While we are all for a tax cut I find it questionable why the middle school tax cut isn't double what is in the bill. My daughter's taxes will increase some while others on each side go down. A sham. A lie. How about severely cutting middle class taxes?

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Why not a huge tax cut for the middle class

- Thread starter initforme

- Start date

Rambunctious

Diamond Member

- Jan 19, 2010

- 72,845

- 68,644

- 3,605

How do you know what your taxes will be the bill isn't even out of the senate yet?While we are all for a tax cut I find it questionable why the middle school tax cut isn't double what is in the bill. My daughter's taxes will increase some while others on each side go down. A sham. A lie. How about severely cutting middle class taxes?

If you are in the middle class the news is that you will pay less in taxes next year. PERIOD!!! if you make over one million dollars and you live in NY CA and other high tax states you may pay more but you will still do quite well when the growth rate hits 4% or higher. It's good all the way around.

If someone is telling you your middle class daughter and yourself will pay more they are misinforming you.

Reasonable

Gold Member

- Feb 9, 2017

- 19,787

- 2,401

- 290

- Banned

- #4

It's not the republican way. They need to keep their big donors happy so they pad their pockets. They could care less about the middle class which makes it a hoot why so many wingnuts support a party that sticks their middle finger at them.While we are all for a tax cut I find it questionable why the middle school tax cut isn't double what is in the bill. My daughter's taxes will increase some while others on each side go down. A sham. A lie. How about severely cutting middle class taxes?

Reasonable

Gold Member

- Feb 9, 2017

- 19,787

- 2,401

- 290

- Banned

- #5

Yes the middle class deserves it but it will NEVER happen under this presidentNo you are wrong. Middle class folk are due for a massive tax cut let's say double what is in the bill. Then start cutting and begin with a bloated military budget.

Reasonable

Gold Member

- Feb 9, 2017

- 19,787

- 2,401

- 290

- Banned

- #6

You're such a tool.How do you know what your taxes will be the bill isn't even out of the senate yet?While we are all for a tax cut I find it questionable why the middle school tax cut isn't double what is in the bill. My daughter's taxes will increase some while others on each side go down. A sham. A lie. How about severely cutting middle class taxes?

If you are in the middle class the news is that you will pay less in taxes next year. PERIOD!!! if you make over one million dollars and you live in NY CA and other high tax states you may pay more but you will still do quite well when the growth rate hits 4% or higher. It's good all the way around.

If someone is telling you your middle class daughter and yourself will pay more they are misinforming you.

LUPICA: Republican tax reform will walk all over the middle class

Zander

Platinum Member

What is "the Middle class"?

Define it. Otherwise it's meaningless.

Define it. Otherwise it's meaningless.

Reasonable

Gold Member

- Feb 9, 2017

- 19,787

- 2,401

- 290

- Banned

- #9

I guess you didn't finish grade school.What is "the Middle class"?

Define it. Otherwise it's meaningless.

Reasonable

Gold Member

- Feb 9, 2017

- 19,787

- 2,401

- 290

- Banned

- #10

57% of Americans are against this horrendous tax bill. They're just trying to ram it thru because they're so desperate they haven't had even one legislative achievement.

JakeStarkey

Diamond Member

- Aug 10, 2009

- 168,037

- 16,522

- 2,165

- Banned

- #11

Temporary. The tax cuts for the middle class are for four years then elapse. There is no end date to the corporate tax cuts.

Rambunctious

Diamond Member

- Jan 19, 2010

- 72,845

- 68,644

- 3,605

Well thank you for showing us another OPINION piece. I disagree with the writer. You want to believe him even though the bill has not passed the senate and has not gone back to the house for mark up and Trump hasn't had a look at it as of yet? sounds like you are the major tool pal.You're such a tool.

