIME BUBBLE TO HAPPEN!!!!

No....bankers must work withing the structure and regulations of the politicians.

That is why the

blame for the mortgage meltdown must be laid squarely at the feet of the Democrats/Liberals/Progressives.

For your edification:

It all

began with Democrat megalomaniac Franklin Roosevelt, who, when not appointing KKK members to the Supreme Court, decided to invade the private economy with the creation of GREs.

You were unable to deny that he did so....but you were afraid to answer whether the meltdown would have occurred sans the efforts of this Democrat.

It would not have.

Too bad FDR would not give due respect to the Constitution.

Now....Democrat debilitation via contemporary efforts......

Take notes:

a. Congress passed a bill in 1975 requiring banks to provide the government with information on their lending activities in poor urban areas. Two years later, it passed the Community Reinvestment Act (CRA), which gave regulators the power to deny banks the right to expand if they didnt lend sufficiently in those neighborhoods. In 1979 the FDIC used the CRA to block a move by the Greater NY Savings Bank for not enough lending.

b. In 1986, when the Association of Community Organizations for Reform Now [Democrat associate] (Acorn)threatened to oppose an acquisition by a southern bank, Louisiana Bancshares, until it agreed to new flexible credit and underwriting standards for minority borrowersfor example, counting public assistance and food stamps as income.

c. In 1987, Acorn led a coalition of advocacy groups calling for industry-wide changes in lending standards. Among the demanded reforms were the easing of minimum down-payment requirements and of the requirement that borrowers have enough cash at a closing to cover two to three months of mortgage payments (research had shown that lack of money in hand was a big reason some mortgages failed quickly).

d. ACORN then attacked Fannie Mae, the giant quasi-government agency that bought loans from banks in order to allow them to make new loans. Its underwriters were strictly by-the-book interpreters of lending standards and turned down purchases of unconventional loans, charged Acorn. The pressure eventually paid off. In 1992, Congress passed legislation requiring Fannie Mae and the similar Freddie Mac to devote 30 percent of their loan purchases to mortgages for low- and moderate-income borrowers.

e.

Clinton Administration housing secretary, Henry Cisneros, declared that he would expand homeownership among lower- and lower-middle-income renters. His strategy: pushing for no-down-payment loans; expanding the size of mortgages that the government would insure against losses; and using the CRA and other lending laws to direct more private money into low-income programs.

f. Shortly after Cisneros announced his plan,

Fannie Mae and Freddie Mac agreed to begin buying loans under new, looser guidelines. Freddie Mac, for instance, started approving low-income buyers with bad credit histories or none at all, so long as they were current on rent and utilities payments. Freddie Mac also said that it would begin counting income from seasonal jobs and public assistance toward its income minimum, despite the FHA disaster of the sixties.

g.

Freddie Mac began an alternative qualifying program with the Sears Mortgage Corporation that let a borrower qualify for a loan with a monthly payment as high as 50 percent of his income, at a time when most private mortgage companies wouldnt exceed 33 percent. The program also

allowed borrowers with bad credit to get mortgages if they took credit-counseling classes administered by Acorn and other nonprofits. Subsequent research would show that such classes have little impact on default rates.

h.

Pressuring nonbank lenders to make more loans to poor minorities [Democrat policy] didnt stop with Sears. If it didnt happen, Clinton officials warned, theyd seek to extend CRA regulations to all mortgage makers. In Congress,

[Democrat] Representative Maxine Waters called financial firms not covered by the CRA among the most egregious redliners.

i. Mortgage Bankers Association (MBA) shocked the financial world by signing a

1994 agreement with the Department of Housing and Urban Development (HUD), pledging to increase lending to minorities and join in new efforts to

rewrite lending standards. The first MBA member to sign up:

[Democrat bagman] Countrywide Financial, the mortgage firm that would be at the core of the subprime meltdown.

j. A 1998 sales pitch by a Bear Stearns managing director advised banks to begin packaging their loans to low-income borrowers into securities that the firm could sell.

Forget traditional underwriting standards [Democrat policy] when considering these loans, the director advised. For a low-income borrower, he continued in all-too-familiar terms, owning a home was a near-sacred obligation. A family will do almost anything to meet that monthly mortgage payment.

