Whichever.I would vote for UHC....I wouldn't the ACA.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

A simple economic lesson... raise capital gains to 43% will do what?

- Thread starter healthmyths

- Start date

- Apr 1, 2011

- 169,997

- 47,201

- 2,180

Only if they are directly tied to it. If the government can borrow the money, that connection goes away.Think about it. If ACA had been accompanied by the massive tax increases required to actually pay for it, it would have been DOA.

Yep.Only if they are directly tied to it. If the government can borrow the money, that connection goes away.

- Aug 4, 2009

- 281,170

- 140,740

- 2,615

Should come out of our Military Budget of $800 billion a yearBiden: we plan to send 3 billion to Ukraine. To pay for that we will have to raise taxes on X, X and X.

Think we would then actually do it?

They will barely notice $3 Billion

The Original Tree

Diamond Member

It will do nothing but help Biden's Puppet Master, Xi and China Economically Prosper and then dominate The United States.

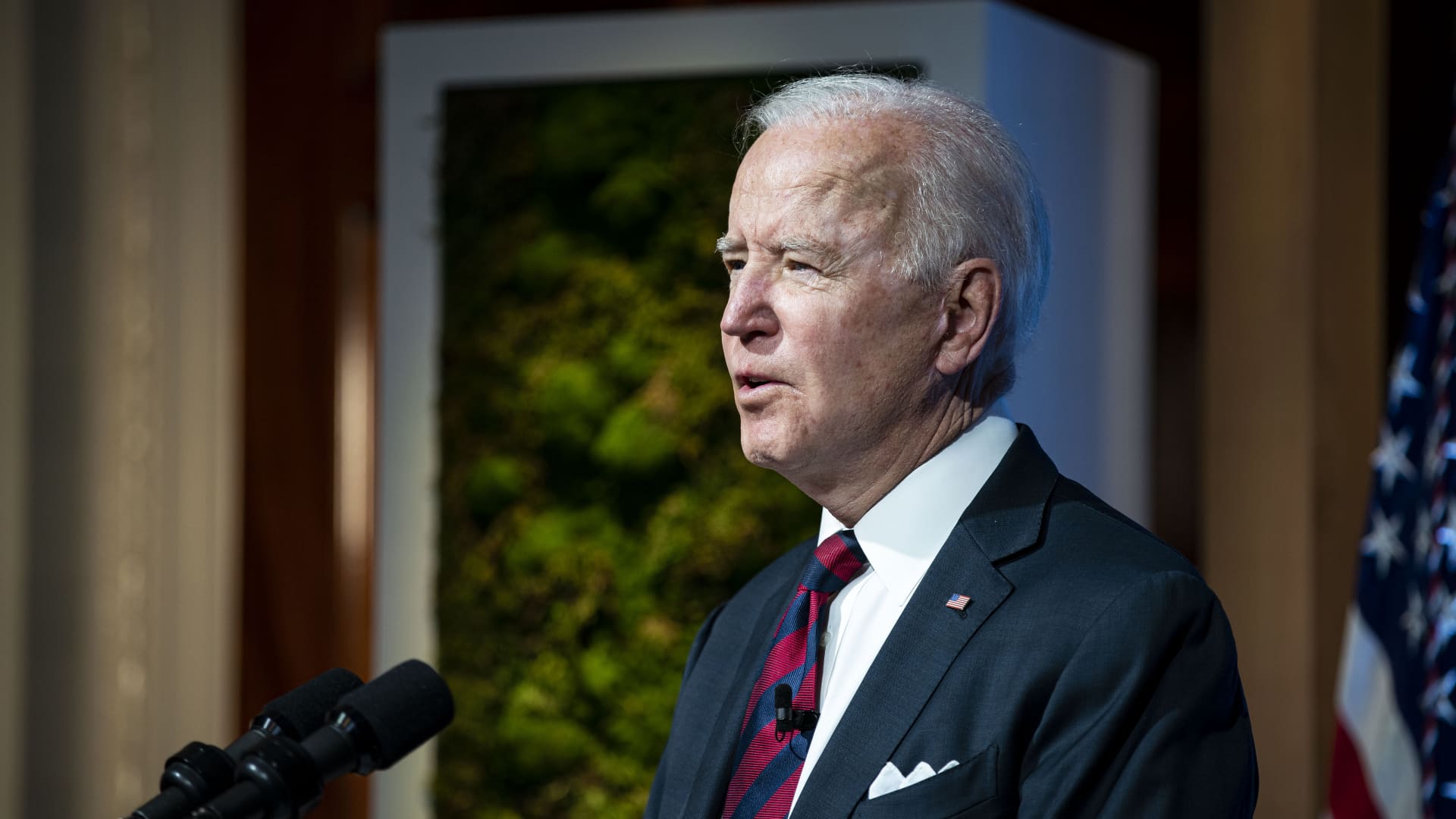

- President Joe Biden is expected to raise long-term capital-gains tax for the wealthiest Americans to 43.4%, including a surtax. That would be higher than the top federal tax rate on wage income. How the Biden capital gains tax proposal would hit the wealthy

"Unintended Consequences"...

How the Biden capital gains tax proposal would hit the wealthy

President Joe Biden is expected to double the top long-term capital gains rate to 43.4%. But investors shouldn't necessarily rush for the exits.www.cnbc.com

1) Analyses show that every 10% gain in the capital gains tax rate leads to a 7% change in capital gains realizations. That suggests Biden’s rate increase — which represents a 66% effective increase in the rate, could lead to a 45% to 50% increase in capital gains sales, which could create a large downward force in the market.

So this would mean 401K fund managers would be selling easily 50% reduction in values.

So what are 401ks value today:

About one-third of U.S. adults (35%) said they personally owned stocks, bonds or mutual funds outside of retirement accounts in a Pew Research Center survey from September 2019.

