JimBowie1958

Old Fogey

- Sep 25, 2011

- 63,590

- 16,753

- 2,220

There is a lot of inaccurate repeated information about COVID19, and some of it is done knowingly for partisan reasons, and some of it is done to reduce panic.

1) The Trump supporters need to raise the threshold of expectations for more deaths from this comparable to Europe with a one month time lag to serve their President well. They should not lower expectations regarding the lethality of COVID19 which will make the e3ventual death count look much worse for Trump when it finally gets here. I think the standard of measure for Trump should be something like comparing his effectiveness to that of the European union which is about the only other large democratic capitalist region comparable to the USA.

That makes Trump look like a genius and Republicans should go to it and stick like Super Epoxy Resin.

2) There have been four ranges of plausible outcome from COVID19 discussed since midJanuary.

a. Optimistic case - COVID19 gets contained to China. Well that didnt happen.

b. Achievable, but still hopeful - The worst of it is contained to the Far East. Nope, thank you EU.

c. Worst case - COVID19 spreads, but enough time was made to brace public health services for the full impact. Well, that is not happening either, thanks to Globalists controlling the EU.

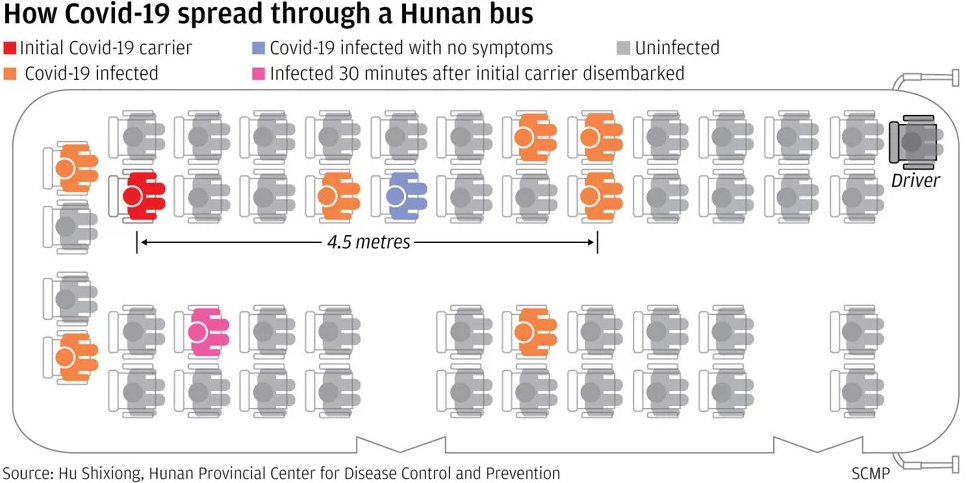

d. Unthinkable case - COVID19 is uncontainable due to persistence in airbourne vectors (15 feet for more than 30 minutes) and long lasting dry surface conditions (9 days), and it spreads to pretty much all nations and impacts global trade by shutting down commerce in large blocks of countries.

We are clearly hitting the Unthinkable range of events.

Chinese scientists identify two strains of the coronavirus, indicating it's already mutated at least once

3) The public health reaction impact is the exact opposite effect for global trade. The more that we restrict commerce and travel, the more we can contain the virus, but the worse it is for trade and the Global economy.

Eventually far left and also theocratic governments that are inherently incompetent will chose to let the disease spread and get a twofer; more Global trade (and more taxes from it) and fewer seniors (and reduced health care burdens from that).

4) The USA needs to bring back its production of medical supplies, from masks to antibiotics to other pharmaceuticals in general. The Chicoms have already threatened to cut us off from 90% of all virus treatment medicines and anti-biotics. Why let that situation continue?

5) COVID19 is not influenza. It has a lipid layer that protects the core DNA/RNA of the virus allowing it to survive where most influenza would not, and it is much more lethal than the flu. We are not tanking the global economy to stop the freaking flu, so stop looking stupid by saying that.

The Full Impact Of Raging Covid-19 Has Yet To Show Its Face

1) The Trump supporters need to raise the threshold of expectations for more deaths from this comparable to Europe with a one month time lag to serve their President well. They should not lower expectations regarding the lethality of COVID19 which will make the e3ventual death count look much worse for Trump when it finally gets here. I think the standard of measure for Trump should be something like comparing his effectiveness to that of the European union which is about the only other large democratic capitalist region comparable to the USA.

