Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Where are the Fiscal Conservatives? GOP Tax Bill Adds $1.7T to Debt

- Thread starter RDD_1210

- Start date

- Aug 4, 2009

- 281,359

- 142,368

- 2,615

Nor, will theyWe're eleven pages in. Has any pseudocon ripped Trump a new one for this bill to increase the debt yet?

Didn't think so.

Borrowing money to give to their wealthy benefactors is as conservative as it gets

Only double taxation in the federal code is the death tax.

What about dividends?

Dividends are the equivalent of rental income, without the hassle of dealing with tenants and property maintenance.

.

Company earnings are taxed at the corporate level and again when the dividend is paid to the investor.

The dividend is based on after tax profits, so technically it's reduced by the taxes already paid.

.

Yes, the dividends are reduced because the earnings are double taxed.

Once again, you're conflating business income with individual income. If you sell a stock at a profit your profit it's taxed, the same applies to dividends, it's profit on a stock you just retain the stock.

.

Once again, you're conflating business income with individual income.

Dividends I receive are from business income.

Income which is taxed at the corporate level and then again at the individual level.

That is accounting, not taxationThe company pays taxes on its profitCompany earnings are taxed at the corporate level and again when the dividend is paid to the investor.

The investor pays taxes on HIS profit

Every time money changes hands, it is taxed

The company pays taxes on its profit

The investor pays taxes on HIS profit

Company profits are company profits, paid out or not.

When they pay them out as dividends, they're taxed for the second time.

Every time money changes hands, it is taxed

But of course that isn't true.

Afraid it is

If you believe otherwise....take it up with the IRS

Afraid it is

A corporation pays my salary, I'm taxed, they deduct.

A company pays interest to a bank, the bank is taxed, the corporation deducts.

I could also give examples involving trading where money changes hands and is not taxed.

The company makes a profit and pays a tax

They pay me ....I pay a tax on the income

I use my salary to buy a car......I pay tax on the car

Every time that money changes hands....it is taxed

That is accounting, not taxation

And we were discussing double taxation.

Dividends are the equivalent of rental income, without the hassle of dealing with tenants and property maintenance.

.

Company earnings are taxed at the corporate level and again when the dividend is paid to the investor.

The dividend is based on after tax profits, so technically it's reduced by the taxes already paid.

.

Yes, the dividends are reduced because the earnings are double taxed.

Once again, you're conflating business income with individual income. If you sell a stock at a profit your profit it's taxed, the same applies to dividends, it's profit on a stock you just retain the stock.

.

Once again, you're conflating business income with individual income.

Dividends I receive are from business income.

Income which is taxed at the corporate level and then again at the individual level.

Are you saying you own the business that pays you dividends?

.

Aldo Raine

Gold Member

Yeah, just keep denying Trump and GOP will add to the debt with their plan.First static scoring is BS, you can't discount the growth this bill will cause. Second debt and deficit are two different animals. The deficit is calculated against the budget which only accounts for about 30% of federal spending. Off budget spending accounts for most of the debt.

.

