excalibur

Diamond Member

- Mar 19, 2015

- 22,749

- 44,305

- 2,290

Biden and the leftoids of the world have in short order made a mess of everything. Ukraine is a distraction from what is really going on.

“Farming looks mighty easy when your plow is a pencil and you're a thousand miles from the corn field.” – Dwight D. Eisenhower

doomberg.substack.com

doomberg.substack.com

“Farming looks mighty easy when your plow is a pencil and you're a thousand miles from the corn field.” – Dwight D. Eisenhower

... The coming crash in global food supply will be driven by a similar phenomenon across virtually every input into farming – they are all spiking to historic highs simultaneously, supply availability is diminishing across the spectrum, and the time to reverse the worst of the upcoming consequences is rapidly running short.

Other than that, things are great.

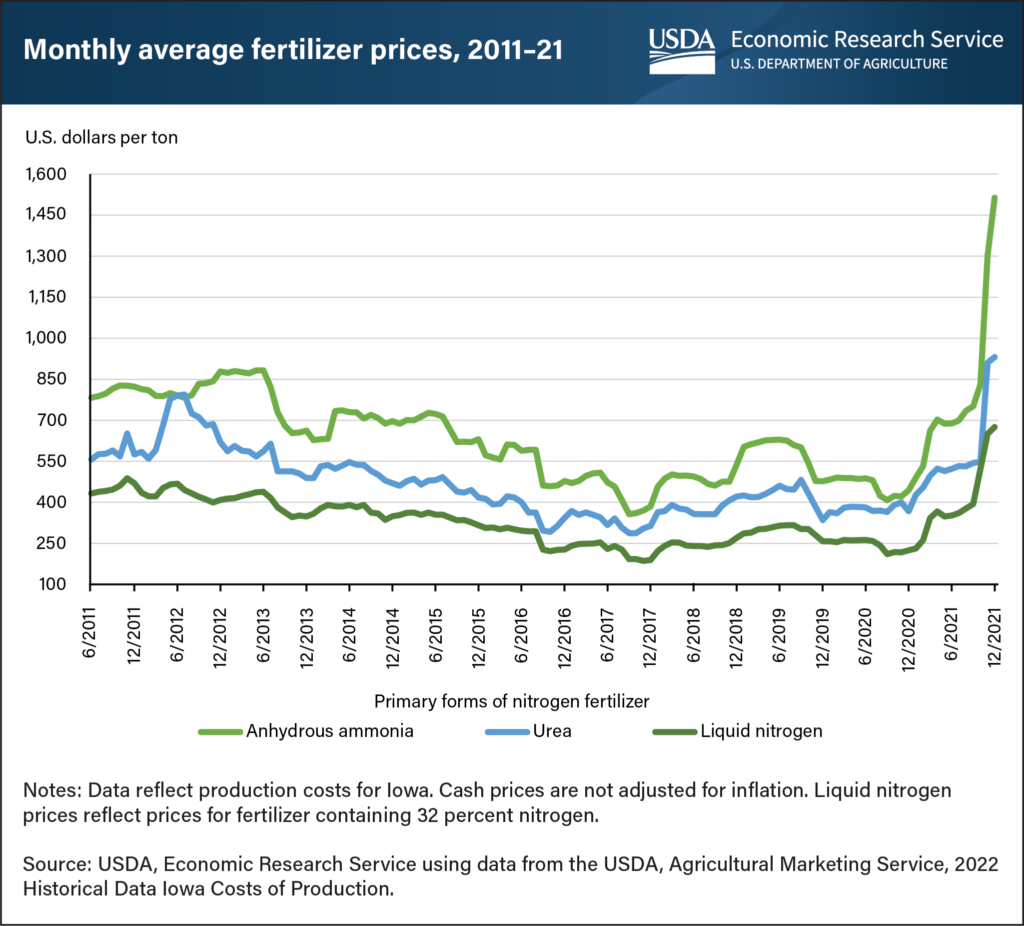

We begin with the price of fertilizer, which has been soaring to record highs across the globe. Key sources of nitrogen, potassium, and phosphorous – important inputs into soil fertility, crop yield, and plant maintenance – have all gone vertical. Ammonia is derived directly from natural gas, and the price of natural gas outside of the US has gone vertical. It's no surprise that the price of ammonia has tripled over the past twelve months. Belarus is the third-largest supplier of potash in the world and its state-owned miner, Belaruskali, declared force majeure after sanctions were imposed by the US and Europe. The number two supplier of potash globally? Russia. Perhaps front-running the Russian move on Ukraine, China halted phosphate exports last fall in an effort to ensure adequate domestic supply. The combined impact of these events can be seen in the green Markets North American Fertilize Index, which tracks a blend of fertilizer prices globally:

...

Glyphosate is effectively little more than an elegantly modified fertilizer, containing both phosphorous and nitrogen. It is derived from similar starting materials – including ammonia – and, as such, its price has soared amid chronic supply shortages. This has caused the price of other herbicides to rise as farmers desperately seek substitutes, as described by this article in The Western Producer (emphasis added throughout):

If farmers skimp on herbicides to get by this season, it only makes dealing with weeds more challenging in the future. As one expert warned us, it only takes one year of negligence to do several years of damage to a field.

If farmers skimp on herbicides to get by this season, it only makes dealing with weeds more challenging in the future. As one expert warned us, it only takes one year of negligence to do several years of damage to a field.

Diesel is another significant input into farming, and it too is facing a global supply crunch. Javier Blas, an energy and commodities columnist at Bloomberg whose Twitter account is an absolute must-follow, recently published an editorial sounding the alarm:

