berg80

Diamond Member

- Oct 28, 2017

- 25,922

- 21,870

- 2,320

Enforcement by the Numbers | Consumer Financial Protection Bureau

When we take an enforcement action against an entity or individual, we found or allege has violated the law, we will post filings and other related materials here. To increase transparency of the Bureau’s public enforcement actions, we have also posted summary data on all our public enforcement...

Despite its track record, Repubs have tried, and failed, to shut it down.

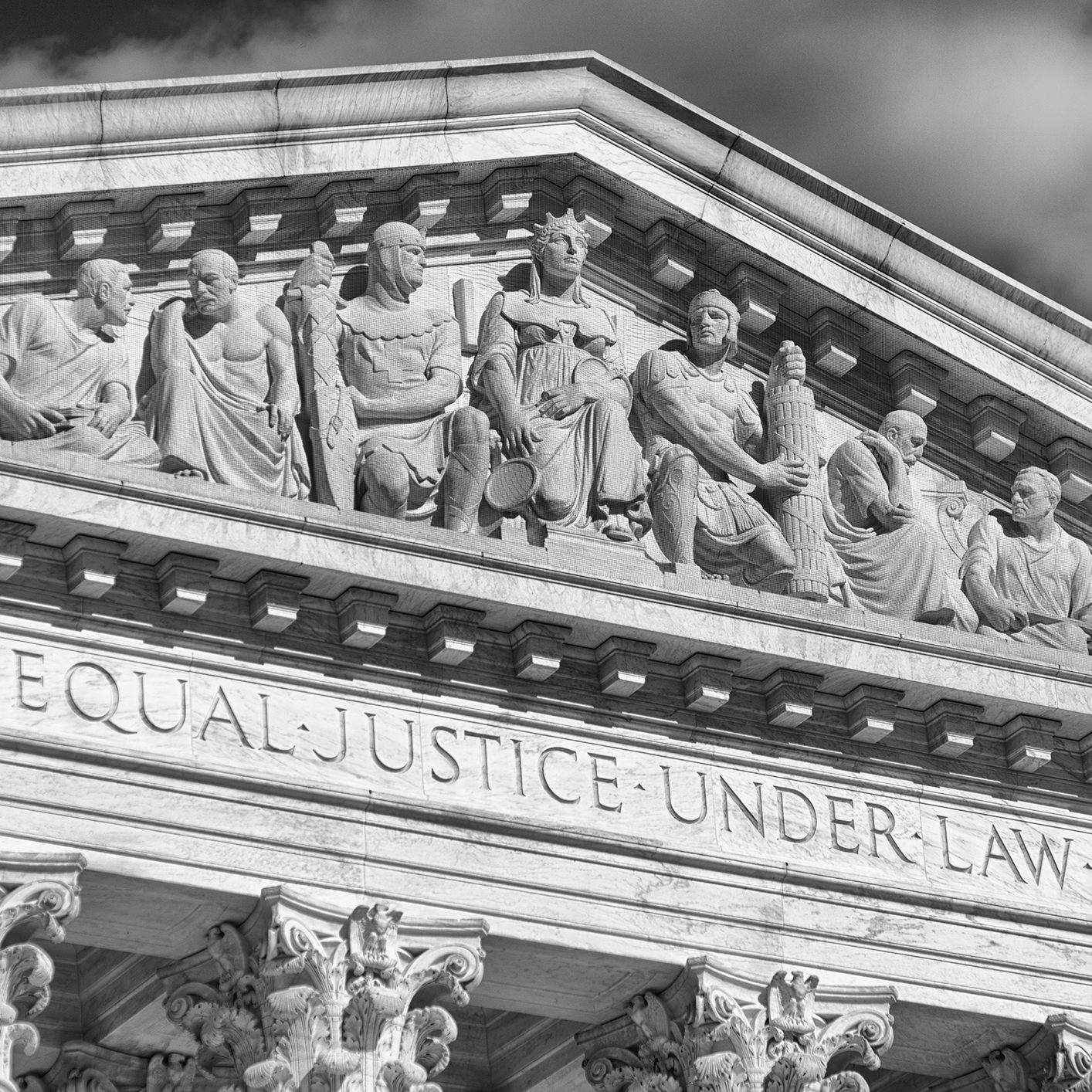

Supreme Court Rules That the CFPB Is Constitutionally Funded

Supreme Court Rules That the CFPB Is Constitutionally Funded | Foley & Lardner LLP

On May 16, 2024, the Supreme Court reversed a Fifth Circuit decision which held that the funding for the Consumer Financial Protection Bureau violated the Appropriations Clause.

It's difficult to draw another conclusion as to why Repubs have been going after the CFPB since it was created other than they'd rather leave consumers to fend for themselves against financial predators.

Trump official quietly drops payday loan case, mulls others

WASHINGTON (Reuters) - The top cop for U.S. consumer finance has decided not to sue a payday loan collector and is weighing whether to drop cases against three payday lenders, said five people with direct knowledge of the matter.The move shows how Mick Mulvaney, named interim head of the Consumer Financial Protection Bureau (CFPB) by U.S. President Donald Trump, is putting his mark on an agency conceived to stamp out abusive lending.

trump's motivation is less murky.

How Payday Lenders Spent $1 Million at a Trump Resort — and Cashed In

How Payday Lenders Spent $1 Million at a Trump Resort — and Cashed In

At the Trump Doral outside Miami, payday lenders celebrated the potential death of a rule intended to protect their customers. They couldn’t have done it without President Donald Trump and his latest deregulator, Kathleen Kraninger.

Trump and His Project 2025 Chief Sued Over Sudden CFPB Shutdown

The National Treasury Employees Union, which represents employees at the bureau, on Sunday filed two lawsuits against Russell Vought, the newly confirmed director of the Office of Management and Budget and the CFPB’s acting head. One lawsuit is seeking to block Elon Musk’s Department of Government Efficiency, or DOGE, from gaining access to employee information, stating that three of the pseudo-department’s staffers were granted internal system access.

The same day that Vought granted DOGE access to CFPB systems, the lawsuit alleges, Musk posted “CFPB RIP” on X.

The second lawsuit attacks a directive from Vought issued in an email over the weekend ordering the CFPB’s employees to stop most, if not all, their work, including investigations and issuing new rules. The suit alleges that Vought’s directive “reflects an unlawful attempt to thwart Congress’s decision to create the CFPB to protect American consumers.” Vought also has refused to receive the agency’s latest funding disbursement.

Trump and His Project 2025 Chief Sued Over Sudden CFPB Shutdown

Donald Trump is being sued again—this time, by a union.

Now that we've established the CFPB has done a lot of good for consumers, not so much for the companies trying to steal their money, the following question arises.

Is trump trying to shut down the agency illegally (it was created by an act of Congress) because he doesn't have the votes in Congress to do so? I mean, what good is having control of Congress if you can't use it to screw the people you claim to be looking out for?

WEEEEEEEEEEEEEEEEEEEEEEEEE

WEEEEEEEEEEEEEEEEEEEEEEEEE