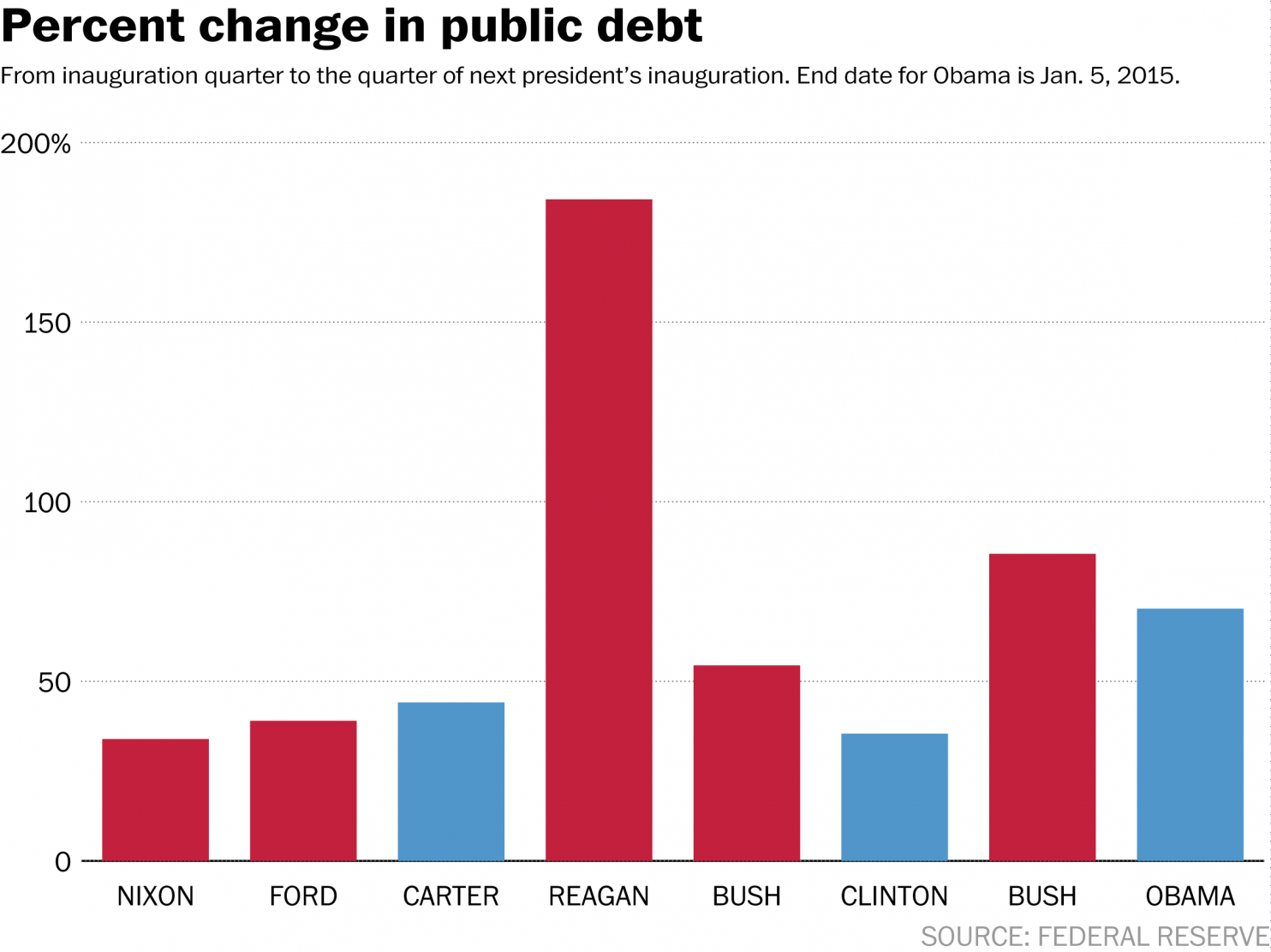

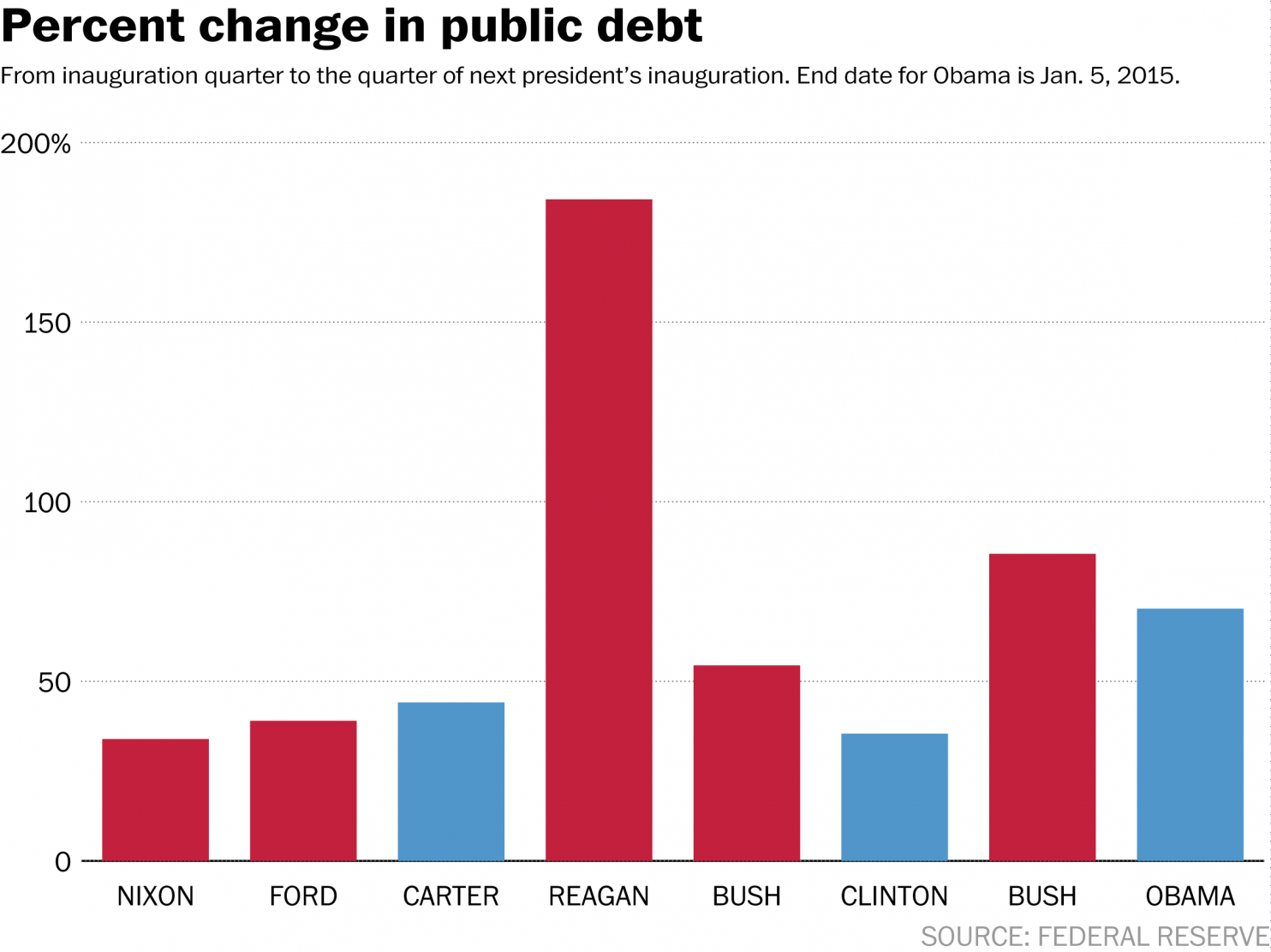

If the name "Obama" was in this picture, you'd be howling and grinding your teeth.

"If someone has a D after their name, they can never do anything right, but if they have an R after their name, they can never do wrong."

So you're saying that if the economy expands dramatically it won't increase revenues to the government?

.

When have tax cuts not added to the debt?

The Reagan tax cuts more than doubled revenue, the problem spending almost did the same.

.

Come on buddy, if his tax-cuts "doubled revenue" why did he and hs successors chased it up with tax raises and not more tax-cuts?

Because they didn't is the simple answer. Debt EXPLODED under Reagan, yet conservatives still refer him as a model of economic genius. Which of course only makes sense if we think of the movement as a tax-cut cult.

Yes the Raygun tax cuts. The greatest redistribution of wealth in the history of the world. From the middle class to the uber wealthy!

Last edited:

- Aug 4, 2009

- 281,359

- 142,368

- 2,615

We are still paying the priceYeah, just keep denying Trump and GOP will add to the debt with their plan.

If the name "Obama" was in this picture, you'd be howling and grinding your teeth.

"If someone has a D after their name, they can never do anything right, but if they have an R after their name, they can never do wrong."

So you're saying that if the economy expands dramatically it won't increase revenues to the government?

.

When have tax cuts not added to the debt?

The Reagan tax cuts more than doubled revenue, the problem spending almost did the same.

.

Come on buddy, if his tax-cuts "doubled revenue" why did he and hs successors chased it up with tax raises and not more tax-cuts?

Because they didn't is the simple answer. Debt EXPLODED under Reagan, yet conservatives still refer him as a model of economic genius. Which of course only makes sense if we think of the movement as a tax-cut cult.

Yes the Raygun fax cuts. The greatest redistribution of wealth in the history of the world. From the middle class to the uber wealthy!

