Trade deficits are ALWAYS detrimental to their nations GDPs.

Nations entire production of goods and service products contribute to their GDPs but prices of individual products do not always reflect the entire goods and services that supported the production of those products. Also individual product prices certainly do not reflect their productions inducement of additional goods or services productions.

All production contributes to producing nations gross domestic product, (GDP). The production is not statistically lost; but to the extent that production costs of globally traded goods are understated, nations global trade imbalances affects upon their GDPs are not fully attributed to global trade.

////////////////////////////////// Further Explanations ///////////////////////

For example governments often induce producers to establish their factories within their jurisdictions by granting them favorable tax considerations or providing infrastructure thats particularly favorable to targeted enterprises. Governments and other nonprofits often co-operate by favoring enterprises with research, loans of equipment, or access to their expertise. These production supports are of lesser or no cost to the favored enterprises and thus those enterprises products are lesser priced.

All of a nations production, (including production support thats not reflected within produced products prices), are included within the producing nations GDPs. But domestic production support not included within the supported export products are not to that extent attributed as exports contributions to the producing nations GDP.

Production of products can support or induce the production of other unrelated products.

For example increasing the production rate of export goods can increase the factorys payroll and induce increasing revenues for local beauty parlor service products. This is an additional example of exports additionally increasing the nations GDP but the addition is not attributed to the nations global trade.

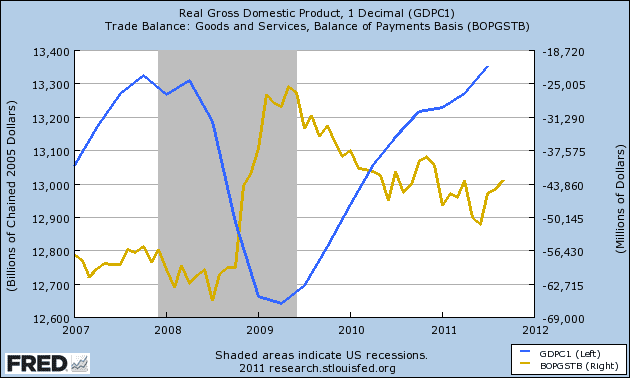

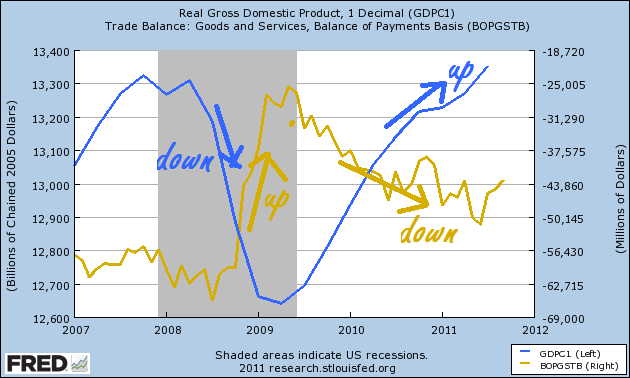

[We cannot spend the same money twice. Thats why the GDP calculation formulas are reduced by the amount of the nations imports. When U.S. purchasers perceiving their own individual benefits chose to purchase imported products their transaction reduces their nations GDPs. Trade surpluses increase their nations GDPs.]

Trade surpluses ALWAYS contribute and trade deficits are ALWAYS detrimental to their nations GDPs.

This is baked into the formula defining and calculating GDP; it is not matters of opinion.

Respectfully, Supposn

Nations entire production of goods and service products contribute to their GDPs but prices of individual products do not always reflect the entire goods and services that supported the production of those products. Also individual product prices certainly do not reflect their productions inducement of additional goods or services productions.

All production contributes to producing nations gross domestic product, (GDP). The production is not statistically lost; but to the extent that production costs of globally traded goods are understated, nations global trade imbalances affects upon their GDPs are not fully attributed to global trade.

////////////////////////////////// Further Explanations ///////////////////////

For example governments often induce producers to establish their factories within their jurisdictions by granting them favorable tax considerations or providing infrastructure thats particularly favorable to targeted enterprises. Governments and other nonprofits often co-operate by favoring enterprises with research, loans of equipment, or access to their expertise. These production supports are of lesser or no cost to the favored enterprises and thus those enterprises products are lesser priced.

All of a nations production, (including production support thats not reflected within produced products prices), are included within the producing nations GDPs. But domestic production support not included within the supported export products are not to that extent attributed as exports contributions to the producing nations GDP.

Production of products can support or induce the production of other unrelated products.

For example increasing the production rate of export goods can increase the factorys payroll and induce increasing revenues for local beauty parlor service products. This is an additional example of exports additionally increasing the nations GDP but the addition is not attributed to the nations global trade.

[We cannot spend the same money twice. Thats why the GDP calculation formulas are reduced by the amount of the nations imports. When U.S. purchasers perceiving their own individual benefits chose to purchase imported products their transaction reduces their nations GDPs. Trade surpluses increase their nations GDPs.]

Trade surpluses ALWAYS contribute and trade deficits are ALWAYS detrimental to their nations GDPs.

This is baked into the formula defining and calculating GDP; it is not matters of opinion.

Respectfully, Supposn