ilia25

I can do math

- Jan 12, 2012

- 1,859

- 100

- 48

- Thread starter

- #21

Monetary policy too slow? That's ridiculous.

We had this argument before, and I explained to you what "too slow" means in this context -- Fed not willing to help beyond lowering the nominal rates to zero, which is not enough to keep up with deleveraging.

We have? I don't remember that...

Here you go

http://www.usmessageboard.com/econo...ion-to-end-this-depression-5.html#post5455601

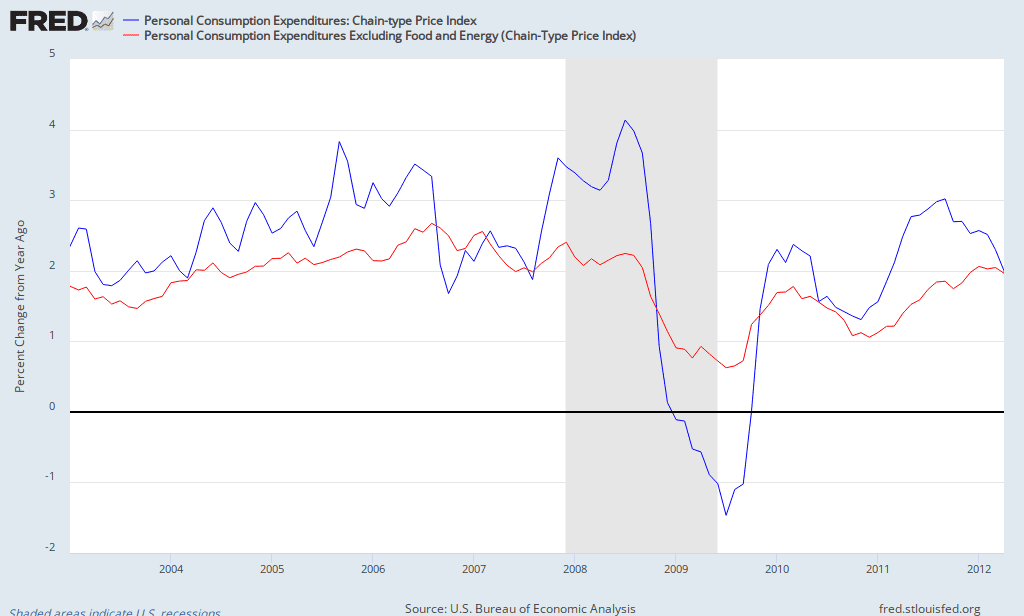

So the Fed is too hawkish to ease further. They're also very close to their explicit inflation target of 2% PCE. Why do we assume that fiscal expansion won't be offset with tighter money to keep inflation on target?

Because the inflation will not take off until the economy reaches the state of full employment. And we won't need any more stimulus once that happens.