- Apr 1, 2011

- 170,018

- 47,208

- 2,180

Lowering your taxes is being given money, dumbass.Nor, will theyWe're eleven pages in. Has any pseudocon ripped Trump a new one for this bill to increase the debt yet?

Didn't think so.

Borrowing money to give to their wealthy benefactors is as conservative as it gets

Company earnings are taxed at the corporate level and again when the dividend is paid to the investor.

The dividend is based on after tax profits, so technically it's reduced by the taxes already paid.

.

Yes, the dividends are reduced because the earnings are double taxed.

Once again, you're conflating business income with individual income. If you sell a stock at a profit your profit it's taxed, the same applies to dividends, it's profit on a stock you just retain the stock.

.

Once again, you're conflating business income with individual income.

Dividends I receive are from business income.

Income which is taxed at the corporate level and then again at the individual level.

Are you saying you own the business that pays you dividends?

.

I own stock in publically traded companies.

Those companies have earnings.

Earnings which are taxed at the corporate level.

My portion of those earnings, which I receive as dividends, are taxed again at the individual level.

The dividend is based on after tax profits, so technically it's reduced by the taxes already paid.

.

Yes, the dividends are reduced because the earnings are double taxed.

Once again, you're conflating business income with individual income. If you sell a stock at a profit your profit it's taxed, the same applies to dividends, it's profit on a stock you just retain the stock.

.

Once again, you're conflating business income with individual income.

Dividends I receive are from business income.

Income which is taxed at the corporate level and then again at the individual level.

Are you saying you own the business that pays you dividends?

.

I own stock in publically traded companies.

Those companies have earnings.

Earnings which are taxed at the corporate level.

My portion of those earnings, which I receive as dividends, are taxed again at the individual level.

And, it's a personal gain related to your investment, the same applies if I put money in the bank that I already paid taxes on, the gains on earned interest are still taxable.

.

- Aug 4, 2009

- 281,359

- 142,368

- 2,615

Not when it adds to our debt FingerboyLowering your taxes is being given money, dumbass.Nor, will theyWe're eleven pages in. Has any pseudocon ripped Trump a new one for this bill to increase the debt yet?

Didn't think so.

Borrowing money to give to their wealthy benefactors is as conservative as it gets

- Aug 4, 2009

- 281,359

- 142,368

- 2,615

As they should beThe dividend is based on after tax profits, so technically it's reduced by the taxes already paid.

.

Yes, the dividends are reduced because the earnings are double taxed.

Once again, you're conflating business income with individual income. If you sell a stock at a profit your profit it's taxed, the same applies to dividends, it's profit on a stock you just retain the stock.

.

Once again, you're conflating business income with individual income.

Dividends I receive are from business income.

Income which is taxed at the corporate level and then again at the individual level.

Are you saying you own the business that pays you dividends?

.

I own stock in publically traded companies.

Those companies have earnings.

Earnings which are taxed at the corporate level.

My portion of those earnings, which I receive as dividends, are taxed again at the individual level.

Yes, the dividends are reduced because the earnings are double taxed.

Once again, you're conflating business income with individual income. If you sell a stock at a profit your profit it's taxed, the same applies to dividends, it's profit on a stock you just retain the stock.

.

Once again, you're conflating business income with individual income.

Dividends I receive are from business income.

Income which is taxed at the corporate level and then again at the individual level.

Are you saying you own the business that pays you dividends?

.

I own stock in publically traded companies.

Those companies have earnings.

Earnings which are taxed at the corporate level.

My portion of those earnings, which I receive as dividends, are taxed again at the individual level.

And, it's a personal gain related to your investment, the same applies if I put money in the bank that I already paid taxes on, the gains on earned interest are still taxable.

.

Yes, my portion of the corporate earnings are taxed a second time.

As they should beYes, the dividends are reduced because the earnings are double taxed.

Once again, you're conflating business income with individual income. If you sell a stock at a profit your profit it's taxed, the same applies to dividends, it's profit on a stock you just retain the stock.

.

Once again, you're conflating business income with individual income.

Dividends I receive are from business income.

Income which is taxed at the corporate level and then again at the individual level.

Are you saying you own the business that pays you dividends?