LUPICA: Republican tax reform will walk all over the middle class

Rambunctious

Diamond Member

- Jan 19, 2010

- 72,845

- 68,644

- 3,605

8 years not four and again you are freaking out about a bill in process...when will you tools wake up?Temporary. The tax cuts for the middle class are for four years then elapse. There is no end date to the corporate tax cuts.

shockedcanadian

Diamond Member

- Aug 6, 2012

- 32,178

- 29,539

- 2,905

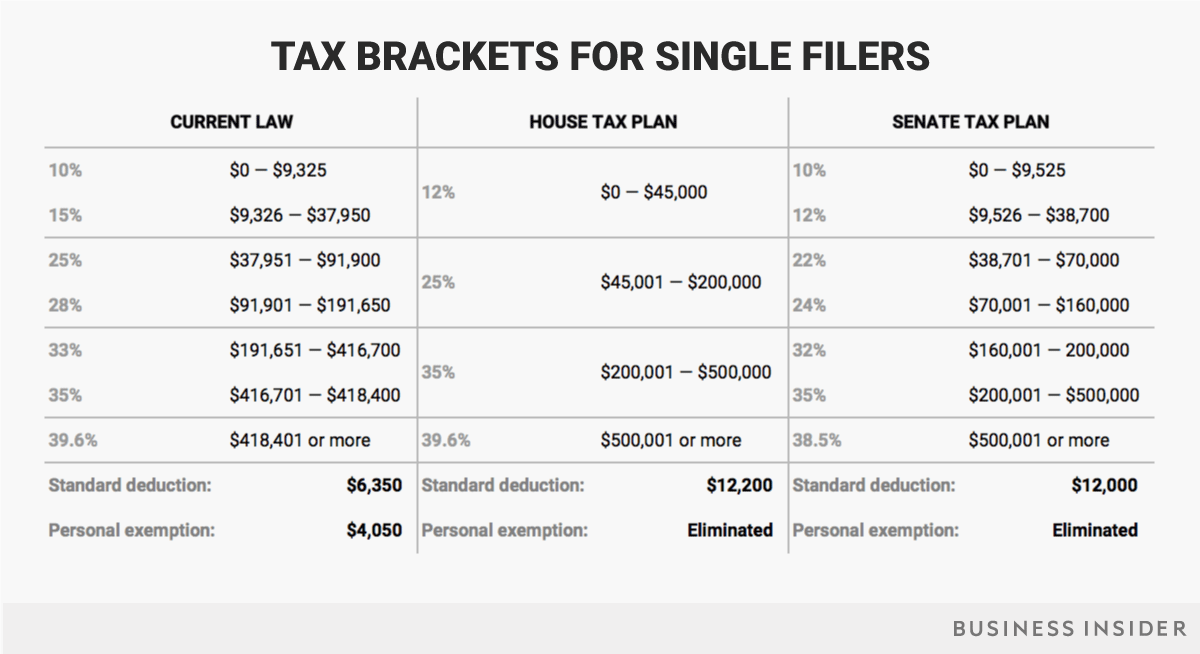

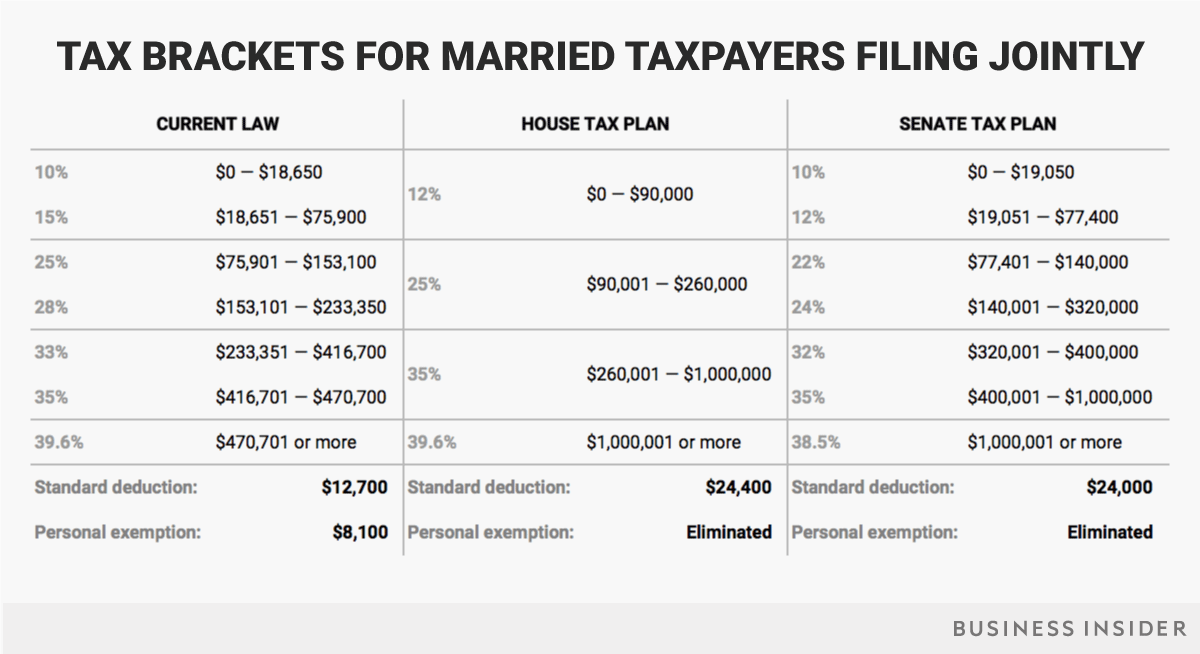

I have to agree with the OP about cuts to the middle class, though I wouldn't go as far as to call it a "sham and a lie". Why is the original Trump to lower the tax brackets down to four from it's current seven not acceptable? That is concerning that the government isn't supporting that aspect of his plan.

My recommendation, and one I think Rand Paul and a few others embrace is to have an across the board tax, equal for all. You do this, cut out loopholes and simplify it for everyone. Say 17.5% for all or something, just an example I throw out I have no evidence as to it's direct suitability.

You could then push to decrease expenses and bring America back to a healthy fiscal state. The biggest issue here is not that they can't lower taxes, its that some lifetime politicians KNOW they want the revenue as they refuse to cut costs. It's a problem all across the Western world and it's silly.

My recommendation, and one I think Rand Paul and a few others embrace is to have an across the board tax, equal for all. You do this, cut out loopholes and simplify it for everyone. Say 17.5% for all or something, just an example I throw out I have no evidence as to it's direct suitability.

You could then push to decrease expenses and bring America back to a healthy fiscal state. The biggest issue here is not that they can't lower taxes, its that some lifetime politicians KNOW they want the revenue as they refuse to cut costs. It's a problem all across the Western world and it's silly.

Last edited:

Zander

Platinum Member

I believe corporate tax cuts will help. But then the middle class gets practically Zippo. Why? How about the middle class pays 12 percent for awhile?

12% of what?

