Cammmpbell

Senior Member

- Sep 13, 2011

- 5,095

- 519

- 48

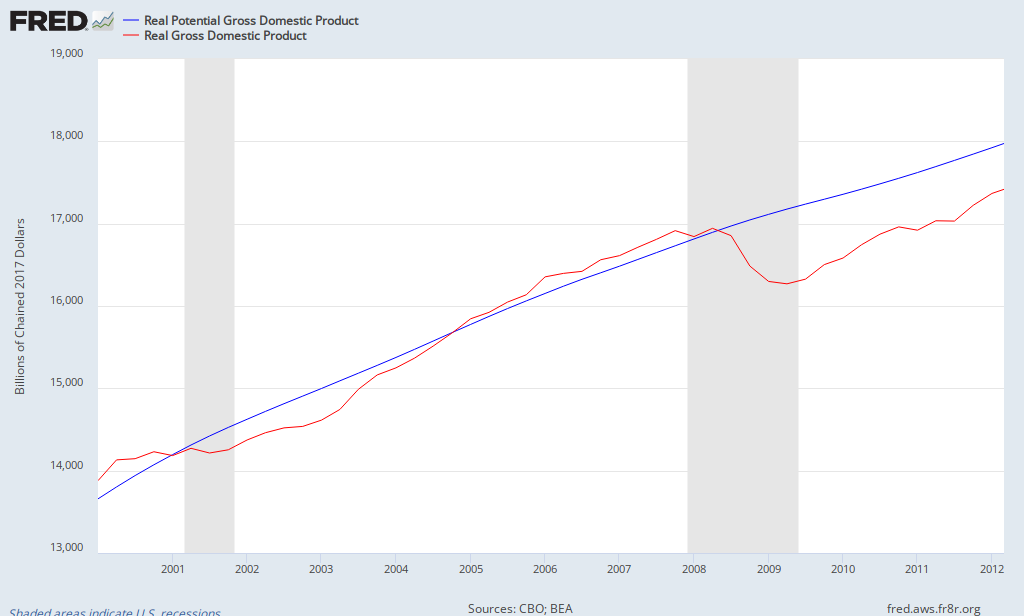

The last stimulus was $1 trillion and it failed.

It did not fail, it stopped the economy from sliding deeper into recession.

ROFL! What it really did is turn a recession into a depression. Handing out money to parasites does not increase the productivity of our economy. I can't think of any plausible explanation of how it would.

Can you?

Handing out money to the wealthiest among us as tax cuts and borrowing from foreign banks to cover the shortfall is no doubt what you think is right:

Total U S Debt

09/30/2009 $11,909,829,003,511.75(80% Of All Debt Across 232 Years Borrowed By Reagan And Bushes)

09/30/2008 $10,024,724,896,912.49(Times Square Debt Clock Modified To Accomodate Tens of Trillions)

09/30/2007 $9,007,653,372,262.48

09/30/2006 $8,506,973,899,215.23

09/30/2005 $7,932,709,661,723.50

09/30/2004 $7,379,052,696,330.32

09/30/2003 $6,783,231,062,743.62(Second Bush Tax Cuts Enacted Using Reconciliation)

09/30/2002 $6,228,235,965,597.16

09/30/2001 $5,807,463,412,200.06(First Bush Tax Cuts Enacted Using Reconciliation)

09/30/2000 $5,674,178,209,886.86(Administration And Congress Arguing About How To Use Surplus)

09/30/1999 $5,656,270,901,615.43(First Surplus Generated...On Track To Pay Off Debt By 2012)

09/30/1998 $5,526,193,008,897.62

09/30/1997 $5,413,146,011,397.34

09/30/1996 $5,224,810,939,135.73

09/29/1995 $4,973,982,900,709.39

09/30/1994 $4,692,749,910,013.32

09/30/1993 $4,411,488,883,139.38(Debt Quadrupled By Reagan/Bush41)

09/30/1992 $4,064,620,655,521.66

09/30/1991 $3,665,303,351,697.03

09/28/1990 $3,233,313,451,777.25

09/29/1989 $2,857,430,960,187.32

09/30/1988 $2,602,337,712,041.16

09/30/1987 $2,350,276,890,953.00

09/30/1986 $2,125,302,616,658.42

09/30/1985 $1,823,103,000,000.00

09/30/1984 $1,572,266,000,000.00

09/30/1983 $1,377,210,000,000.00

09/30/1982 $1,142,034,000,000.00(Total Debt Passes $1 Trillion)

09/30/1981 $997,855,000,000.00