.

I own stock in publically traded companies.

Those companies have earnings.

Earnings which are taxed at the corporate level.

My portion of those earnings, which I receive as dividends, are taxed again at the individual level.

Why? If I own an S-Corp, it's only taxed once.

- Aug 4, 2009

- 281,359

- 142,368

- 2,615

Shouldn't beAs they should beOnce again, you're conflating business income with individual income. If you sell a stock at a profit your profit it's taxed, the same applies to dividends, it's profit on a stock you just retain the stock.

.

Once again, you're conflating business income with individual income.

Dividends I receive are from business income.

Income which is taxed at the corporate level and then again at the individual level.

Are you saying you own the business that pays you dividends?

.

I own stock in publically traded companies.

Those companies have earnings.

Earnings which are taxed at the corporate level.

My portion of those earnings, which I receive as dividends, are taxed again at the individual level.

Why? If I own an S-Corp, it's only taxed once.

Shouldn't beAs they should beOnce again, you're conflating business income with individual income.

Dividends I receive are from business income.

Income which is taxed at the corporate level and then again at the individual level.

Are you saying you own the business that pays you dividends?

.

I own stock in publically traded companies.

Those companies have earnings.

Earnings which are taxed at the corporate level.

My portion of those earnings, which I receive as dividends, are taxed again at the individual level.

Why? If I own an S-Corp, it's only taxed once.

S-Corp should be taxed twice?

Once again, you're conflating business income with individual income. If you sell a stock at a profit your profit it's taxed, the same applies to dividends, it's profit on a stock you just retain the stock.

.

Once again, you're conflating business income with individual income.

Dividends I receive are from business income.

Income which is taxed at the corporate level and then again at the individual level.

Are you saying you own the business that pays you dividends?

.

I own stock in publically traded companies.

Those companies have earnings.

Earnings which are taxed at the corporate level.

My portion of those earnings, which I receive as dividends, are taxed again at the individual level.

And, it's a personal gain related to your investment, the same applies if I put money in the bank that I already paid taxes on, the gains on earned interest are still taxable.

.

Yes, my portion of the corporate earnings are taxed a second time.

No more than my earned interest is taxed a second time. We're done.

.

deanrd

Gold Member

- May 8, 2017

- 29,411

- 3,635

- 290

- Banned

- #238

That's their plan."The GOP’s tax bill would add $1.7 trillion to the national debt over the course of a decade, and increase the country’s debt-to-GDP ratio by 5.9 percentage points, according to the Congressional Budget Office."

GOP tax bill would add $1.7 trillion to debt: CBO

So where are those tea party conservatives that ran on a very strict ‘we will not add to the federal debt/deficit!’

Clearly, that policy does not apply to tax breaks for corporations and the already wealthy.

deanrd

Gold Member

- May 8, 2017

- 29,411

- 3,635

- 290

- Banned

- #239

I feel like I'm trying to sell you the Titanic.

Republicans are truly trying to sell us the Titanic.

Republicans are truly trying to sell us the Titanic.

Once again, you're conflating business income with individual income.

Dividends I receive are from business income.

Income which is taxed at the corporate level and then again at the individual level.

Are you saying you own the business that pays you dividends?

.

I own stock in publically traded companies.

Those companies have earnings.

Earnings which are taxed at the corporate level.

My portion of those earnings, which I receive as dividends, are taxed again at the individual level.

And, it's a personal gain related to your investment, the same applies if I put money in the bank that I already paid taxes on, the gains on earned interest are still taxable.

.

Yes, my portion of the corporate earnings are taxed a second time.

No more than my earned interest is taxed a second time. We're done.

.

With your confusion, I agree, you should stop.

Similar threads

- Replies

- 4

- Views

- 110

- Replies

- 69

- Views

- 660

- Replies

- 7

- Views

- 175

- Replies

- 115

- Views

- 1K

- Replies

- 13

- Views

- 336

Latest Discussions

- Replies

- 623

- Views

- 3K

- Replies

- 292

- Views

- 1K

- Replies

- 1

- Views

- 2

- Replies

- 37

- Views

- 124

Forum List

-

-

-

-

-

Political Satire 8072

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 471

-

-

-

-

-

-

-

-

-

-