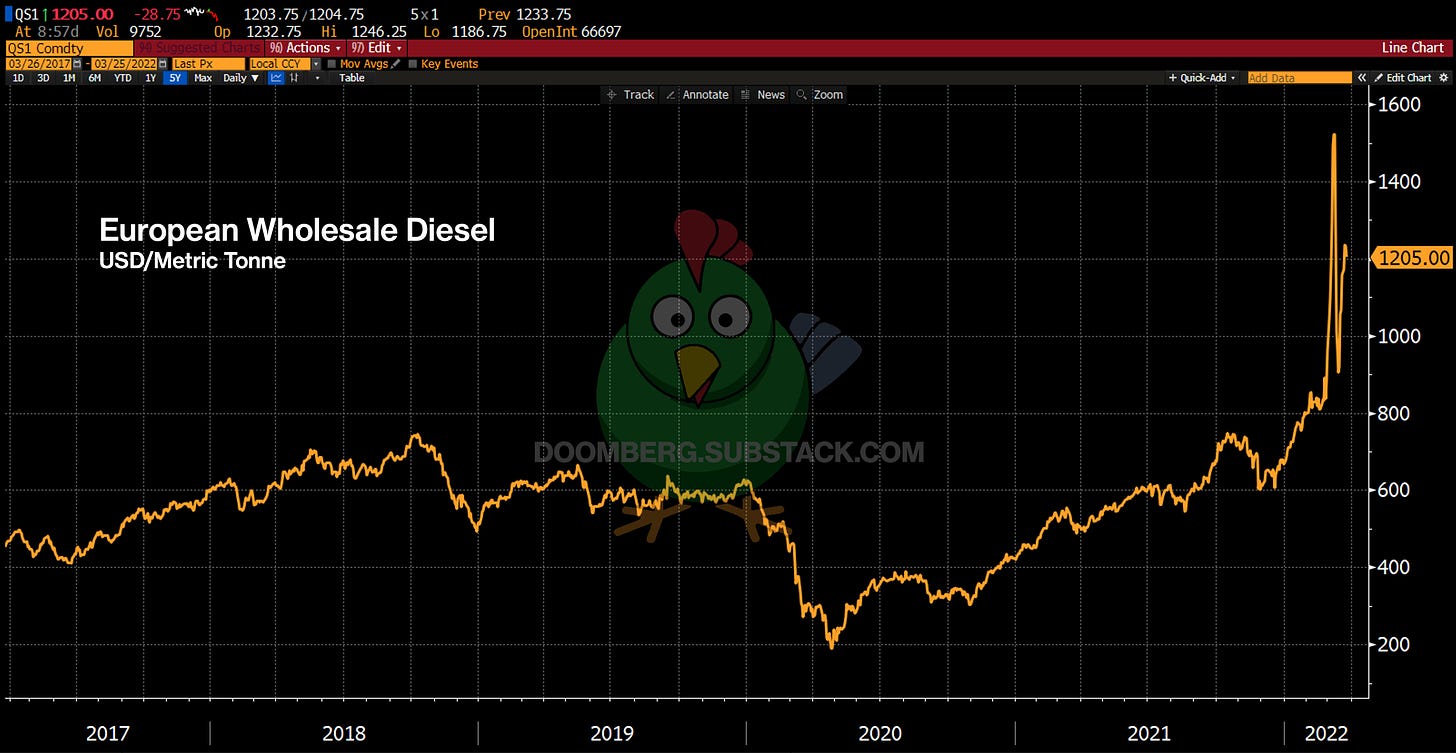

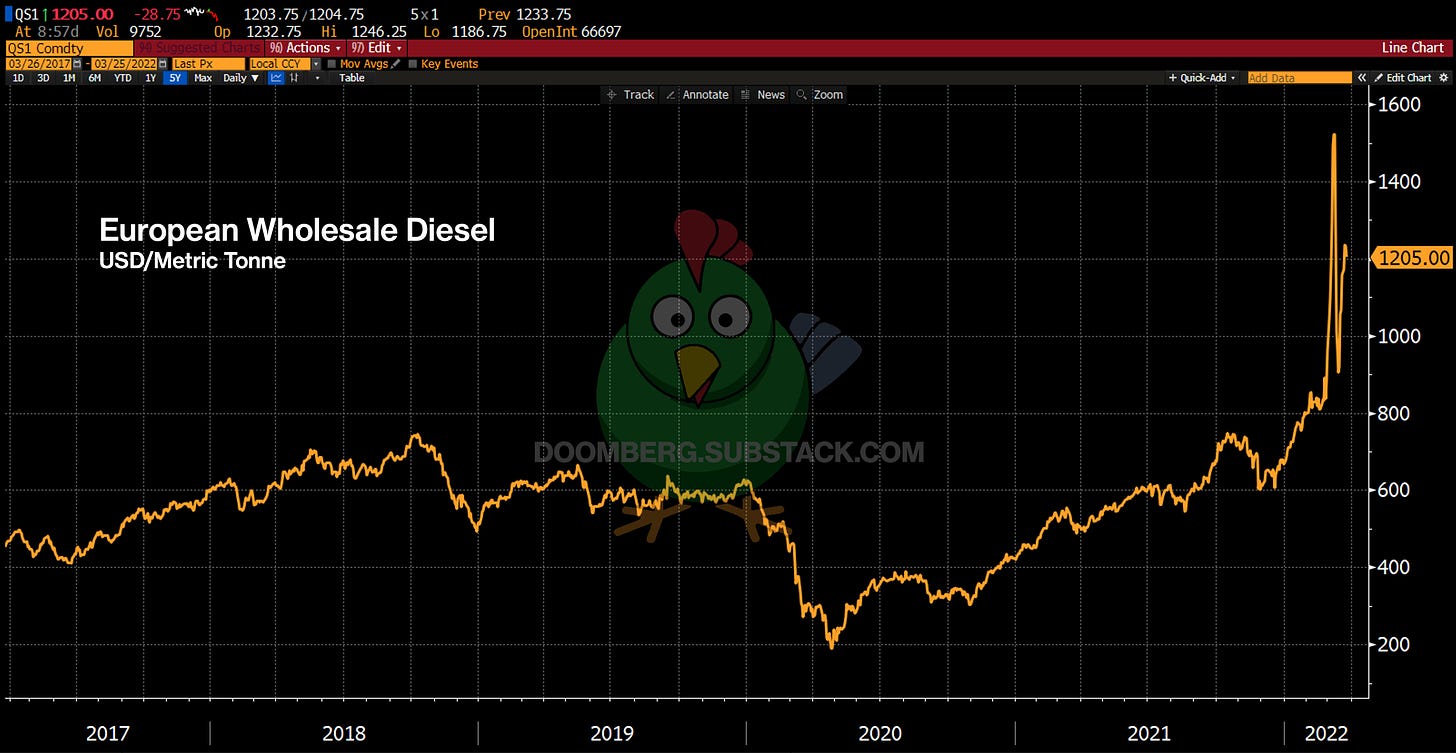

Once again, we discover the vital role natural gas plays in many downstream verticals, a key theme of many Doomberg pieces. With inventories at record lows and supplies constrained, the retail price of diesel in the US smashed previous record highs. In Europe, which depends heavily on Russian imports for both diesel and its semi-processed oil precursor, the wholesale market is on the verge of breaking. Here’s an updated version of the chart in Blas’ editorial:

...

Other than that, things are great.

We begin with the price of fertilizer, which has been soaring to record highs across the globe. Key sources of nitrogen, potassium, and phosphorous – important inputs into soil fertility, crop yield, and plant maintenance – have all gone vertical. Ammonia is derived directly from natural gas, and the price of natural gas outside of the US has gone vertical. It's no surprise that the price of ammonia has tripled over the past twelve months. Belarus is the third-largest supplier of potash in the world and its state-owned miner, Belaruskali, declared force majeure after sanctions were imposed by the US and Europe. The number two supplier of potash globally? Russia. Perhaps front-running the Russian move on Ukraine, China halted phosphate exports last fall in an effort to ensure adequate domestic supply. The combined impact of these events can be seen in the green Markets North American Fertilize Index, which tracks a blend of fertilizer prices globally:

