Quantum Windbag

Gold Member

- May 9, 2010

- 58,308

- 5,106

- 245

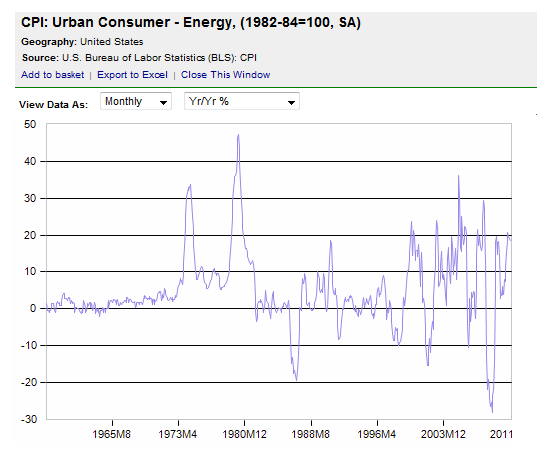

They are inflationary. QEI and II have increased the money supply and driven up the cost of commodities.

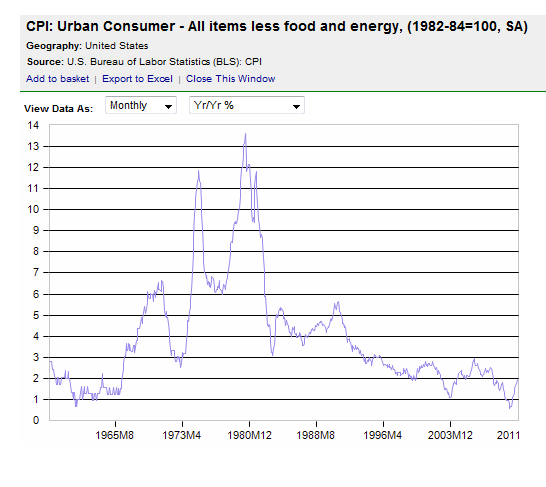

a little Econ 101 for you. Inflation is the cost of everything, not the cost of commodities. Some stuff has gone up and some stuff, like houses, has gone down so there has been little inflation. Sorry. Plus Bernanke did some huge huge stuff to avoid a huge depression; he still may go down as the best central banker of all time.

How does that invalidate my statement?

Increasing the money supply is inflationary. The fact that there is massive deflation going on at the same time through most of the economy does not change the fact that devaluing the dollar increases prices.

Last edited: