I’m still trying to understand how Obama managed to increase our national debt over 100% while depleting our military and doing absolutely nothing to improve our infrastructure.

Shovel trillions to Unions and government workers and that was supposed to "trickle down' to us through the magic of the "Keynesian Multiplier".

- Deficits do not represent new money injected into the economy.

The economic models that assert that every $1 of deficit spending grows the economy by $1.50 cannot explain why $1 trillion in deficit spending did not create a $1.5 trillion explosion of new economic activity.

These folks claim that Congress can "inject" new money into the economy, increasing demand and therefore production. This raises the obvious question: From where does the government acquire the money it pumps into the economy? Congress does not have a vault of money waiting to be distributed. Every dollar Congress injects

into the economy must first be taxed or borrowed

out of the economy. No new spending power is created. It is merely redistributed from one group of people to another.

Congress cannot create new purchasing power out of thin air.

- If it funds new spending with taxes, it is simply redistributing existing purchasing power.

- If Congress instead borrows the money from domestic investors, those investors will have that much less to invest or to spend in the private economy.

- If they borrow the money from foreigners, the balance of payments will adjust by equally raising net imports, leaving total demand and output unchanged.

Every dollar Congress spends must first come from somewhere else.

For example, many lawmakers claim that every $1 billion in highway stimulus can create 47,576 new construction jobs. But Congress must first borrow that $1 billion from the private economy, which will then

lose at least as many jobs. Highway spending simply transfers jobs and income from one part of the economy to another. The only way that $1 billion of new highway spending can create 47,576 new jobs is if the $1 billion appears out of nowhere as if it were manna from heaven.

Removing water from one end of a swimming pool and pouring it in the other end will not raise the overall water level. Similarly, taking dollars from one part of the economy and distributing it to another part of the economy will not expand the economy.

MV = PQ

- M stands for money.

- V stands for the velocity of money (or the rate at which people spend money).

- P stands for the general price level.

- Q stands for the quantity of goods and services produced.

Very low interest rates have been slowing money velocity.

Money Supply * Money Velocity = Nominal GDP

So even if they stimulate money supply, if Velocity falls, GDP still flounders:

As you can see, we still have a ton of available upside here, despite some early improvement under Trump.

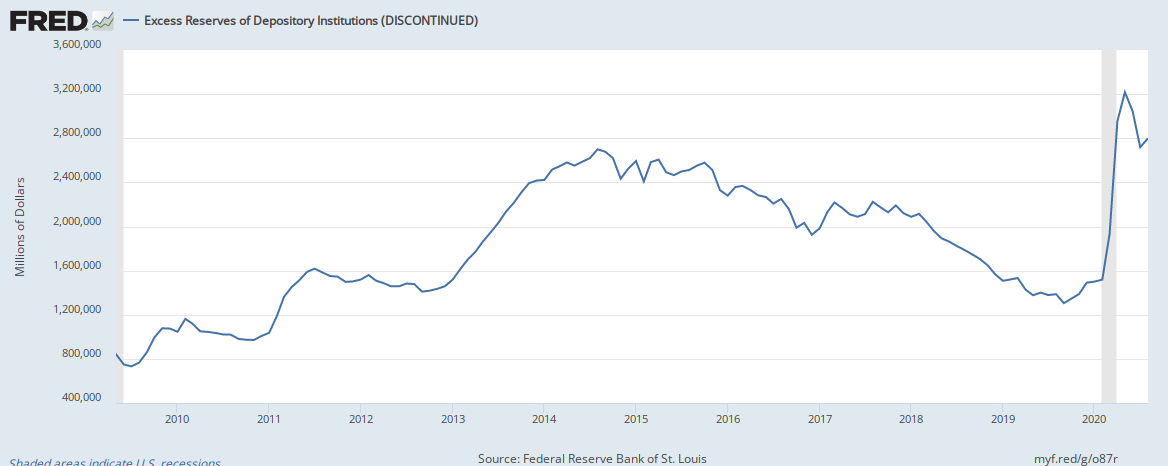

So where did all that money go that was piped into the US economy under Obama? Remember when the "multiplier" didn't manifest and we heard that Americans were hoarding rather than spending? Well, I checked savings rates and no cigar. Then I checked excess reserves at our deposit institutions and bingo!

From $732,000M (or $732B) in 2009, all the way up to $2,700,000M (or $2.7T) just 5 year later.

So why are our deposit institutions sitting on these $Trillions? Well, they are required to keep particular amounts on deposit with the Fed. Excess Reserves are those amounts in excess of deposit requirements. Prior to 2008, the Fed did not pay interest on those deposits, so in order to gain interest, these institutions had to put these funds at risk. Since 2008, that is no longer the case. Now the Fed pays interest on those deposits, so banks can park their money for periods until they find a better investment or lending opportunity.

So how does the Fed increase the fed funds rate? By raising the interest rate it pays on reserves.

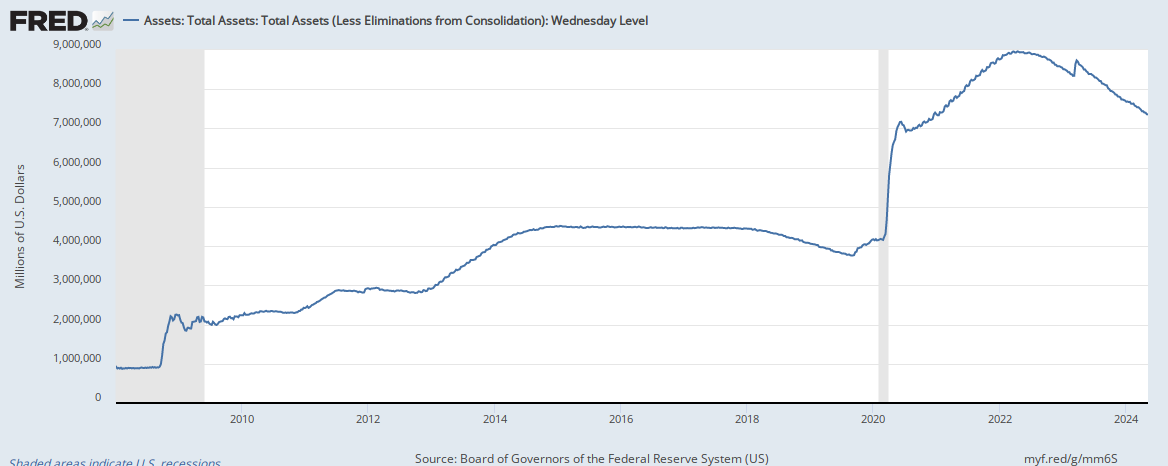

So yes $T was pumped as liquidity into US economy, but a large fraction was put on the Fed Balance sheet.