Bunk, says Stan Liebowitz, a professor of economics at the University of Texas: The claim that lower-income homeowners are somehow different in their devotion to their home is a purely emotional claim with no evidence to support it.[Democrat policy]

k. Any concern was quickly dismissed. When in early 2000 the FDIC proposed increasing capital requirements for lenders making subprime loans [Republican policy] loans to people with questionable credit, that is

Democratic representative Carolyn Maloney of New York told a congressional hearing that she feared that the step would dry up CRA loans. Her fellow

New York Democrat John J. LaFalce urged regulators not to be premature in imposing new regulations.[Democrat policy]

l. In July 1999, HUD proposed new levels for Fannie Maes and Freddie Macs low-income lending; in September, Fannie Mae agreed to begin purchasing loans made to borrowers with

slightly impaired creditthat is, with credit standards even lower than the government had been pushing for a generation.[Democrat policy]

m. In 2004 Congress pressed new affordable-housing goals on the two mortgage giants, which through 2007 purchased some $1 trillion in loans to lower- and moderate-income buyers. The buying spree helped spark a massive increase in securitization of mortgages to

people with dubious credit.[Democrat policy]

n. In October

1994, Fannie Mae head James Johnson had reminded a banking convention that mortgages with small down payments had

a much higher risk of defaulting. (A Duff & Phelps study found that they were nearly three times more likely to default than conventional mortgages.)

Yet the very next month, Fannie Mae said that it expected to back loans to low-income home buyers with a 97 percent loan-to-value ratio[Democrat policy] that is, loans in which the buyer puts down just 3 percentas part of a commitment, made earlier that year to Congress, to purchase $1 trillion in affordable-housing mortgages by the end of the nineties. According to Edward Pinto, who served as the companys chief credit officer,

the program was the result of political pressure on Fannie Mae trumping lending standards.

[Democrat policy- 'political pressure']

o. In

1992, the Boston Fed produced an extraordinary 29-page document that codified

the new lending wisdom.[Democrat policy]

Conventional mortgage criteria, the report argued, might be unintentionally biased because they didnt take into account

the economic culture of urban, lower-income and nontraditional customers.[Democrat policy]

Lenders should thus consider junking the industrys traditional income-to-payments ratio and

stop viewing an applicants lack of credit history as a negative factor. [Democrat policy]

Further,

if applicants had bad credit, banks should consider extenuating circumstances[Democrat policy]

even though a study by mortgage insurance companies would soon show, not surprisingly, that borrowers with no credit rating or a bad one were far more likely to default. If applicants didnt have enough savings for a down payment, the Boston Fed urged, banks should allow loans from nonprofits or government assistance agencies to count toward one. A later study of Freddie Mac mortgages would find that a borrower who made a down payment with third-party funds was

four times more likely to default, a reminder that traditional underwriting standards werent arbitrary but based on historical lending patterns. [Republican wisdom]

p. The

Congressional Hispanic Caucus launched Hogar in 2003, an initiative that pushed for

easing lending standards [Democrat policy]for immigrants, including touting so-called seller-financed mortgages in which a builder provided down-payment aid to buyers via contributions to nonprofit groups. As a result, mortgage lending to Hispanics soared. And today, in districts where Hispanics make up at least 25 percent of the population, foreclosure rates are now nearly 50 percent higher than the national average, according to a Wall Street Journal analysis.

q.

Republicans and Democrats, meanwhile, have scrambled to reignite the housing market through ill-conceived tax credits and renewed

federal subsidies for mortgages, including the Obama administrations mortgage bailout plan, which recalls the New Deals HOLC. [Democrat policy]

Behind these efforts is

a fundamental misconception among politicians [Democrat policy]that housing drives the American economy and therefore demands subsidy at virtually any cost. Our praiseworthy initial efforts

to eliminate housing discrimination and provide all Americans an equal opportunity to buy a home[Democrat policy]were eventually turned on their heads by advocates and politicians, who instead tried to

ensure equality of outcomes.[Democrat policy]

Obsessive Housing Disorder by Steven Malanga, City Journal Spring 2009

Timeline shows Dems were warned:

[ame=http://www.youtube.com/watch?v=cMnSp4qEXNM]Timeline shows Bush, McCain warning Dems of financial and housing crisis; meltdown - YouTube[/ame]

During the seventies and eighties, CRA enforcement was perfunctory. Regulators asked banks to demonstrate that they were trying to reach their entire "assessment area" by advertising in minority-oriented newspapers or by sending their executives to serve on the boards of local community groups.

The [Democrat] Clinton administration changed this state of affairs dramatically. Ignoring the sweeping transformation of the banking industry since the CRA was passed, the Clinton Treasury Department's 1995 regulations made getting a satisfactory CRA rating much harder. [/B

]The new regulations de-emphasized subjective assessment measures in favor of strictly numerical ones. Bank examiners would use federal home-loan data, broken down by neighborhood, income group, and race, to rate banks on performance. There would be no more A's for effort. Only resultsspecific loans, specific levels of servicewould count. Where and to whom have home loans been made? Have banks invested in all neighborhoods within their assessment area? Do they operate branches in those neighborhoods?

The Trillion-Dollar Bank Shakedown That Bodes Ill for Cities by Howard Husock, City Journal Winter 2000