EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

he's knows what he's talking about.

If so you would not be so afraid to present a good example for the whole world to see.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

he's knows what he's talking about.

Anyone that thinks the grek's debt problem is simply due to greek over spending needs to go read "This time is different". The point of the paper is actualy to prove the opposite: that this is just the countinuation of a long macroeconomic cycle. It examines economic trends back to about 1800

"Also consonant with the modern theory of crises is the striking correlation between freer capital mobility and the incidence of banking crises, as illustrated in Figure 3. Periods of high international capital mobility have repeatedly produced international banking crises, not only famously as they did in the 1990s, but historically."

Figure 3:

Basically greece and other periphery countries are the victim of increasing capital flowing into their country after the creation of the euro.

What? So failed Progressive economic theory is because of stuff that happened in the 1800's?

Maybe he doesn't have time to keep tutoring you.

Whether one agrees with him or not, he's knows what he's talking about.

I dont know how many times i have to explain this, but this isnt the result of over spending. The governments in the north, the ones that are supposedly the examples of fiscal discipline, arguable have more expansive welfare states than southern europe, the part with debt issues.

The model that over spending caused the crisis only really fits greece anyways. Spain, for example: ran a budget surplus before the recession.

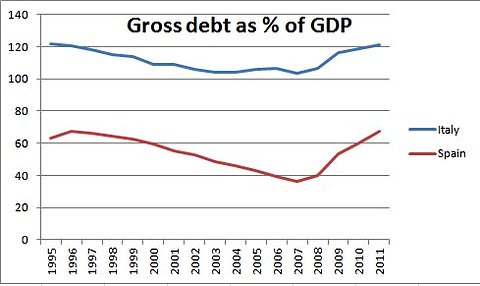

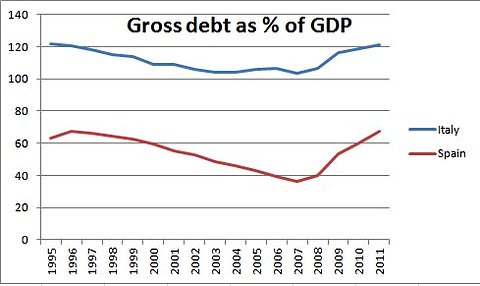

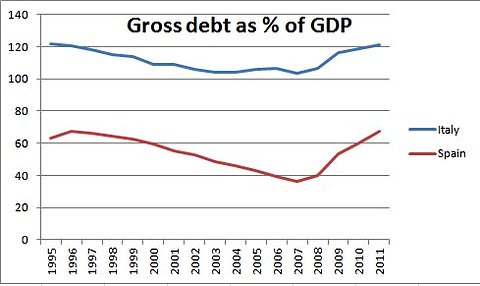

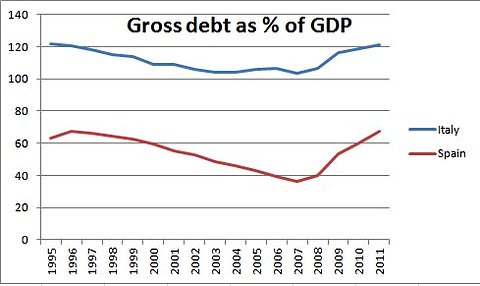

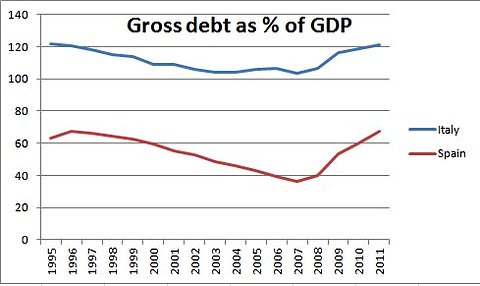

In reality: italy and spain were decreasing their debt rather than increasing it before this crisis started.

