- Sep 19, 2011

- 28,465

- 10,042

- 900

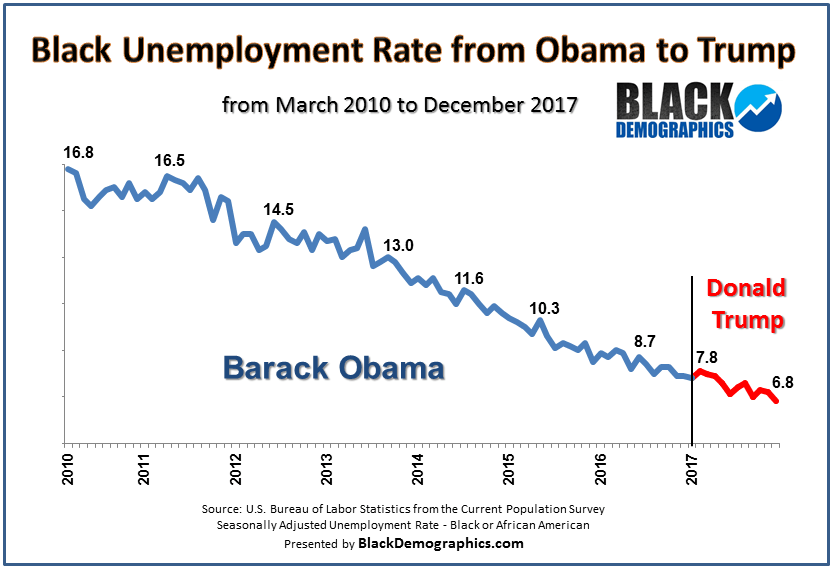

Trump inherited a booming economy with low unemployment and steady job growth — an easy win on day one — and he quickly claimed credit. Early in his presidency, Trump boasted about job gains starting from his election onward, crediting Obama's final months as his own. Let our news meet your inbox.

Fact check: Did Trump pull off an 'economic turnaround?'

The economy was, however, struggling when Obama took office in 2009. He inherited a dismal economy in the middle of a recession that lasted 18 months, facing what many feared would be a depression, and was able to turn it around in the first years of his presidency. The U.S. is now its 10th year of economic growth, and in its longest period of growth with 95 straight months of job creation. The bulk of that decade of growth was under Obama’s presidency, and can fairly be credited to him.

Still, as Trump accurately points out, the recovery under Obama was marked by a slower rate of growth than what followed previous recessions, such as the recovery under President Ronald Reagan in 1983 and 1984.

But, what about the Trump effect?

Trump's supporters say he's supercharged the economy. Now in the second year of his presidency, he has passed a major tax bill and rolled back a significant number of regulations, giving the economy another injection of capital — though economists disagree on the how much the tax cuts will really benefit the larger economy and whether it will have lasting effects to the economy.

Trump has surely seen some impressive data points in his first term: GDP growth has reached 4.2 percent, unemployment has reached its lowest point in half a century, and the stock market has reached new heights.

The president and his administration have been eager to tout the numbers. Kevin Hassett, chairman of the Council of Economic Advisers, kicked off the White House press briefing on Monday with a slew of charts. He said the growth is not an extension of a trend, but rather a "clear upward trajectory, way above the trend."

Economists aren't buying it: While the tax cuts probably helped inject some cash into the economy — particularly the stock market — the country has largely maintained the growth it saw under Obama.

Fact check: Did Trump pull off an 'economic turnaround?'

Just think if Obama wasn't in favor of utilities going bankrupt, gas prices going higher, destruction of 1,400 companies that paid $100 billion a year in taxes and unemployed 450,000 people. Or if Obama wanted the USA to be the biggest OIL customer for foreign oil.

Or that he approved of 1 million barrels of Canadian oil in one tanker a day on the open ocean destroying 1,000s of miles of ocean.

Or he put into a plan to make in his words utility rates skyrocket.

Or forcing small businesses for example that had 49 employees and forced when hiring the 50th to spend then because of the 50th

employee nearly $15,000/month just to hire that 50th employee. Really is that a way to reduce unemployment? As a result these small businesses hired part time employees! All of the above are FACTS.