OohPooPahDoo

Gold Member

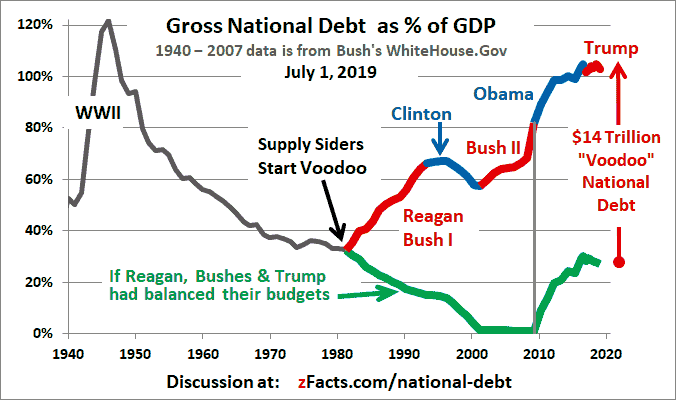

Note the green line

The green line shows what would have happened to the national debt if Reagan and the Bushes had balanced their budgets as Reagan claimed he would. G.W. Bush, in all modesty, claimed he would "retire nearly $1 trillion in debt over the next four years. This will be the largest debt reduction ever achieved by any nation at any time."

Conservatives are quite embarrassed by this performance, so they have invented a cover story: The Democratic Congress did it. Nice try. But for 12 of the 20 years the Congress was not Democratic. Also, presidents can veto, and when it was Democratic, Congress passed smaller budgets on average than the Republican Presidents asked for. Presidents propose the budget, and they have the most influence. Check it out.

LOL! right wingers, there's nothing you hate more than facts.

LOL! right wingers, there's nothing you hate more than facts.