I believe you need to try again. Yes, the tax system in the United States is regressive in the sense that the ultra-wealthy pay a lower percentage of their income in taxes than the moderately wealthy, and in some cases, even the middle class. John Kerry and Mitt Romney consistently have paid a lower percentage of their income in taxes than say, Biden or Obama. While Obama and Biden might be millionaires, both Kerry and Romney are worth more than a "unit". Of course, you don't know how much a "unit" is, which reveals how uneducated you are concerning this issue.

And yes, trickle down is based on a Macroeconomic fallacy called "supply side". Supply side is based on Say's Law, which simply put means, "supply creates its own demand". Consumption plus investment equals aggregate demand, or so the theory holds. Here is a great explanation as to why that is not always true,

The fallacy of Say’s Law is revealed by Keynes’s division of aggregate demand into investment and consumption for purposes of income analysis (Y = C + I). Keynes points out that the factors which determine consumption are quite different from the factors determining investment but together they constitute the aggregate demand and determine the level of income. Consumption is a function of current income, but it does not increase as much as the increase in income.

Investment, on the other hand, depends upon technological developments and the marginal efficiency of capital. It is, therefore, clear that the determinants of consumption and the determinants of investments are not interconnected in such a way as to ensure adequate aggregate demand.

Read this article to discover the eleven major criticisms against the Say’s Law of market. 1. Possibilities of Deficiency of Effective Demand: It is assumed in Say's Law that whatever is earned is spent either on consumption goods or on investment goods, thus, income is automatically spent at a...

www.economicsdiscussion.net

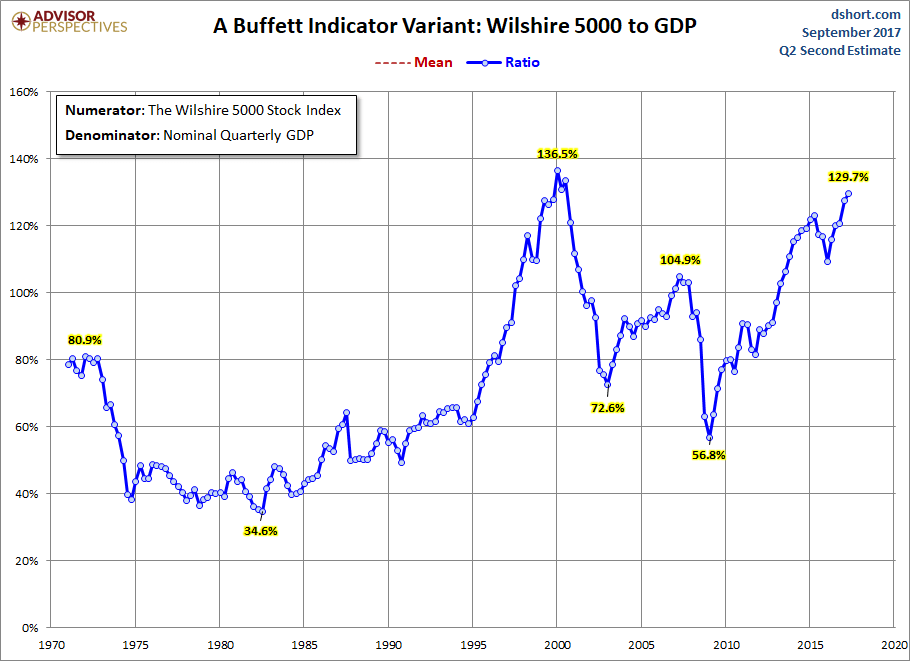

The problem here is "savings". Savings are not investments, a clear example is the stock market. When you purchase a stock on the exchange you are not investing, you are saving. You are purchasing a certificate that you plan to sell, in the future, at a profit. No company is getting any capital to invest. Now, if you buy a lawnmower, trailer, and pick-up to start a lawn mowing business, you are investing. Investing can create demand, but savings can stifle demand. So, aggregate demand is equal to Consumption plus investment MINUS savings. That savings is the fallacy in "trickle down" economics. And that savings has led to the obscene expansion in the wealth held by the ultra-wealthy. It is locked up in paper wealth, stocks, treasuries, hell, even art and baseball cards.