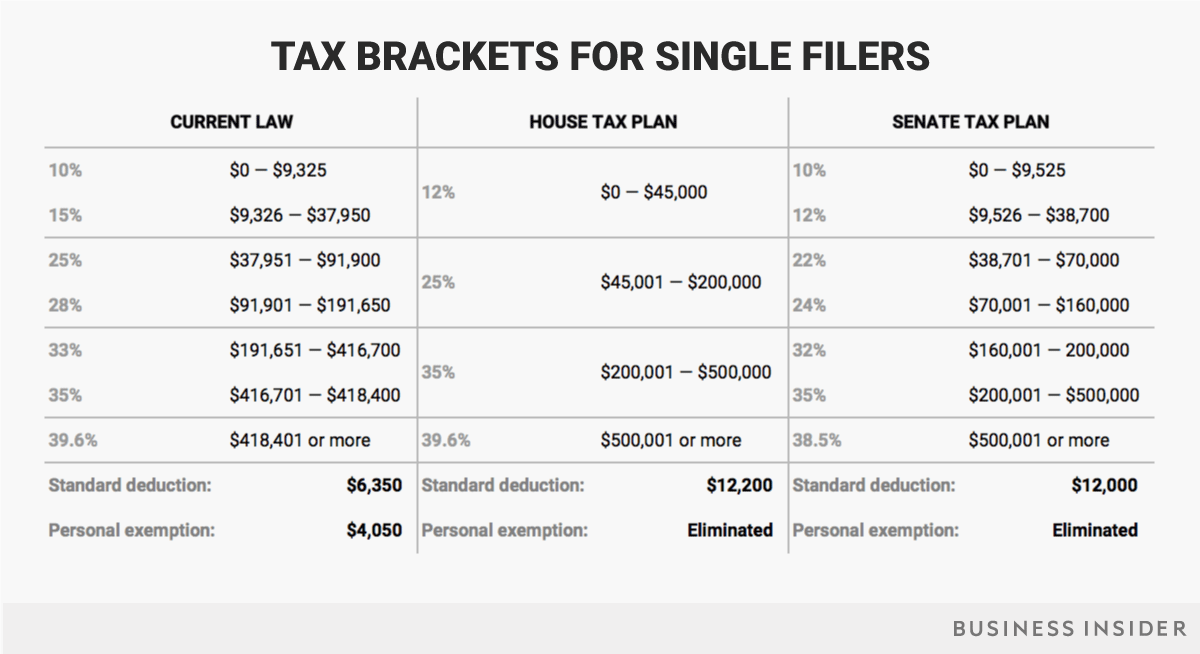

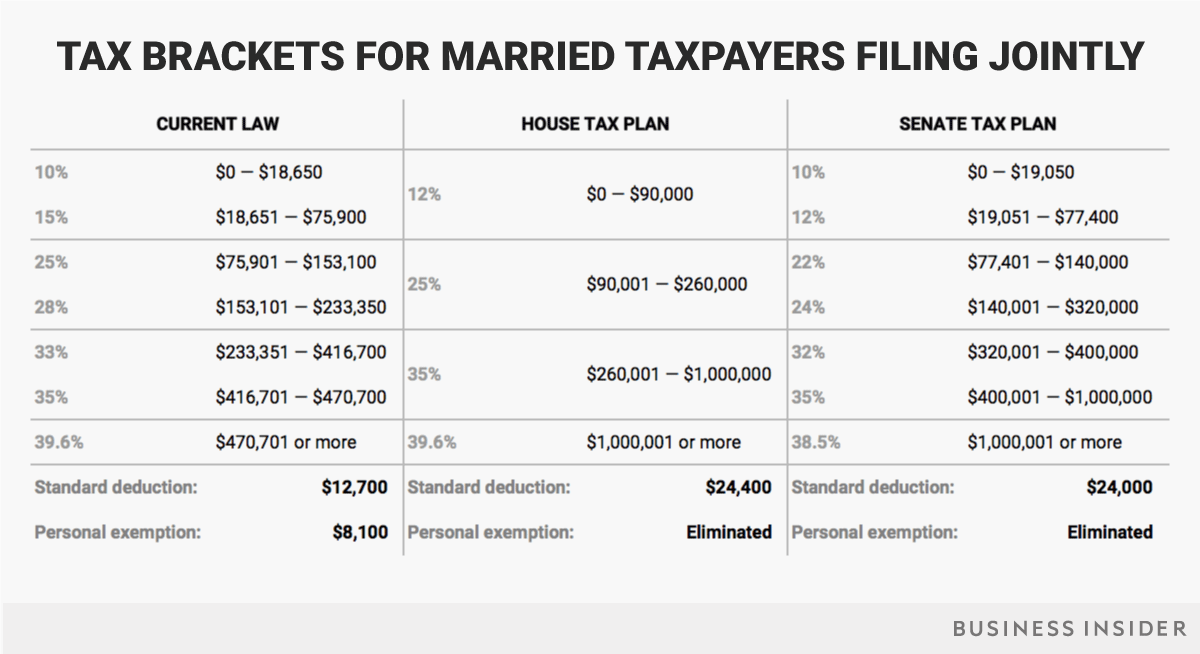

If the "middle class" is a single person earning $50K per year., under the proposed plans -

they'd pay= 50,000 - 12,000 standard deduction = 38,000 taxable X12% = $4560 -making an effective tax rate of 9.12%