...

Glyphosate is effectively little more than an elegantly modified fertilizer, containing both phosphorous and nitrogen. It is derived from similar starting materials – including ammonia – and, as such, its price has soared amid chronic supply shortages. This has caused the price of other herbicides to rise as farmers desperately seek substitutes, as described by this article in The Western Producer (emphasis added throughout):

“The much-ballyhooed glyphosate shortage is just the first domino to fall, according to a leading crop protection company.

‘The knock-on effect on basically every other herbicide molecule is starting to manifest itself,’ said Cornie Thiessen, general manager of ADAMA Canada. ‘We are seeing quite a domino effect in the market because of the glyphosate challenges.’

Bayer was already warning customers in late 2021 about a potential glyphosate shortage.”

If farmers skimp on herbicides to get by this season, it only makes dealing with weeds more challenging in the future. As one expert warned us, it only takes one year of negligence to do several years of damage to a field.

If farmers skimp on herbicides to get by this season, it only makes dealing with weeds more challenging in the future. As one expert warned us, it only takes one year of negligence to do several years of damage to a field.

Diesel is another significant input into farming, and it too is facing a global supply crunch. Javier Blas, an energy and commodities columnist at Bloomberg whose Twitter account is an absolute must-follow, recently published an editorial sounding the alarm:

“The dire diesel supply situation predates the Russian invasion of Ukraine. While global oil demand hasn’t yet reached its pre-pandemic level, global diesel consumption surged to a fresh all-time high in the fourth quarter of 2021. The boom reflects the lopsided Covid economic recovery, with transportation demand spiking to ease supply-chain messes.

European refineries have struggled to match this revival in demand. One key reason is pricey natural gas. Refineries use gas to produce hydrogen, which they then use to remove sulphur from diesel. The spike in gas prices in late 2021 made that process prohibitively expensive, cutting diesel output.”

Once again, we discover the vital role natural gas plays in many downstream verticals, a key theme of many Doomberg pieces. With inventories at record lows and supplies constrained, the retail price of diesel in the US smashed previous record highs. In Europe, which depends heavily on Russian imports for both diesel and its semi-processed oil precursor, the wholesale market is on the verge of breaking. Here’s an updated version of the chart in Blas’ editorial:

...

Farmers on the Brink

We are at the onset of a global famine of historic proportions.