With 39% of the $6 trillion total 401K assets invested in the market..or about $2.4 Trillion will be at risk of dropping at least 50% in value.

Now that is just the affect on stock market and then on 401ks and then on the 60 million Americans with 401ks.

Now what about jobs in America?

At one point under Trump

U.S. companies have repatriated $1 trillion since tax overhaul

U.S. companies have repatriated $1 trillion since tax overhaul

That's still short of the $4 trillion in overseas profits that President Trump would return as a result of the 2017 tax law.www.latimes.com

Corporations have brought back more than $1 trillion of overseas profits to the U.S. since Congress overhauled the international tax system and prodded companies to repatriate offshore funds, a report showed Thursday. (snip)

Investment banks and think tanks have estimated that American corporations held $1.5 trillion to $2.5 trillion in offshore cash at the time the law was enacted. Before the overhaul, companies were incentivized to keep profits overseas because they owed a 35% tax when bringing it back and could defer payment by keeping funds offshore.

The law set a one-time 15.5% tax rate on cash and 8% on non-cash or illiquid assets.

Compare and contrast the way that Presidents Trump and Obama chose to stimulate the American economy, each of them generating roughly a trillion dollars in “stimulus.”

In summary folks... all the economic benefits of the "repatriation" and the capital gains tax cuts will result in nearly $10 trillion in economic losses to 60 million Americans at the minimum!

One trillion dollars have flowed into the American economy as Trump’s tax law changes allowed companies to repatriate profits without tax penalty

President Trump’s tax reform has delivered more than a trillion dollars of stimulus to the American economy through corporations repatriating profits held overseas in order to avoid penalties that the tax law had imposed on bringing home the fu...www.americanthinker.com

As intended.

As he was ordered to do.

Similar threads

- Replies

- 11

- Views

- 143

- Replies

- 56

- Views

- 2K

Latest Discussions

- Replies

- 458

- Views

- 2K

- Replies

- 23

- Views

- 127

Forum List

-

-

-

-

-

Political Satire 8044

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 469

-

-

-

-

-

-

-

-

-

-