Dad2three

Gold Member

I said "That the Democrats are the provenance of the problem.....and the bar to the solution."

And your post pertained to that......how?

Ahhhhh, the perpetual dumb act!!!

My post unassailably, as exposed by your dumb act, put the lie to your claim that the powerless Dems were the problem by showing that the GOP blocked every bill in the committees they controlled.

Of course it did no such thing.

They blocked every attempt at resolution.

And more to the point...."I said "That the Democrats are the provenance of the problem.....and the bar to the solution."

And you have tap-danced as though on hot coals.

I suspect you realize your position is built on lies.

Perhaps you'd care to answer what Dot Coma would not, could not:

If Democrat policy, beginning with Franklin Roosevelt, to ignore the Constitution, and involve government in the private market, had not taken place.....

....would there have been a mortgage meltdown?

Or....return to the tap-dancing.

If Democrat policy, beginning with Franklin Roosevelt, to ignore the Constitution, and involve government in the private market, had not taken place.....

....would there have been a mortgage meltdown?

GSE'S WERE AROUND FOR 70 YEARS, WHAT HAPPENED? Every USA Prez had a housing push, ONLY Reagan ignored the S&L regulator (Mr Gray) in 1984 AND Dubya did the same in 2004, actually doing MUCH more!

Right-wingers Want To Erase How George Bush's "Homeowner Society" Helped Cause The Economic Collapse

2004 Republican Convention:

Another priority for a new term is to build an ownership society, because ownership brings security and dignity and independence.

...

Thanks to our policies, home ownership in America is at an all- time high.

(APPLAUSE)

Tonight we set a new goal: 7 million more affordable homes in the next 10 years, so more American families will be able to open the door and say, "Welcome to my home."

FACTS on Dubya's great recession

Q When did the Bush Mortgage Bubble start?

A The general timeframe is it started late 2004.

From Bush’s President’s Working Group on Financial Markets October 2008

“The Presidents Working Group’s March policy statement acknowledged that turmoil in financial markets clearly was triggered by a dramatic weakening of underwriting standards for U.S. subprime mortgages, beginning in late 2004 and extending into 2007.”

Q Did the Community Reinvestment Act under Carter/Clinton caused it?

A "Since 1995 there has been essentially no change in the basic CRA rules or enforcement process that can be reasonably linked to the subprime lending activity. This fact weakens the link between the CRA and the current crisis since the crisis is rooted in poor performance of mortgage loans made between 2004 and 2007. "

http://www.federalreserve.gov/newsevents/speech/20081203_analysis.pdf

Q Why would Bush’s regulators let banks lower their lending standards?

A. Federal regulators at the Office of the Comptroller of the Currency (OCC) and the Office of Thrift Supervision work for Bush and he was pushing his “Ownership Society” programs that was a major and successful part of his re election campaign in 2004. And Bush’s regulators not only let banks do this, they attacked state regulators trying to do their jobs. Bush’s documented policies and statements in timeframe leading up to the start of the Bush Mortgage Bubble include (but not limited to)

Wanting 5.5 million more minority homeowners

Tells congress there is nothing wrong with GSEs

Pledging to use federal policy to increase home ownership

Routinely taking credit for the housing market

Forcing GSEs to buy more low income home loans by raising their Housing Goals

Lowering Invesntment bank’s capital requirements, Net Capital rule

Reversing the Clinton rule that restricted GSEs purchases of subprime loans

Lowering down payment requirements to 0%

Forcing GSEs to spend an additional $440 billion in the secondary markets

Giving away 40,000 free down payments

PREEMPTING ALL STATE LAWS AGAINST PREDATORY LENDING

But the biggest policy was regulators not enforcing lending standards.

http://www.usmessageboard.com/economy/362889-facts-on-dubya-s-great-recession.html

Examining the big lie: How the facts of the economic crisis stack up

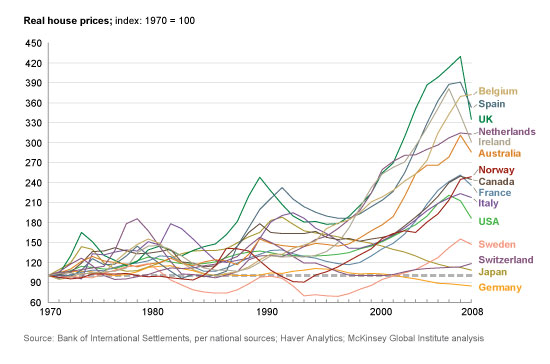

•The boom and bust was global. Proponents of the Big Lie ignore the worldwide nature of the housing boom and bust.

•Nonbank mortgage underwriting exploded from 2001 to 2007, along with the private label securitization market, which eclipsed Fannie and Freddie during the boom.

Private lenders not subject to congressional regulations collapsed lending standards.

http://www.ritholtz.com/blog/2011/1...ow-the-facts-of-the-economic-crisis-stack-up/

Last edited:

2008. Thats what happens when Repubs *cough* "man" the SEC

2008. Thats what happens when Repubs *cough* "man" the SEC  They hand "the keys to the store" to those they're supposed to be regulating

They hand "the keys to the store" to those they're supposed to be regulating

[MENTION=12394]PoliticalChic[/MENTION]

[MENTION=12394]PoliticalChic[/MENTION]