If they are married and earn a $50,000 income - they get a $24000 exemption - making the taxable income $26,000 x 12% = $3,120 for and effective rate of 6.24%

There isn't much to cut.....the "middle class" simply doesn't pay a lot of taxes ....

depotoo

Diamond Member

- Sep 9, 2012

- 40,719

- 13,425

- 2,280

Yeah, that’s why the wp says dems are worried. Lol

Democrats see backlash over Republicans’ tax bill as a key to winning in the suburbs

Democrats see backlash over Republicans’ tax bill as a key to winning in the suburbs

57% of Americans are against this horrendous tax bill. They're just trying to ram it thru because they're so desperate they haven't had even one legislative achievement.

depotoo

Diamond Member

- Sep 9, 2012

- 40,719

- 13,425

- 2,280

That shut them up. Lol

I believe corporate tax cuts will help. But then the middle class gets practically Zippo. Why? How about the middle class pays 12 percent for awhile?

12% of what?

If the "middle class" is a single person earning $50K per year., under the proposed plans -

they'd pay= 50,000 - 12,000 standard deduction = 38,000 taxable X12% = $4560 -making an effective tax rate of 9.12%

If they are married and earn a $50,000 income - they get a $24000 exemption - making the taxable income $26,000 x 12% = $3,120 for and effective rate of 6.24%

There isn't much to cut.....the "middle class" simply doesn't pay a lot of taxes ....

usmbguest5318

Gold Member

Here's a rundown of some of the other key findings from the TPC:

Read the bullet points above or read the whole study (click the link at the start of this post). The top 1% of individual taxpayers will realize increasing savings, and that's regardless of what growth the economy experiences. In contrast, the folks in middle and lower taxable income brackets will between 2018 and 2027 realize decreasing savings, and 28% of individual taxpayers will see a tax increase!

- By 2018:

- The average American's tax bill would decline by $1,100, increasing the average after-tax income by 1.5%.

- Taxes for people in the lower two quintiles would decrease by between 0.3% and 0.5%. People in the middle quintile, those making $48,000 to $86,000, would see an average cut of $700, or 1.2% of their after-tax income.

- Taxpayers with incomes in the top 1% would receive 22% of total tax cuts -- with an average cut of $37,000.

- The report said that "70 percent of taxpayers would experience a tax cut from the included provisions averaging $2,000, and 12 percent would face an average tax increase of nearly $1,600."

- By 2027:

- The average American's tax bill would decline by $700, increasing after-tax incomes by 0.7%.

- Taxes for people in the lower two quintiles would increase slightly, with an average increase of $10 to $20.

- Taxpayers with incomes in the top 1% would receive "nearly 50 percent" of the overall benefit, with an average cut of $52,780.

- "In 2027, 57 percent of taxpayers would see an average tax cut of $2,400, while nearly 28 percent of taxpayers would face an average tax increase of nearly $2,000," the report said.

- Some high-income earners would see a tax increase due to the loss of itemized deductions.

When the U.S. economy experienced growth periods over the past 25 years, which of those growth periods yielded income increases that kept your wages/wealth growing at rates that matched (or nearly so) those of high income earners?

Growth rates are fitting to include in an analysis, but including them in one's analysis is appropriate only with regard to the segments of society that can be reasonably expected to realize material returns from that growth.Read the bullet points above or read the whole study (click the link at the start of this post). The top 1% of individual taxpayers will realize increasing savings, and that's regardless of what growth the economy experiences. In contrast, the folks in middle and lower taxable income brackets will between 2018 and 2027 realize decreasing savings, and 28% of individual taxpayers will see a tax increase!

Similar threads

- Replies

- 18

- Views

- 137

- Replies

- 95

- Views

- 655

- Replies

- 2

- Views

- 118

Latest Discussions

- Replies

- 1

- Views

- 2

- Replies

- 84

- Views

- 903

- Replies

- 22

- Views

- 113

Forum List

-

-

-

-

-

Political Satire 8886

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 492

-

-

-

-

-

-

-

-

-

-