What we only made cars with our industry Cupcake? IF that's all it was why is Germany 40% the size of US and yet they export as much as US Cupcake? OH RIGHT, THEY HAVE GOOD GOV'T POLICIES!

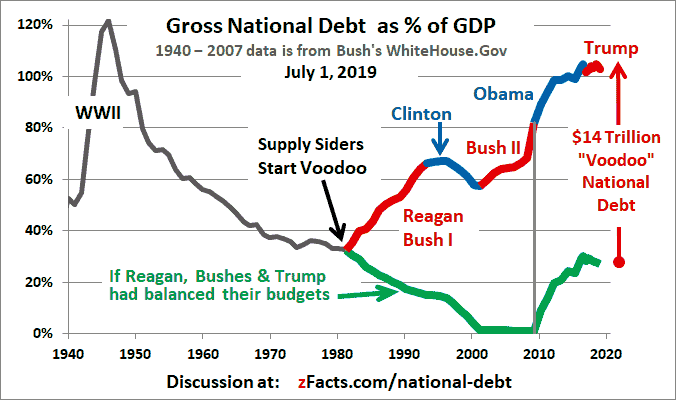

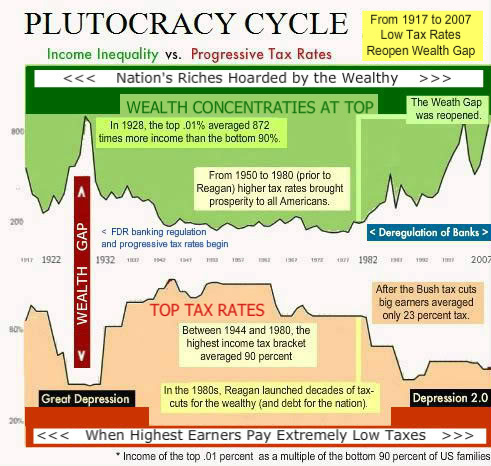

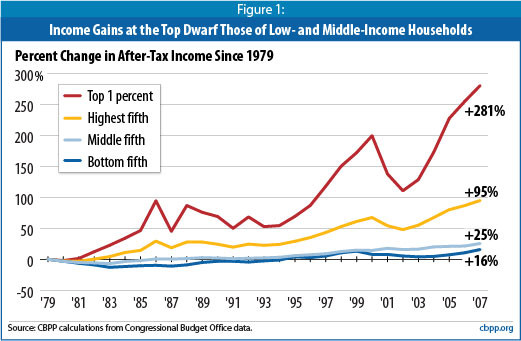

Reagan GUTTED taxes on the richest AND his and the CONServatives policies REWARDED those (Chinese/Mexico) "job creators" to off shore US jobs

What bullshit. Companies didn't leave because of any permission by the government. The only tax breaks companies get when they leave is writing off their moving expenses. That's it. The rest is a liberal lie. Need the FactCheck article? I have it in my folder, just ask.

Unions and government are responsible for the jobs leaving this country. The American consumer buys whatever items are the cheapest. That's how Walmart became our number one store. That's why brick and mortar stores are closing up all the time, because people get cheaper products through the internet.

In order for a company to sell products to the American consumer, they have to produce those products as cheap as possible. It had nothing to do with Reagan.

Hey dumbfuck, think the US Gov't could set the rules for who sells in the worlds largest economy, if it wanted too?

You know like stopping the ability to write off shipping jobs oversea? Having strong policy on creating FAIR trade vs CONservatives "free trade" BS?

I warned you:

FULL ANSWER

Do companies get a tax break for shipping U.S. jobs overseas? Several readers asked us that question after it came up

during the first debate between President Obama and Mitt Romney.

Obama claimed that “companies that are shipping jobs overseas” get tax breaks, saying that they “can actually take a deduction for moving a plant overseas.” But Mitt Romney said that he had “no idea” what the president was talking about, adding that “the idea that you get a break for shipping jobs overseas is simply not the case.” And both men are right, in a way.

There is no specific tax break for the sole purpose of relocating a U.S. job to another country, as Romney said. But the tax code does allow companies to deduct business expenses when calculating their tax liability. And those expenses can include the costs of moving a job to another state or even to another country, according to tax experts with whom we spoke. The White House confirmed in an email that that is what Obama was referring to in the debate.

“Firms can generally deduct business expenses,” said

Kimberly Clausing, the Thormund A. Miller and Walter Mintz Professor of Economics at Reed College. “Thus, of course, if firms incurred expenses in moving abroad, they would be able to deduct those expenses.”

“My interpretation is that the President’s statement was accurate,” she said in an email to FactCheck.org

William McBride, chief economist for the pro-business Tax Foundation, agreed with her point about the ability of companies to deduct moving costs as a business expense.

“There are no special tax provisions that provide incentives to move overseas, but, of course, in general, the IRS allows companies to deduct business expenses, one of which is moving expenses, whether within the U.S. or abroad,” he said.

Talking Tax Breaks for Offshoring - FactCheck.org