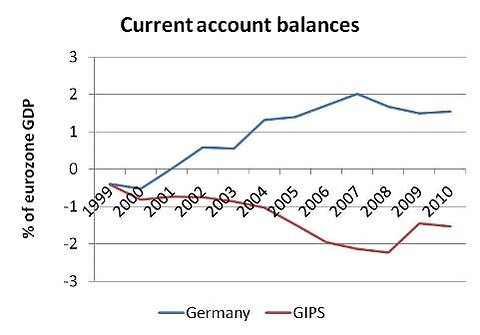

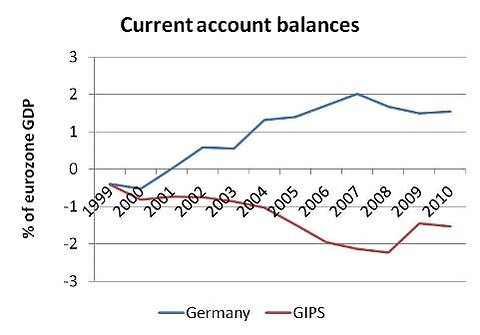

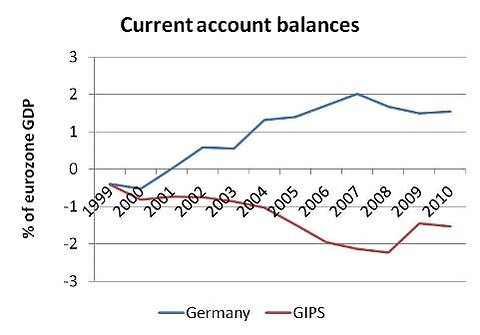

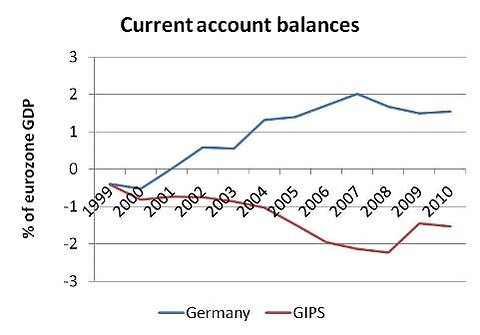

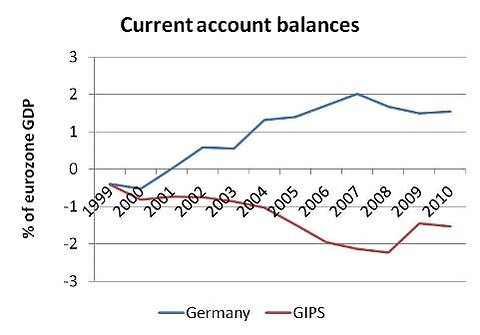

The Problem is that the creation of the euro allowed investors to treat every euro country the same. That caused massive amounts of capital to flow into the country, you can see this in the form of trade deficits. In 2008, that flow abruptly stopped:

This increased capital had the effect of increasing prices and wages and making the periphery economies less competitive:

This is the problem that needs to be unwound. Its not the problem of over spending, its a trade problem caused by the half-assed structure of the euro. Stronger treaties will fix this, thats what Merkel and Sarkozy are doing now.

The periphery needs to spend less, this is true. But Germany and the other northern countries need to spend more to offset, otherwise youll just see the euro as a whole plunge into a recession. You also need slightly higher inflation overall, or else you have deflation in the periphery. Thats why the ECB said over the weekend that it would allow higher inflation overall so that the periphery didnt deflate.

So in case you cant follow: this is not a spending problem, its a trade problem. Conservatives are just giant propaganda machines....

Anyone that thinks the grek's debt problem is simply due to greek over spending needs to go read "This time is different". The point of the paper is actualy to prove the opposite: that this is just the countinuation of a long macroeconomic cycle. It examines economic trends back to about 1800

"Also consonant with the modern theory of crises is the striking correlation between freer capital mobility and the incidence of banking crises, as illustrated in Figure 3. Periods of high international capital mobility have repeatedly produced international banking crises, not only famously as they did in the 1990s, but historically."

Figure 3:

Basically greece and other periphery countries are the victim of increasing capital flowing into their country after the creation of the euro.

What? So failed Progressive economic theory is because of stuff that happened in the 1800's?

Are you fucking serious?

Where in the paper does it say that shit from the 1800's caused this? You've got to be very dumb to think that.

It graphs capital mobility versus government defaults and proves that, historically, governments default after periods of increased capital mobility. Thats the only reason it mentions the 1800's, to prove that this has been true throughout history. When capital flow from one part of the world to another increases dramtically, default inevitably follows when that flow ceases.

Besides, how exactly is this crisis the result of government spending. Greece is the only country that even fits that model, and its still an incorrect analysis

italy and spain, the two countries everyone is really worried about now, were actually decreasing their debt before the crisis. Spain had a surplus before 2008.

The problem is that capital that was once freely flowing from the core to the periphery abruptly stopped in 2008. Notice how the reduction in the current account deficits exactly coincides with the rise in the debt to GDP ratio in spain and italy.

Am i going to fast for you?

What? So failed Progressive economic theory is because of stuff that happened in the 1800's?

Are you fucking serious?

Where in the paper does it say that shit from the 1800's caused this? You've got to be very dumb to think that.

It graphs capital mobility versus government defaults and proves that, historically, governments default after periods of increased capital mobility. Thats the only reason it mentions the 1800's, to prove that this has been true throughout history. When capital flow from one part of the world to another increases dramtically, default inevitably follows when that flow ceases.