That makes Trump look like a genius and Republicans should go to it and stick like Super Epoxy Resin.

2) There have been four ranges of plausible outcome from COVID19 discussed since midJanuary.

a. Optimistic case - COVID19 gets contained to China. Well that didnt happen.

b. Achievable, but still hopeful - The worst of it is contained to the Far East. Nope, thank you EU.

c. Worst case - COVID19 spreads, but enough time was made to brace public health services for the full impact. Well, that is not happening either, thanks to Globalists controlling the EU.

d. Unthinkable case - COVID19 is uncontainable due to persistence in airbourne vectors (15 feet for more than 30 minutes) and long lasting dry surface conditions (9 days), and it spreads to pretty much all nations and impacts global trade by shutting down commerce in large blocks of countries.

We are clearly hitting the Unthinkable range of events.

Chinese scientists identify two strains of the coronavirus, indicating it's already mutated at least once

Chinese scientists identify two strains of the coronavirus, indicating it’s already mutated at least once

3) The public health reaction impact is the exact opposite effect for global trade. The more that we restrict commerce and travel, the more we can contain the virus, but the worse it is for trade and the Global economy.

Eventually far left and also theocratic governments that are inherently incompetent will chose to let the disease spread and get a twofer; more Global trade (and more taxes from it) and fewer seniors (and reduced health care burdens from that).

4) The USA needs to bring back its production of medical supplies, from masks to antibiotics to other pharmaceuticals in general. The Chicoms have already threatened to cut us off from 90% of all virus treatment medicines and anti-biotics. Why let that situation continue?

5) COVID19 is not influenza. It has a lipid layer that protects the core DNA/RNA of the virus allowing it to survive where most influenza would not, and it is much more lethal than the flu. We are not tanking the global economy to stop the freaking flu, so stop looking stupid by saying that.

The Full Impact Of Raging Covid-19 Has Yet To Show Its Face

An article in the South China Morning Post reports scientists said in a recent paper that this new virus uses an outreaching spike protein to hook on to the host cell. Normally this protein is inactive. This finding suggests that 2019-nCoV [the new coronavirus] may be significantly different from the Sars coronavirus in the infection pathway it employs. Compared to the Sars’ way of entry, this binding method is “100 to 1,000 times” as efficient, according to the study. Just two weeks after its release, the paper has already become the most viewed ever on Chinaxiv.org, a platform used by the Chinese Academy of Sciences to release scientific research papers before they have been peer-reviewed.

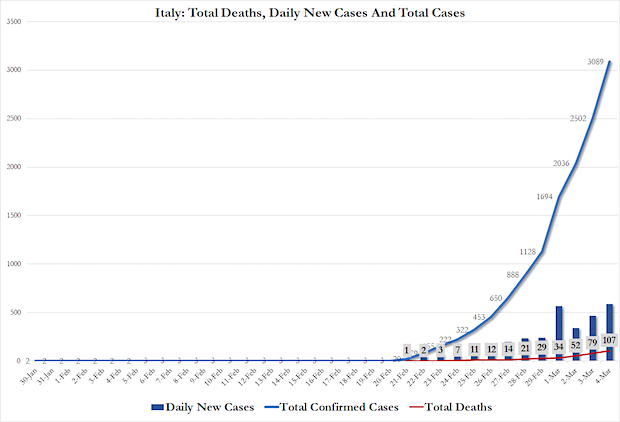

It is important to acknowledge that propaganda has gone full tilt and China's Communist Party is not telling the truth. An article that explores "group-think" in China today delves into how decades have created a society conditioned to be manipulated. China is busy playing the long game and now pointing at other countries as having caused this and the World Health Organization (WHO) is in their pocket. The bottom-line is that a lot more testing is needed from open and honest countries before the truth. Sadly, when it comes to this Japan may even be unreliable because it has so much resting upon the upcoming Impolitic games. Italy and South Korea currently may be the best place to see how nasty things really get.

It is important to acknowledge that propaganda has gone full tilt and China's Communist Party is not telling the truth. An article that explores "group-think" in China today delves into how decades have created a society conditioned to be manipulated. China is busy playing the long game and now pointing at other countries as having caused this and the World Health Organization (WHO) is in their pocket. The bottom-line is that a lot more testing is needed from open and honest countries before the truth. Sadly, when it comes to this Japan may even be unreliable because it has so much resting upon the upcoming Impolitic games. Italy and South Korea currently may be the best place to see how nasty things really get.

Last edited: