Dot Com

Nullius in verba

Hillary on the other hand seems to be one of his fan grls

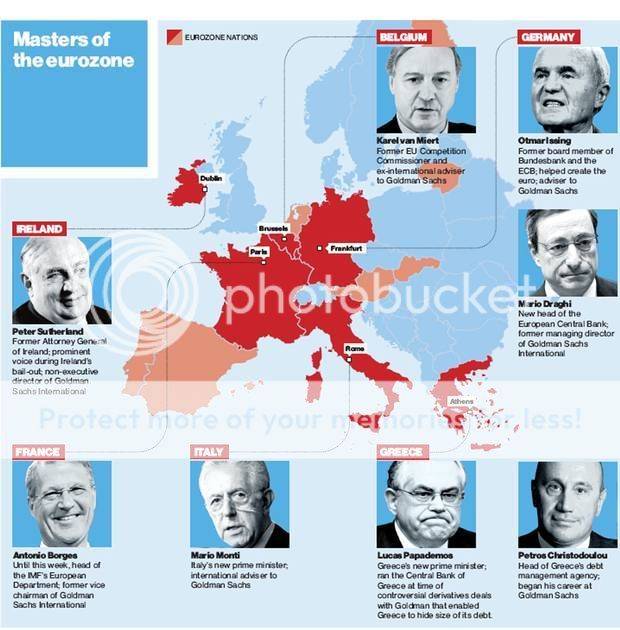

I have to say that I'm not a supporter either despite their aggressive media window dressing advertisement campaign after they helped to crater the economy by betting against it

Bernie has Goldman Sachs CEO running scared: Sanders’ candidacy is a ‘dangerous moment’

I must say, I'm not a big fan of his either

http://dealbook.nytimes.com/2011/06/15/misdirection-in-goldman-sachss-housing-short/

I have to say that I'm not a supporter either despite their aggressive media window dressing advertisement campaign after they helped to crater the economy by betting against it

Bernie has Goldman Sachs CEO running scared: Sanders’ candidacy is a ‘dangerous moment’

I must say, I'm not a big fan of his either

http://dealbook.nytimes.com/2011/06/15/misdirection-in-goldman-sachss-housing-short/