MaggieMae

Reality bits

- Apr 3, 2009

- 24,043

- 1,635

- 48

Big Oil Goes Green for Real

By Rana Foroohar | NEWSWEEK

Published Sep 19, 2009

From the magazine issue dated Sep 28, 2009

Remember back in 2001 when BP went "Beyond Petroleum"? It was a brilliant marketing campaign, but it had less to do with changing the company's business model than positioning Lord John Browne as the Teflon oil executive. All but a tiny fraction of BP's revenue came, and still comes, from oil. So how should we take the spate of new green announcements from the world's major oil firms? In July, ExxonMobil announced big plans to grow green algae to fuel cars; last week, Chevron unveiled the world's largest carbon-sequestration project in Australia; and in recent months, Valero, Marathon, and Sunoco carried out a series of acquisitions that resulted in Big Oil controlling 7 percent of the U.S. ethanol business.

The list goes on. And this time it's the real deal. It's not just that these projects involve bigger money, which will grow exponentially if new technologies work. That's still peanuts for oil majors, which put only 4 percent of their total 2008 profits into alternative-energy investment. It's that companies are actually beginning to think about alternatives not just as a tool for greenwashing (throw up a few solar panels here, sponsor a conference on wind energy there) but as real businesses that might one day turn real profitsor at least help make fossil-fuel production more profitable. The catalyst is that governments are moving to force industry to cut carbon emissions, creating a new "long-term regulatory reality" that favors alternative energy, says PFC Energy chairman J. Robinson West. Meanwhile, President Obama's green-stimulus efforts and China's massive investment in alternatives have created a serious market for green technologies.

The fact that nations like Russia and Venezuela are pushing out big oil companies also gives CEOs an incentive to consider green alternatives. So does the fact that oil companies are among the world's biggest energy users, and will ultimately need to offset emissions. "I believe the large integrated oil firms will eventually become major playersperhaps even the dominant playersin alternative energy," says Don Paul, a former Chevron executive who now runs the University of Southern California's Energy Institute.

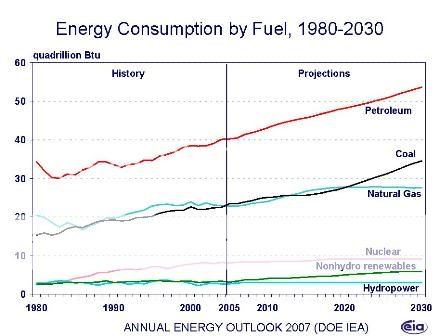

This doesn't mean that wind and solar, which currently provide less than 1 percent of the world's primary energy, will replace fossil fuels, which provide 82 percent. In fact, while companies like BP and Shell are cutting back on commercial projects in wind and solar, Big Oil is taking a closer look at how they might be used to increase efficiency internally, or to free up increasingly profitable fossil fuels, like natural gas, for commercial sale. For example, Valero is building windmills to power refineries, and Chevron is using solar power to make steam to extract tough-to-reach oil. When you consider that the top 15 oil and gas companies have a market capitalization of $1.9 trillion, it's clear that these firms themselves have the potential to be major renewable customers.

Oil companies are also taking a harder look at how to make their own business models work in the alternative sector. Paul notes that Big Oil's key assetsgiant pipes, huge swaths of land with existing industrial-use permits, geo-engineering expertise, and extremely deep pocketsare "tailor-made for developing and delivering biofuels." Hence ExxonMobil's $600 million research foray into car fuel made from pond scum, and Shell's decision to freeze all other investment in renewables to focus on biofuels. Likewise, companies like Chevron are capitalizing on geological expertise to build large geothermal businesses.

Big Oil is going to be an increasingly important investor in alternative energy. Venture-capital money has dried up. But with oil at $70 a barrel, the internal venture arms of the major oil firms are increasing the amount and percentage of investment going to alternatives. Historically, when Big Oil spends a dollar on research, it will spend many hundreds more to bring a product to market. If the new projects coming online this summer are any indicator, alternatives may soon be awash in black gold.

Find this article at

Big Oil Goes Green | Newsweek Environment | Newsweek.com

By Rana Foroohar | NEWSWEEK

Published Sep 19, 2009

From the magazine issue dated Sep 28, 2009

Remember back in 2001 when BP went "Beyond Petroleum"? It was a brilliant marketing campaign, but it had less to do with changing the company's business model than positioning Lord John Browne as the Teflon oil executive. All but a tiny fraction of BP's revenue came, and still comes, from oil. So how should we take the spate of new green announcements from the world's major oil firms? In July, ExxonMobil announced big plans to grow green algae to fuel cars; last week, Chevron unveiled the world's largest carbon-sequestration project in Australia; and in recent months, Valero, Marathon, and Sunoco carried out a series of acquisitions that resulted in Big Oil controlling 7 percent of the U.S. ethanol business.

The list goes on. And this time it's the real deal. It's not just that these projects involve bigger money, which will grow exponentially if new technologies work. That's still peanuts for oil majors, which put only 4 percent of their total 2008 profits into alternative-energy investment. It's that companies are actually beginning to think about alternatives not just as a tool for greenwashing (throw up a few solar panels here, sponsor a conference on wind energy there) but as real businesses that might one day turn real profitsor at least help make fossil-fuel production more profitable. The catalyst is that governments are moving to force industry to cut carbon emissions, creating a new "long-term regulatory reality" that favors alternative energy, says PFC Energy chairman J. Robinson West. Meanwhile, President Obama's green-stimulus efforts and China's massive investment in alternatives have created a serious market for green technologies.

The fact that nations like Russia and Venezuela are pushing out big oil companies also gives CEOs an incentive to consider green alternatives. So does the fact that oil companies are among the world's biggest energy users, and will ultimately need to offset emissions. "I believe the large integrated oil firms will eventually become major playersperhaps even the dominant playersin alternative energy," says Don Paul, a former Chevron executive who now runs the University of Southern California's Energy Institute.

This doesn't mean that wind and solar, which currently provide less than 1 percent of the world's primary energy, will replace fossil fuels, which provide 82 percent. In fact, while companies like BP and Shell are cutting back on commercial projects in wind and solar, Big Oil is taking a closer look at how they might be used to increase efficiency internally, or to free up increasingly profitable fossil fuels, like natural gas, for commercial sale. For example, Valero is building windmills to power refineries, and Chevron is using solar power to make steam to extract tough-to-reach oil. When you consider that the top 15 oil and gas companies have a market capitalization of $1.9 trillion, it's clear that these firms themselves have the potential to be major renewable customers.

Oil companies are also taking a harder look at how to make their own business models work in the alternative sector. Paul notes that Big Oil's key assetsgiant pipes, huge swaths of land with existing industrial-use permits, geo-engineering expertise, and extremely deep pocketsare "tailor-made for developing and delivering biofuels." Hence ExxonMobil's $600 million research foray into car fuel made from pond scum, and Shell's decision to freeze all other investment in renewables to focus on biofuels. Likewise, companies like Chevron are capitalizing on geological expertise to build large geothermal businesses.

Big Oil is going to be an increasingly important investor in alternative energy. Venture-capital money has dried up. But with oil at $70 a barrel, the internal venture arms of the major oil firms are increasing the amount and percentage of investment going to alternatives. Historically, when Big Oil spends a dollar on research, it will spend many hundreds more to bring a product to market. If the new projects coming online this summer are any indicator, alternatives may soon be awash in black gold.

Find this article at

Big Oil Goes Green | Newsweek Environment | Newsweek.com