Besides, how exactly is this crisis the result of government spending. Greece is the only country that even fits that model, and its still an incorrect analysis

italy and spain, the two countries everyone is really worried about now, were actually decreasing their debt before the crisis. Spain had a surplus before 2008.

The problem is that capital that was once freely flowing from the core to the periphery abruptly stopped in 2008. Notice how the reduction in the current account deficits exactly coincides with the rise in the debt to GDP ratio in spain and italy.

Am i going to fast for you?

Too fast? You're a window licker on the short bus. You're steeped in the Krugmanonics and are genetically unteachable.

Greece, Italy, Spain, the USA all suffer from the same malady: Progressive economics. The faster we let assets and liabilities reprice, let the Free Markets work again, the better off we'll all be.

Are you fucking serious?

Where in the paper does it say that shit from the 1800's caused this? You've got to be very dumb to think that.

It graphs capital mobility versus government defaults and proves that, historically, governments default after periods of increased capital mobility. Thats the only reason it mentions the 1800's, to prove that this has been true throughout history. When capital flow from one part of the world to another increases dramtically, default inevitably follows when that flow ceases.

Besides, how exactly is this crisis the result of government spending. Greece is the only country that even fits that model, and its still an incorrect analysis

italy and spain, the two countries everyone is really worried about now, were actually decreasing their debt before the crisis. Spain had a surplus before 2008.

The problem is that capital that was once freely flowing from the core to the periphery abruptly stopped in 2008. Notice how the reduction in the current account deficits exactly coincides with the rise in the debt to GDP ratio in spain and italy.

Am i going to fast for you?

Too fast? You're a window licker on the short bus. You're steeped in the Krugmanonics and are genetically unteachable.

Greece, Italy, Spain, the USA all suffer from the same malady: Progressive economics. The faster we let assets and liabilities reprice, let the Free Markets work again, the better off we'll all be.

Yes im sure the NY Fed is just steeped in "krugmanonics" as well

http://www.newyorkfed.org/research/current_issues/ci17-5.pdf

"After the creation of the euro area, Greece and other periphery countries had access to financing at much lower interest rates than would otherwise have been possible (Chart 3). Investors knew

that monetary policy for the region as a whole would be set by the European Central Bank (ECB), seen as likely to continue the strong anti-inflation policies of Germanys central bank. This essentially eliminated the risk that investments in periphery countries debt instruments would be eroded by high inflation. Moreover, given the common currency, the possibility of depreciation or devalua- tion in the periphery countries was eliminated as well. The one risk that remained, of course, was credit or default risk: the prospect that the periphery sovereigns could not or would not make good on obligations as they came duesomething to which the market assigned little probability.1

Not surprisingly, the fall in interest rates that came with

the periphery countries entry into the euro area facilitated the buildup of current account deficits."

Evvvvvvery page is filled with things like that?

Why would the fed put out a report saying exactly what the fuck i just said.

Are you suggesting that current account deficits dont matter? Do you even understand what the fuck i said!?

Of course the market wants another damn stimulus?

Can we all say in unison...1...2...3.....DUUUHHH.

2008...market collapses finally under the weight of it's own corruption and miles of fake money.

Fall of 2008....stimulus.

2009...the banks and Wall Street has the best year in the history of Wall Street. Financial institutions gave record bonuses and salary hikes - also - in history...and guess where that money came from???

YOU.

Hell yeah they want another stimulus.

A year later, after following the forced austerity measures your advocating, greece missed the same deficit target!

The truth is that Business owners have been saying they aren't hiring because of a lack of demand. They've been saying it "LOUD AND CLEAR" it's a "lack of demand".

Republicans hear "uncertainty". Which is not what business has been saying.

Sorry, but I think the safe bet is with experts from the Federal Reserve.

Liberals are short-sighted; they go by the IMAGINED results of their spending programs, not the realities.

Most of the reason is that Liberals go by feelings, and it "sounds" good to be spending money on something to "help" others. It takes mental EFFORT to think through the all of the effects of their spending on recepients (their initiative, dependency, narcissism) and the overall citizenry (less income, fewer purchases, less money available for lending, discouraging business start-ups, etc.).

Liberals will always appeal to emotions and relate to an imaginary world where Santa Claus can provide. This is easy to discern by their direct statements or implications that they actually believe - like children at Christmas - that presents are "free."

A year later, after following the forced austerity measures your advocating, greece missed the same deficit target!

Of course if your deficit is too large you must spend less. Only in liberal goofy land is reducing what you spend relative to income called, austerity.

Of course only in liberal goofy goofy land is spending more than you have a fomula for prosperity.